Reports

UBS's Pre-Tax Profits Rise

The bank issued its 2018 results today and reported the numbers in dollars for the first time.

UBS today reported a

fourth-quarter pre-tax profit of $862 million, rising by 2 per

cent from the same quarter a year ago, while net profit surged by

25 per cent to $4.9 billion, with the year-on-year rise inflated

by the US tax changes of late 2017.

On an adjusted basis, pre-tax profit for 2018 rose by 2 per cent,

standing at $6.4 billion in 2018.

For the fourth quarter, net profit attributable to shareholders was $696 million in the quarter, below a consensus forecast $729 million. Total invested assets fell and the wealth arm sustained a drop in transaction-based revenues amid difficult markets.

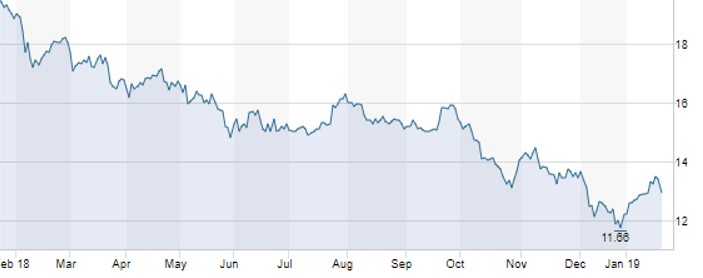

Shares in the bank softened on the results.

Source: SIX Exchange

The Zurich-listed bank has moved to reporting all its financial results

in dollars, having flagged its intention to do so in its

third-quarter statement. With such a significant amount of its

earnings no longer being booked in Swiss francs, the lender

decided that the switch made more sense and would reduce

potential distortions and volatility in its earnings.

News stories have recently speculated on who might

eventually take over from Sergio Ermotti. He has been

chief executive since 2011 and was at the helm when UBS

de-risked its investment bank arm and shifted its focus to wealth

management. Today’s results statement made no reference to

Ermotti’s CEO position.

“We've seen some normalization in markets early in 2019; we

will stay focused on balancing efficiency and investments for

growth, in order to keep delivering on our capital return

objectives while creating sustainable long-term value for our

shareholders,” he said in a statement.

Wealth management

At the group’s global wealth management arm, covering businesses

in the Americas, Asia, Europe and other locations, net new money

totaled $24.7 billion for the year. The adjusted net margin was

17 basis points.

Recurring net fee income and net interest income both increased

year-on-year on higher invested assets during most of 2018,

further progress on mandate penetration, as well as increased net

interest margin on deposits and higher loan volumes.

The wealth business’s adjusted cost/income ratio was 76 per

cent.

UBS had a CET1 capital ratio – a standard test of a bank’s

capital buffer - of 13.1 per cent.

Total invested assets at the firm stood at $3.101 trillion at

December 31, 2018, against $3.262 trillion at December 31,

2017.