Asset Management

Taking Emotion Out Of Investing – In Conversation With Smart Wealth's CEO

WealthBriefing talks to the chief executive and founder of a Swiss asset management firm that is using AI to guide stock and bond investments.

When markets jump around – for example the crash in

early March 2020 amidst the pandemic or rebounding after the

April 2025 selloff – investors who succeed in avoiding

the worst losses and who can capture returns have a reason to be

pleased.

In all the ways that portfolio managers try to avoid the

“noise” of media coverage of current events and other forces, one

is the approach that taps into the science of neural

networks, which is an important element of artificial

intelligence. These days, it is argued, you need AI to help

avoiding mistakes. Above all, taking human emotion out of the mix

is important.

Dr Miro Mitev (pictured), founder and CEO, Smart Wealth based in

Zurich, is using AI to automate investment management. In July,

the firm launched its Irish Collective Asset-management Vehicle

(ICAV), an umbrella structure with two sub funds: the SW Multi

Asset AI Flagship Fund and the SW Global Equity Plus AI

Fund. The ICAV expects more than $100 million from investors

from Europe, the Middle East, Asia, and Australia. The structure

aims to secure $2 billion in assets over the next three years.

Seed share class investors include family offices around the

world.

As explained by Smart Wealth on its website, “every purchase and

sale in our AI-controlled investment process is based on data and

facts,” completely stripping out the human element and risks

of emotions entering the mix. The firm’s forecasting models

handle variables such as macroeconomic, fundamental and technical

inputs of different frequencies. When tailoring a strategy to

match a client's requirements, a client can, for example,

choose what industries they want to include. The idea is to

build an “optimal portfolio” with the highest return for a given

risk level.

Dr Mitev is ambitious about what Smart Wealth can achieve.

“We want to be a core asset manager for the industry worldwide.

We want funds to be in the multi-billions [AuM] in three to five

years,” he told WealthBriefing in a recent

interview.

“Our system is not built on news…our system is not reacting to

noise but to hard data and causal leading indicators…it

looks at what information is significantly important and what is

not,” Dr Mitev said. “It identifies turning points and the

probability that a future change of direction is very high.”

“This is very robust in different market cycles,” he

said.

Dr Mitev said that to demonstrate how it worked, just before the

global pandemic broke, Smart Wealth shut 60 per cent of its

portfolios two weeks before markets collapsed in early March

2020; it later restored portfolio positions one and a half months

later. On the Russia/Ukraine story, it moved into cash on 3

January 2022 by reducing its bonds exposure and on 25 January

2022 cut its equity`s exposure to avoid some of the most

significant market setbacks.

Using this process, for example, a portfolio might move

into cash for a particular period.

Smart Wealth Asset Management – to give its full name

– has $400 million of AuM, and a team of 30 professionals

across Europe, the Middle East and Asia. The firm said it is a

consistent top tier performer; its model portfolio has beaten its

composite index by 6.5 per cent per annum.

