White Papers

The Benefits Of "Seeding" Hedge Funds – Study

Prior to 2000, hedge funds were typically incubated within banks or seeded by wealthy individuals. After the financial crash of 2008, institutional investors and consultants have become more important players in the market.

The business of putting “seed” money into the world’s hedge fund

industry is an investment space in its own right, according to a

white paper published by Investcorp-Tages, the

investment firm created as a joint venture between Investcorp and

Tages.

An early-stage investment into a hedge fund offers investors the

opportunity to take a stake in the fund itself, thereby allowing

them to directly participate in the management and performance

fee revenues.

The authors of the report, entitled Enhancing Returns: The

Case for Hedge Fund Seeding, said they expect demand for

hedge fund seeding to “grow significantly in the coming

years.”

“There is a strong pipeline of highly talented managers facing

increasingly high barriers to entry. These include immediately

visible increasing regulatory, compliance, and operating costs,

but also more indirect barriers such as rising minimum asset size

requirements from prospective institutional investors,” the

report said.

It noted that the breakeven range in terms of assets under

management for a newly-launched hedge fund currently lies at

around $100 million to $150 million. Seeding or “acceleration

capital investments” can help investors with patient capital to

cut hedge fund investment costs and raise hedge fund

returns.

“In exchange for making a day one investment or early-stage

investment into the manager’s hedge fund, investors can directly

participate in the management and performance fee revenues of a

hedge fund manager’s firm,” it said. “This economic interest is

typically structured as a gross revenue share participation which

allows the investor to receive a percentage of the management and

performance fees earned by the manager without bearing exposure

to the costs of running an asset management firm. This economic

interest is received at no additional cost to making the initial

investment in the manager’s fund.”

The study notes that invested capital is typically subject to a

commitment period of two to three years, during which the

investor may not redeem, unless certain pre-negotiated negative

events have occurred; for example, a predefined loss of

capital.

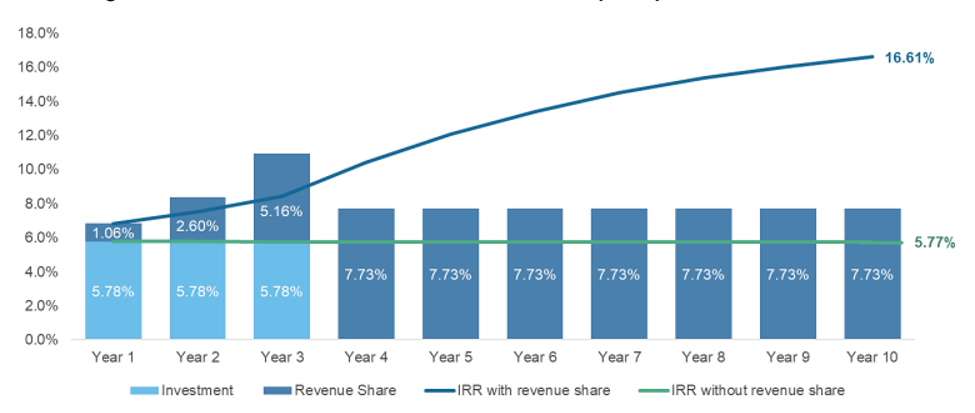

There is a large gap between hedge fund investing with and

without taking part in the seeding process, as the following

chart illustrates:

Source: Investcorp, Tages