Investment Strategies

The Rise Of Digital Health And Genomics In Europe

Terms such as genomics, telemedicine and healthtech are increasingly parts of the investment vocabulary. The long-term nature of such areas makes them well-suited to the wealth management audience. This article delves into the details.

In this commentary from thematic investing firm Global X (more details below) it explores the ways in which forces such as ageing, modern science and technology have come to together to change healthcare and, with it, investment opportunities in the space.

The article is by Morgane Delledonne, director of research, Global X. The editors of this news service are pleased to share these insights and invite responses. The usual editorial disclaimers apply to views of guest contributors. To respond, email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

Structural trends such as inequality, ageing populations,

systemic inefficiencies, and improving connectivity have

reinforced the need for the adoption of technology in the

healthcare sector. While the healthcare sector was slow to

embrace the digital transformation offered by emerging

technologies for many years, the pandemic has been a catalyst to

the adoption of telemedicine and digital health globally. The

overall digital health market is expected to grow from $216

billion in 2020 to more than $657 billion by 2026. In the

following piece, we explore the digitisation of healthcare in

Europe and the telemedicine, digital health, and genomics

companies leading in the region.(1)

Intergovernmental initiatives drive the digitisation of

European healthcare

European countries face several health-related challenges,

including ageing populations, chronic diseases, unequal quality

and access to healthcare services, and a shortage of health

professionals. In Europe, digital health emerged as a strategic

health priority well before the COVID-19 pandemic, but the crisis

further accelerated its adoption across the block.

Prior to the pandemic, Horizon 2020 was the largest EU research

and innovation programme with nearly €80 billion of funding

available over 2014 to 2020 (2). Among other innovative projects,

Horizon 2020 funded Digital Health Europe, which is aimed at

supporting large-scale adoption of digital solutions for

person-centred integrated care, promoting digitised models of

care, enabling breakthroughs and securing Europe's global

competitiveness. For example, Digital Health Europe funded a

project in Spain and Portugal that has created an artificial

intelligence (AI) system capable of monitoring and predicting

future relapses of patients suffering from multi-morbidity

conditions (3). In 2019, the World Health Organisation (WHO) and

the European Union (EU) advocated the use of health technologies

to reduce inequalities and improve health and wellbeing (4). Both

organisations emphasised digital health as a crucial component of

healthcare services to actively contribute to the achievement of

the United Nation’s Agenda 2030 Sustainable Development

Goals.

Since the COVID-19 pandemic began, public authorities have

increasingly relied on the use of digital solutions such as

telemedicine and contact tracing apps to facilitate virtual

patient-doctor visits and monitor outbreaks. As the world returns

to normal, Europe is building on the recent momentum to continue

to digitalise healthcare across the region. The European

Programme of Work for 2020–2025, called “United Action for Better

Health” sets priorities for the future of healthcare in Europe

and identifies digital health as key to realising this vision.

The EU has also created EU4Health, investing €5.1 billion, to

continue efforts from the Horizon 2020 programme (5). The main

objectives behind digitisation of healthcare are to secure access

and exchange of health data across the EU, and pool health data

for research and personalised medicine. These initiatives will

spur existing efforts to adopt digital health across Europe and

complement the WHO Global Strategy on Digital Health.

European digital health and genomics markets

Telemedicine, digital health and genomics companies posted strong

performances amid the pandemic, given the sector's defensive

nature and a surge in healthcare-related spending to combat

COVID-19. The MSCI World Health Care Index and the Solactive

Genomics Index increased 12 per cent and 52 per cent respectively

in 2020. The digital health market in Europe was valued at $38.1

billion in 2019 and is expected to grow at a CAGR of 27.1 per

cent over the next five years (6).

Telemedicine and digital health

The European market for healthcare information technology (HCIT)

and related services, is growing substantially, spurred by the

expanding volume of data in healthcare, the need for fast and

efficient processes and patients’ growing need for data

accessibility. The COVID-19-pandemic in 2020 and the immense

stress it has put on the European healthcare system have

accelerated demand for HCIT solutions. This growth trend has also

been powered by public financial initiatives in recent

years.

