New Office

State Street Targets Saudi Arabia Market

State Street Corporation marks its commitment to Saudi Arabia. The announcement comes at a time when many firms have been enhancing their presence in Dubai and neighbouring Abu Dhabi.

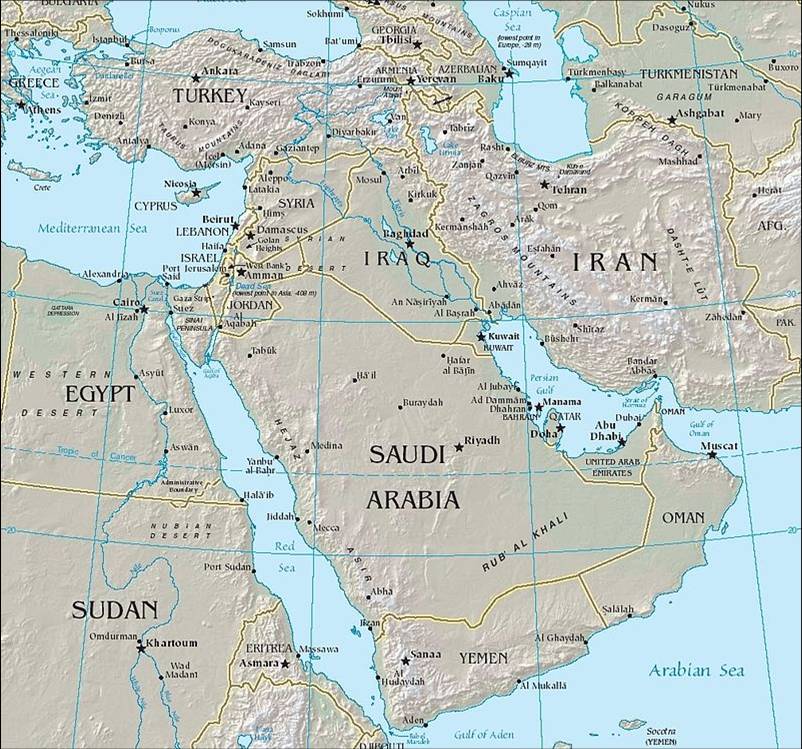

New York-listed State Street has officially launched its Middle East and North Africa regional headquarters in Riyadh, Kingdom of Saudi Arabia, after approval from the Ministry of Investment Saudi Arabia (MISA).

State Street said it has been serving clients in the Kingdom of Saudi Arabia for over 25 years. In 2020, State Street established local operations in the Kingdom. Assets under custody and/or administration have grown to $127 billion while assets under management have grown to $60 billion for clients in the Kingdom.

In addition, in 2024 State Street Saudi Arabia became the 11th investment centre of State Street Investment Management globally; it can manage portfolios for institutional investors in the Kingdom locally.

"Saudi Arabia’s Vision 2030 is reshaping the Kingdom’s financial ecosystem, and we are proud to contribute to this transformation,” Oliver Berger, head of Strategic Growth Markets, said. “Establishing our RHQ in Riyadh reflects our long-term commitment to the Kingdom, and spotlights the world class services State Street has been providing to investors from around the world for over 230 years."

The RHQ will serve as a centre for strategic direction and administration for State Street’s activities across the MENA region.

“This new headquarters helps position us as a global leader in investment solutions and product innovation in the Middle East as one of the fastest growing and most significant economic regions in the world," Emmanuel Laurina, head of Middle East, Africa and official institutions at State Street Investment Management, said.

State Street has been active in the Middle East for over three decades, partnering with sovereign wealth funds, pension schemes, central banks, and asset managers, the firm said in a statement. The Riyadh-based RHQ office will host State Street’s regional senior leadership, corporate functions, and will act as a centre for innovation and collaboration. The RHQ will enhance State Street’s operational efficiency across the MENA region and help foster talent development in alignment with the Saudi Arabia financial sector’s development goals.

A number of firms, such as US-headquartered investment manager Brown Advisory have recently set up shop in Dubai and neighbouring Abu Dhabi, exploiting the rising level of demand for wealth management, for example inter-generational wealth and business transfer advisory work. Hamilton Lane a private markets investment management firm, opened its newest office in the Middle East in February in order to meet the needs of regional clients more effectively. See here and here.