Technology

Teflon Tech's Marvellous Recession: Analysis

In 2010, two of the world’s ten largest companies by market cap were technology firms. Today it's seven. As technology stocks continue to defy gravity, this analysis looks at their rise vis a vis Chinese and US firms, cash on hand for further advances, and where value is still to be found.

This article discusses the recent performance of technology stocks, how they fare amid geopolitical rivalry and regulation, as well as the best way to assess growth opportunities within the sector. The author is Lombard Odier’s CIO, Stéphane Monier. We welcome such timely commentary and your feedback to tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com.

As recessions go, this looks like a technology-stock friendly version. Through the worst economic crisis of the past century, technology stocks have gained, flouting forecasts of their demise and lifting equity indices more widely. Most investors already own many names in the sector; we think there are other opportunities to explore through private markets.

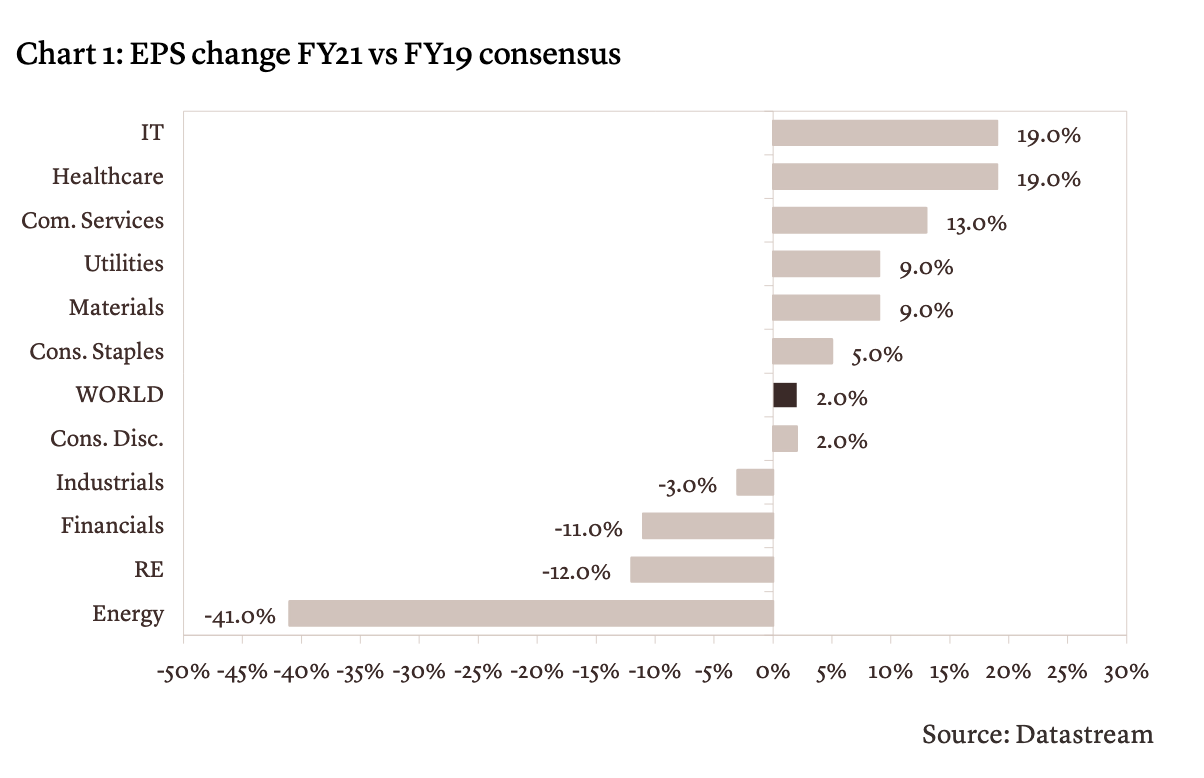

Technology names continue to defy the gravity of the broader corporate world. Along with healthcare, technology is expected to show the fastest growth in earnings per share (EPS) among equity sectors next year, compared with 2019 (see chart). EPS growth for the tech sector in 2020 is estimated at +2.5 per cent, according to Datastream, compared with EPS for the MSCI World index of -20.4 per cent this year.

As of 14 August 2020, the equal-weighted S&P 500 (equal weight of 0.2 per cent for all constituents) registered a decline of 4.1 per cent versus a 4.4 per cent gain for the S&P 500. This demonstrates the tremendous performance contribution from the largest holdings, namely Apple, Microsoft, Amazon, Alphabet and Facebook, which now account for 23 per cent of the S&P 500 Index.

