Surveys

Swiss Entrepreneurs Frustrated By Banks' Service – Study

At a time when it is sometimes claimed that the universal, one-bank model is the most effective way to gather wealth management assets, this report appears to jar with such an assumption. It finds that Swiss entrepreneurs often see their bank offering no value-add for their business.

A survey of 280 Swiss entrepreneurs has found that 70 per

cent of them think their bank does not fully understand them, and

almost the same proportion said their bank has created no

meaningful value for their business.

The findings from Egonomix, a market research

firm based in Zurich, showt that half (50 per cent) said banks

“never will” add value for their firms.

The 30-page report, Swiss Entrepreneur & Banking Report,

makes for uncomfortable reading by banks, noting that more than

60 per cent of entrepreneurs don’t rely on their bank for

corporate advice and the same percentage go elsewhere for private

wealth planning.

Such results come at a time when traditional banking models are

being shaken up by new technology, corporate and regulatory

change. Since the 2023 emergency takeover of Credit Suisse by

UBS, the Alpine state now has only one universal bank.

The report said Revolut, ZKB (Zürcher

Kantonalbank) and UBS

were the top banks most associated with supporting

entrepreneurs.

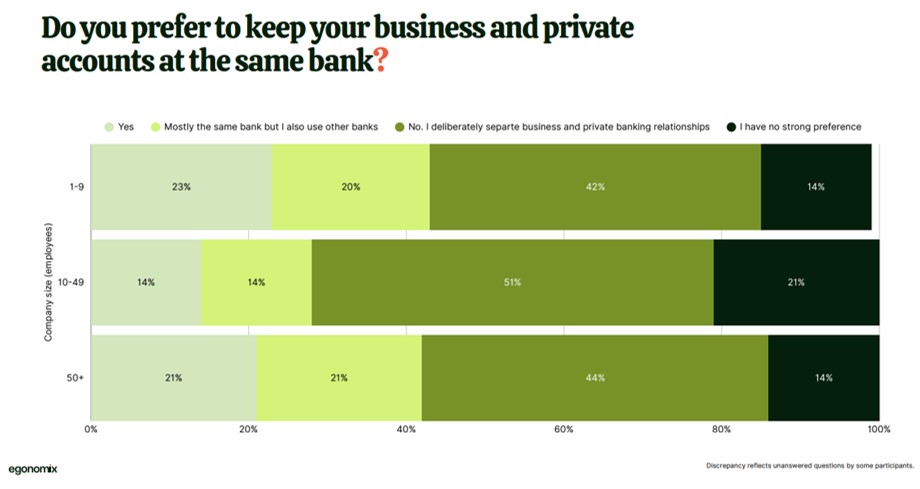

The study also suggests many businessmen and women prefer not to

keep their private wealth with the same bank as their corporate

business – challenging the idea of banks operating as

“one-stop-shops” for entrepreneurs is necessarily the best

business model in many cases.

In firms with more than 50 employees, only 21 per cent keep their

private and corporate wealth with the same lender; 21 per cent

use the same bank, with some freedom to use other banks; 44 per

cent keep private and business financial affairs strictly apart,

and 14 per cent had no clear view. With firms of fewer employees

(see chart below), the ratios were slightly different, but still

showing that only a minority of entrepreneurs held corporate and

private money in the same bank.

Source: Egonomix

The report said 60 per cent of respondents said the largest

differentiators for a bank were better digital tools and flexible

credit. Entrepreneurs are most likely to switch banks to get

faster access to credit, lower fees, and a superior digital

experience.

“Everyone wants to be 'the bank for entrepreneurs,' but few

banks actually ask entrepreneurs what they need. Too often,

strategy is built in echo chambers, by consultants who’ve never

run a business, quoting frameworks no founder has ever used. We

wanted to break that pattern," the introduction to the report

said.

The study said the results of its questions were “not remotely

shocking for those already in the know.”

“They want better tools, faster credit, and a bank who actually

gets them. Or better yet, one who brings something to the table:

capital, connections or clarity,” it said.

In other findings, the report showed that 20 per cent of

entrepreneurs with firms of 50+ staff held their own money at a

private bank; for those with 10 to 49 staff, 13 per cent did so,

and for those with up to nine staff, 14 per cent did.

(Editor's view: This report has a number of lessons, and also upends a few assumptions. Back in June this year, Boston Consulting Group identified a “critical weakness” – slow organic growth in AuM. It also found that universal banks perform more strongly than “pure-play” firms at generating organic growth. If this is true, such one-stop-shop banks must convince business founders and leaders that it makes sense to hold more of their corporate and private wealth in one place. As the Egonomix report findings suggest, fewer than a quarter of the entrepreneurs questioned do so, and a larger share prefer to keep their private and business money with separate institutions.

What this report does, therefore, is keep the debate alive on whether the "one-bank" or "pure-play" model works best for the private banking industry. As ever, the WealthBriefing team likes to hear from readers on their own views about this. Email tom.burroughes@wealthbriefing.com)