Alt Investments

The Evidence Is In: Private Markets Beat Listed Equities

Data shows, the firm says, that private market investing, while less liquid, comes with superior yield and outpaced the results of listed equities. There appears as yet no end in sight to enthusiasm for sectors such as venture capital, private equity and credit.

Nearly $2 trillion of private assets, which were held by

high net worth investors in 2021, have outperformed returns of

listed equities, a situation likely to be compelling for people

fretting about market gyrations and high inflation, a survey

shows.

New York-listed investment firm Hamilton Lane, with

$851 billion in assets under management and supervision, said in

a report that private equity generated an extra 83 cents per

dollar invested since 2017. Private real estate and credit, with

significantly lower risk profiles than equity strategies, have

also done “remarkably well,” the firm said.

There has been a steady drum-beat of commentary on and advocacy

for private market investing over recent years. More than a

decade of ultra-low official interest rates – now slowly starting

to change – has crushed yields on conventional equities and

government bonds. This has encouraged an influx to areas such as

private equity, venture capital and forms of real estate.

Investors have had to tolerate the lower liquidity of these

investments in exchange for superior returns. A cluster of firms,

such as CAIS and

iCapital, among

others, have also developed platforms to make it easier for

investors to tap into previously hard-to-enter sectors.

“The global financial markets continue along a trend of rapid

change that we’ve experienced during the last two years of the

pandemic,” Mario Giannini, CEO of Hamilton Lane, said.

Hamilton Lane’s report draws from its database covering more than

$15 trillion of assets and 45,000 funds.

“We’re examining what’s driven outperformance of late, what

factors are disrupting and transforming the private markets, as

well as what the investor experience could be going forward –

particularly as the asset class continues to expand its investor

base into the private wealth market,” Giannini said.

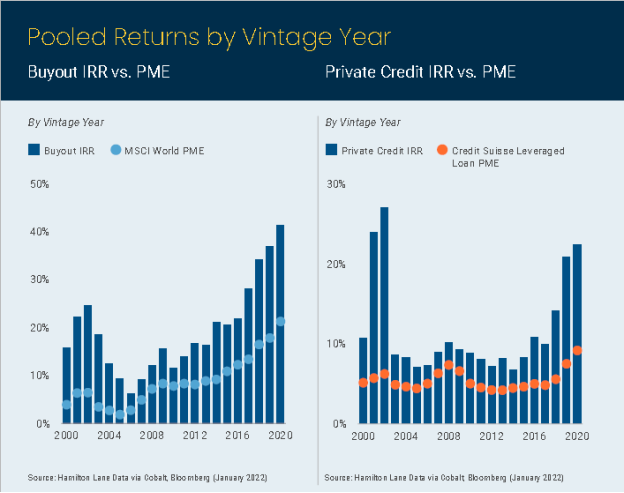

In a longer-term picture of private equity’s performance vis a

vis public markets, the chart below shows pooled average buyout

returns, which have outperformed in every single one of the past

20 vintage years and by an average of more than 1,000 basis

points. Private credit also outperformed in every vintage year

over the last 20. These charts show vintage years and public

market equivalent (PME) – a measurement accepted by investors as

the most appropriate way to benchmark returns, Hamilton Lane

said. (Internal rates of return account for the complex timings

of private equity deals and are not strictly comparable

with those of listed equities, but the PME measure is a

rough equivalent.)

Performance of private markets vs public

markets

The firm also tracked the opportunities available for private

investing. Fundraising has hit a record, on track for a 25 per

cent jump from 2020 to 2021.

The firm said that it had identified a trend for 2022 dubbed the

“15/15 club” – an estimation that at least 15 buyout managers are

seeking to raise $15 billion or more in the coming year. Taking

into account the fact that the managers may outpace their stated

targets and the previous fund sizes of these managers, this

number could top roughly $300 billion – 50 per cent above the

level in 2020.

Access to private markets is widening. The number of smaller

institutional and HNW investors taking part in private markets

increased again in 2021.