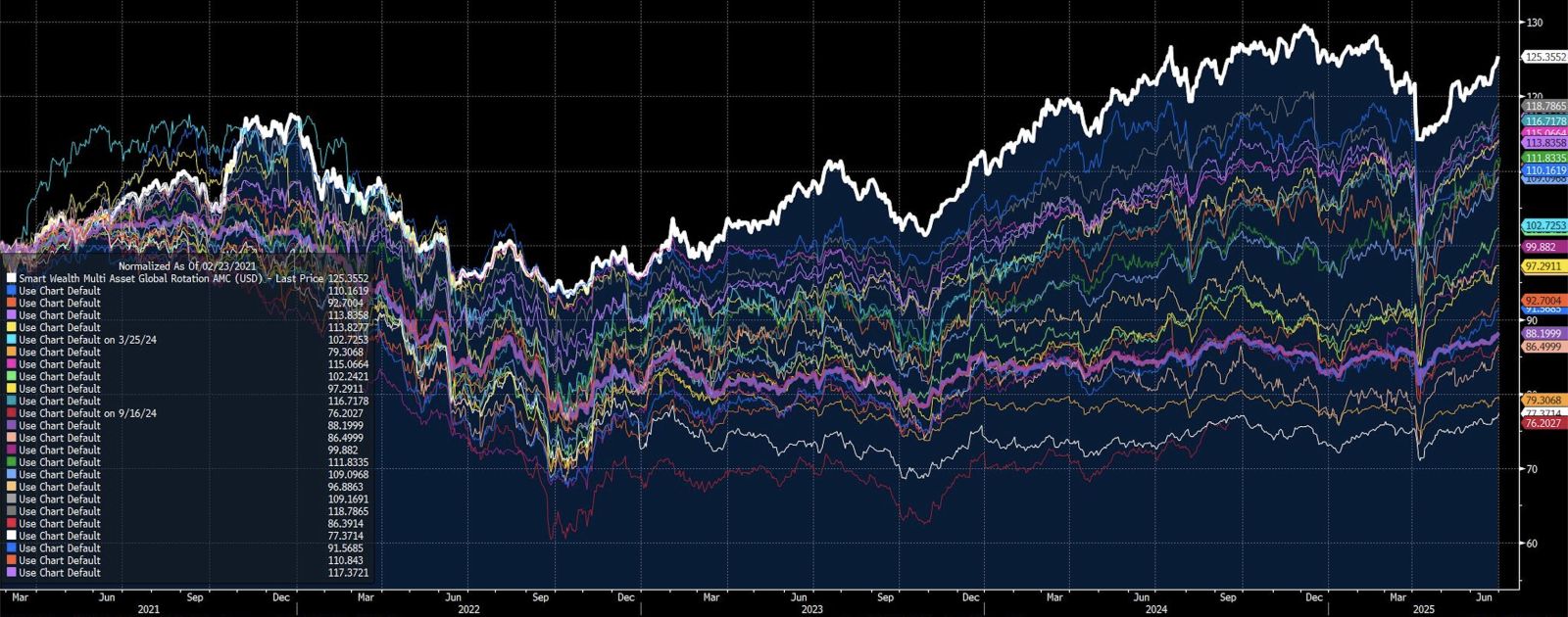

Smart Wealth gives this chart showing top-tier performance,

until July this year, among prominent multi-asset products.

The white line has Smart Wealth at the top.

(Data source: Smart Wealth, Bloomberg.)

The AI impact

The rise of investment houses such as Smart Wealth underscores

the growing use cases of AI, although immense computer power has

been applied to trading systems for years.

Dr Mitev has more than 25 years of experience in what can be

called the quantitative area; he started his involvement

with AI in the late 1990s. He has worked in investment

banking and asset management and built strong experience in

applied research in areas such as operations research, statistics

and portfolio optimisation. Dr Mitev wrote his master’s thesis on

neural networks and their applicability to the stock market,

applying his insights to stock market investing.

And what did the evidence show? Via empirical data, Dr Mitev

said he found that using a neutral network approach improved

the accuracy and reliability of stocks forecasting.

Over the years, Dr Mitev developed trading technology and

insights for banks and asset managers. There is also an academic

side: he has taught at Vienna University of Economics and

Business Administration.

Making new data-driven approaches can work today because

technology makes them possible.

It is easier to develop such quant models today because data and

computational speed is more available and the technology that can

handle it is more sophisticated and powerful.

Stocks and bonds

Smart Wealth only works in the areas of blue-chip listed equities

and stock/bonds ETFs. The firm provides investment products to

institutions and professional investors, including family

offices.

Firms that have used Smart Wealth's forecasts include JP Morgan,

Commerzbank, Fidelity Investment Services, Merrill Lynch, Hyundai

Asset Management, Nomura, Société Générale, and Santander Asset

Management.

Dr Mitev says interest has been positive: “They [users] want

double-digit returns and they want daily liquidity…an annualised

return of 14 to 15 per cent.” Private banks and independent asset

managers are interested in what SW is doing; there has been

“strong” interest in SW funds, he added.