Investment Strategies

The Magnificent Seven Growth Paradox: Record Earnings Meet CapEx Jitters

Whatever volatility there is in equities – perhaps an inevitable sign of a sector in ferment – AI remains a fundamental economic pillar for the next decade, the author argues.

The following article, which addresses the state of equity

markets and issues such as concentration risk, is from Khaled

Louhichi (pictured below the article), head of research at

Mirabaud

Wealth Management. The editors are pleased to share these

insights; the customary editorial disclaimers apply to views of

guest writers. Email tom.burroughes@wealthbriefing.com

and amanda.cheesley@clearviewpublishing.com

The latest earnings season for the “Mag7” (excluding Tesla and

Nvidia) presents a paradox: fundamentals are robust, yet market

reactions are increasingly sceptical. While the group delivered

impressive earnings per share (EPS) growth in the last quarter of

2025, ranging from 11 per cent to 31 per cent, stock price

reactions were largely flat or negative, with one notable

exception.

A clear theme has emerged; investors are no longer satisfied with

“AI promise.” They are demanding immediate returns on the massive

capital expenditures (CapEx) being deployed. The “AI Arms Race”

has transitioned into a "Show Me the Money" phase, where the cost

of growth is under the microscope.

The CapEx conundrum: growth is not enough

For Microsoft and Alphabet, the message from the market was

brutal but clear. Despite posting stellar earnings per share

growth of 28 per cent and 31 per cent respectively, both saw

their stock prices struggle immediately post-release, Microsoft

dropping 10 per cent and Alphabet ending more or less flat.

The culprit? Fears of spiralling AI-related CapEx. As these

hyper-scalers continue to pour billions into GPU clusters and

data centres to secure their AI future, investors are growing

wary of the depreciation drag and the timeline for return on

invested capital (ROIC).

The robust top-line and bottom-line growth were overshadowed by

the sheer scale of investment required to maintain their

leadership, leading the market to discount the immediate value of

their earnings beats. The “AI tax” on valuation is real: massive

growth is being treated as “table stakes” rather than a catalyst

for multiple expansion.

Meta platforms: the efficiency outlier

Meta platforms stood alone as the clear winner of the season,

surging over 10 per cent following its release. Interestingly,

Meta’s EPS growth of 11 per cent was lower than its peers, yet

the market rewarded it.

This divergence underscores a critical lesson: the market favours

visibility and efficiency. Meta has successfully communicated a

narrative whereby AI investment is directly fuelling core

business performance, specifically in advertising efficiency and

user engagement, rather than just future theoreticals. By

balancing its aggressive AI spend with continued discipline (the

enduring legacy of its "Year of Efficiency"), Meta managed to

convince investors that its CapEx is not a black hole, but a

lever for immediate monetisation.

Apple: the resilient ecosystem

Apple delivered a "steady as she goes" performance, with 18 per

cent EPS growth and a flat-to-positive stock reaction (+0.5 per

cent). Unlike the hyper-scalers caught in the CapEx crossfire,

Apple’s narrative remains tethered to the resilience of its

consumer ecosystem and high-margin services

revenue.

While less directly exposed to the server-side AI buildout fears,

Apple benefits from a perception of safety. Its “Apple

Intelligence” strategy is viewed as an ecosystem lock-in feature

rather than a capital-intensive infrastructure bet, insulating it

from the CapEx jitters that plagued Microsoft and Google. The

double-digit EPS growth reaffirms the durability of its premium

franchise even as the broader tech sector grapples with

investment cycles.

Diverging fortunes in 2026

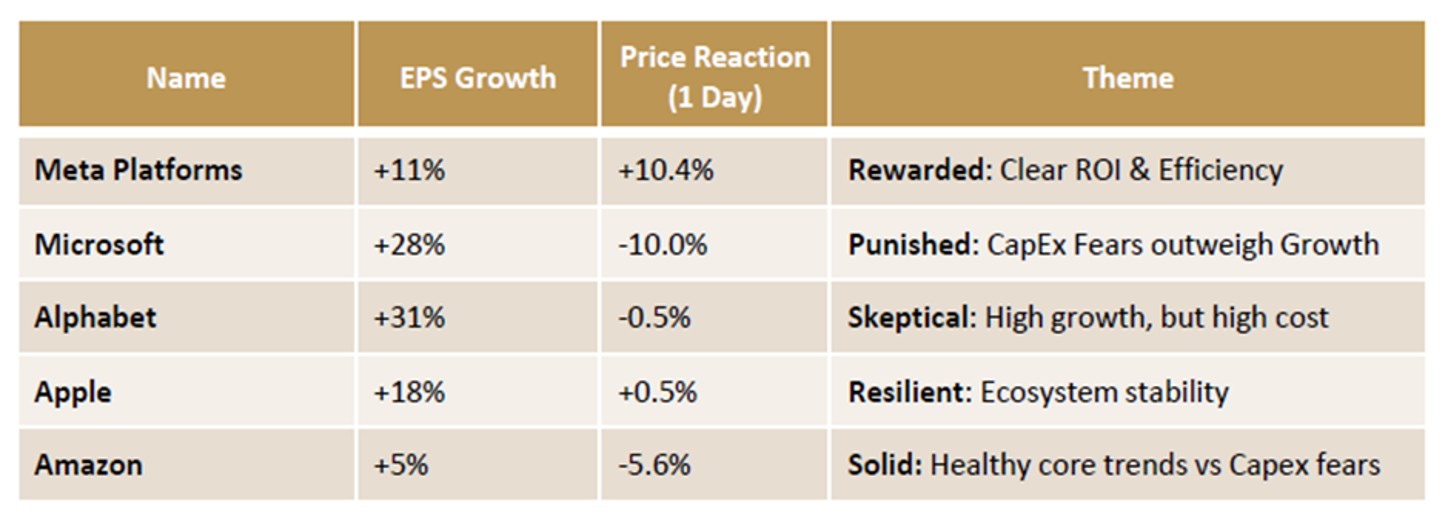

The table below summarises the stark disconnect between

fundamental performance and market reaction this quarter:

Looking ahead: the "proof" phase

As we move deeper into 2026, the burden of proof has shifted. The

initial euphoria of the AI boom is over, and the infrastructure

buildout phase is now being scrutinised for capital efficiency.

For the Mag7, the next leg of stock performance will likely

depend not just on growing AI capabilities, but on demonstrating

that these massive investments can generate cash flow margins

that justify the spend.

The divergence between Meta and Microsoft this quarter suggests

that investors will mercilessly punish "spending without

immediate visibility" while rewarding those who can show that the

AI cheque is already in the mail.

However, this short-term volatility does not signal structural

weakness. AI remains a fundamental economic pillar for the next

decade. The investment thesis is widening beyond tech giants to

physical constraints such as energy and grid infrastructure,

making continued exposure, and the patience to weather

volatility, a strategic necessity.

Khaled Louhichi