Tech companies as a whole, including interactive media, internet and direct marketing, make up 38.5 per cent of the MSCI USA index, 8.9 per cent of the MSCI Europe and 48.2 per cent of the MSCI China market, for example, making passive investors large holders of tech stocks.

The largest tech stocks are also cash rich, even six months into the crisis. The ‘big five’ names are sitting collectively on more than $550 billion of cash. That positions them to invest further and acquire smaller rivals, as well as raise dividends or buy back shares, while increasing their competitive resilience.

The evolution of the market, and the stock market’s dependence on the tech sector, has been rapid, even compared with a decade ago.

In 2010, two of the world’s ten largest companies by market capitalisation were technology firms. Today, the sector accounts for seven of the top ten slots, and two of those, Alibaba Group and Tencent, are Chinese. In July 2019, China launched a new index for tech firms, called the STAR market, as a direct competitor to the NASDAQ. China’s top three tech firms, which includes Baidu, collectively known as ‘BAT,’ have a market capitalisation of $1.36 trillion. That compares with the market cap of the ‘big five’ in the US of $6.88 trillion.

Still, investors rightly wonder whether current valuations, at their highest for the past decade, are sustainable. Price-to-earnings (P/E) for technology stocks are forecast at 26 times earnings for 2021. That compares with a P/E ratio for the MSCI World index of 18.8 times earnings for 2021. In the short run, recent results have been reassuring. The most recent earnings underlined the strengths of the ‘big five’ in the US, as demand for their products and services increased during the lockdown periods.

In fact, consumer trends intensified even more during the COVID-19 pandemic. It is harder than ever to imagine building a portfolio without these companies - as welll as providing essential technologies for our daily lives, they offer structural growth opportunities for investors.

Geopolitical rivalry and regulation

A traditional risk complication for investors is the political

interest in addressing the perceived lack of competition in

technology. Anti-trust regulation in the US and European Union

struggles to get to grips with the way that many tech firms

operate their business models and earnings.

Before the US presidential elections on 3 November there will undoubtedly be more political discussion about containing the dominance of the biggest tech firms. However, a highly publicised antitrust judiciary committee hearing questioned the CEOs of Amazon, Apple, Google and Facebook on 29 July. The hearings, which examined whether the firms abuse their dominant positions, took on a partisan tone to discuss whether social media platforms suppress conservative opinions.

In the longer term, it is hard to see US politicians hamstringing US tech companies, faced with the strategic leadership challenge from China. In time, whatever the colour of a new US administration, large companies tend to have the firepower to lobby and make new regulation in line with their priorities. In such an environment, meaningful regulation looks unlikely, especially when lawmakers are highly aware of the stakes for geopolitical leadership between China and the US and Chinese tech firms are becoming more competitive.

It appears increasingly possible that mutual US/China suspicions and growing protectionism will see the two superpowers seek separate technological solutions. That may lead to separate developments in sectors such as online retail, artificial intelligence and infrastructure.

Accessing growth tech

Once we conclude that technology stocks are a must-have in

portfolios, the question is how best to access their performance.

We believe that in addition to traditional investments, there is

more value available through private market investments. In

recent years, the market for Initial Public Offerings (IPOs) has

been less attractive for companies which have to disclose

more financial data and for investors who have seen lower returns

for their risk.

A number of firms, including Facebook, Dropbox and Pinterest, have only floated after a number of years of successfully attracting venture capital. While there are still good growth opportunities for these companies in the public markets, most of the value creation has already been captured by private market investors as these companies have stayed private longer.

Investments through private markets, including venture capital funds, can provide investors with access to technology firms that choose not to list on an exchange or prefer a longer-term outlook and avoid the constraints imposed by quarterly reporting. In 2019, venture capital remained heavily concentrated in the US, where $116.7 billion was invested, compared with $62.5 billion in Asia and $34.3 billion in Europe [1]. It is worth highlighting, however, that three of the world’s most valuable ‘unicorns,’ private firms valued at more than $1 billion, are Chinese.

Private markets also offer investors opportunities in companies and technologies, from the internet of things and communications to autonomous vehicles, software and cloud computing that are disrupting traditional industries. All of these technologies will continue to change the way we interact, move and consume goods, services and data, offering growth opportunities for agile investors.

[1] Source: 2019 State of European Tech report