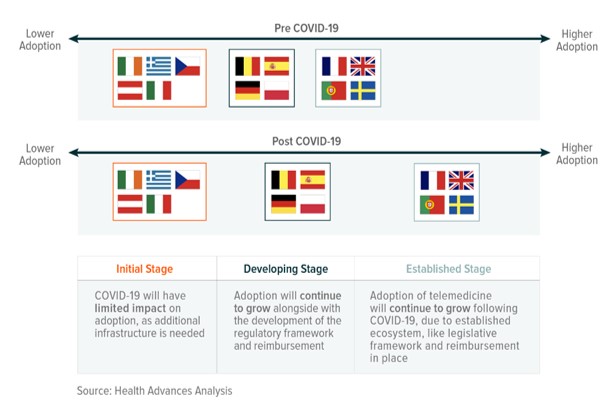

COVID-19 impact on telemedicine adoption in EU

countries

Telemedicine accounted for $1.7 billion in 2019 and is expected

to be the fastest growing segment of the European digital health

market with a CAGR of 26.1 per cent over the next five

years (7).

One of the main companies in the digital health sector is Compugroup Medical SE (CGM), a Germany-based top provider focusing on software solutions for health professionals. Its activities are divided into Health Provider Services, focusing on the development and sale of software solutions for professional healthcare settings and Health Connectivity Services, a networking service between participants in the healthcare sector. The CGM group is successfully converting its product portfolio to a Software-as-a-Service model, becoming a leading player in the development of global eHealth solutions. CGM expects revenue growth of 19 per cent in 2020 to rise to 24 per cent in 2021, including two acquisitions completed in the financial year 2020. Organic growth is expected to range between 4 and 8 per cent (8).

Genomics

Since the completion of the Human Genome Project in 2003,

genomics research has accelerated alongside the vast collection

of genetic data across populations.

By developing a greater understanding of the human body at a

genetic level, new therapies are emerging that can treat diseases

that were previously considered uncurable. Going forward,

integrating data from several genomics-based research projects

and data sets will require a greater incorporation of computing

technology, such as AI-driven computational biology in the drug

development process. Moreover, we believe that AI-based drug

development is likely to benefit from the continued digitisation

of personal biological data and electronic health

records.

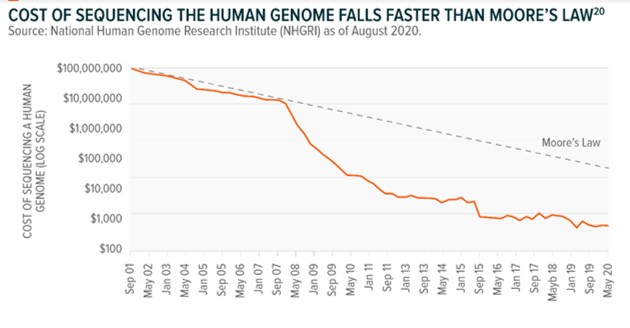

The growth of the genomics market has largely been driven by

factors such as availability of government funding, the

collection of genetic data, the number and success of

genomics-based studies, disease rates, technological

advancements, demand for modified crops, and discoveries of

new-use cases for genomics-based treatments. As DNA sequencing

costs continue to fall at a rapid rate, the collection of genetic

data is becoming easier, furthering advancements in the genomics

space (9).

Good examples of the rapid growth of the genomic market are

uniQure NV, a Netherlands-based company focusing on the

development of gene therapies and Cellectis SA, a French company

which is active in the field of gene-editing. Gene therapy seeks

to modify or control how one’s body expresses certain genetic

information, potentially replacing, modifying, or deactivating

the genes associated with debilitating diseases. Year-on-year

uniQure NV grew revenues by 415.2 per cent from $7.28 million to

$37.5 million (10).

Cellectis develops off-the-shelf gene-edited CAR-T cells that aim

to force the immune system to target and eradicate cancer cells.

Year-on-year Cellectis SA grew revenues by 258.7 per cent from

€23 million to €82.5 million (11).

Conclusion

Telemedicine and digital health can expand access to healthcare

by making it more geographically and financially accessible,

presenting opportunities for large-scale adoption in Europe and

around the world. In the meantime, genomics can revolutionise

treatment options and improve patient outcomes with the rise of

personalised medicine. We believe that the benefits seen by

patients, providers, and payers will continue to drive the

overall adoption of these themes.

Global X, the New York-based firm, operates in the field of thematic investing, providing exchange-traded funds and other investment entities. It oversees more than $33 billion in assets across more than 80 ETF strategies.