ESG

Spotlight On SLM Partners' Regenerative Agriculture Strategy

SLM Partners, a $755 million natural real assets manager with 100 per cent of land under regenerative management in a number of global regions, has published its fifth impact report, unveiling a case study of its regenerative agriculture strategy with quantified financial and environmental returns.

A new 2024 impact report by SLM Partners highlights the benefits of combining livestock production with carbon projects to diversify revenue on Australian properties.

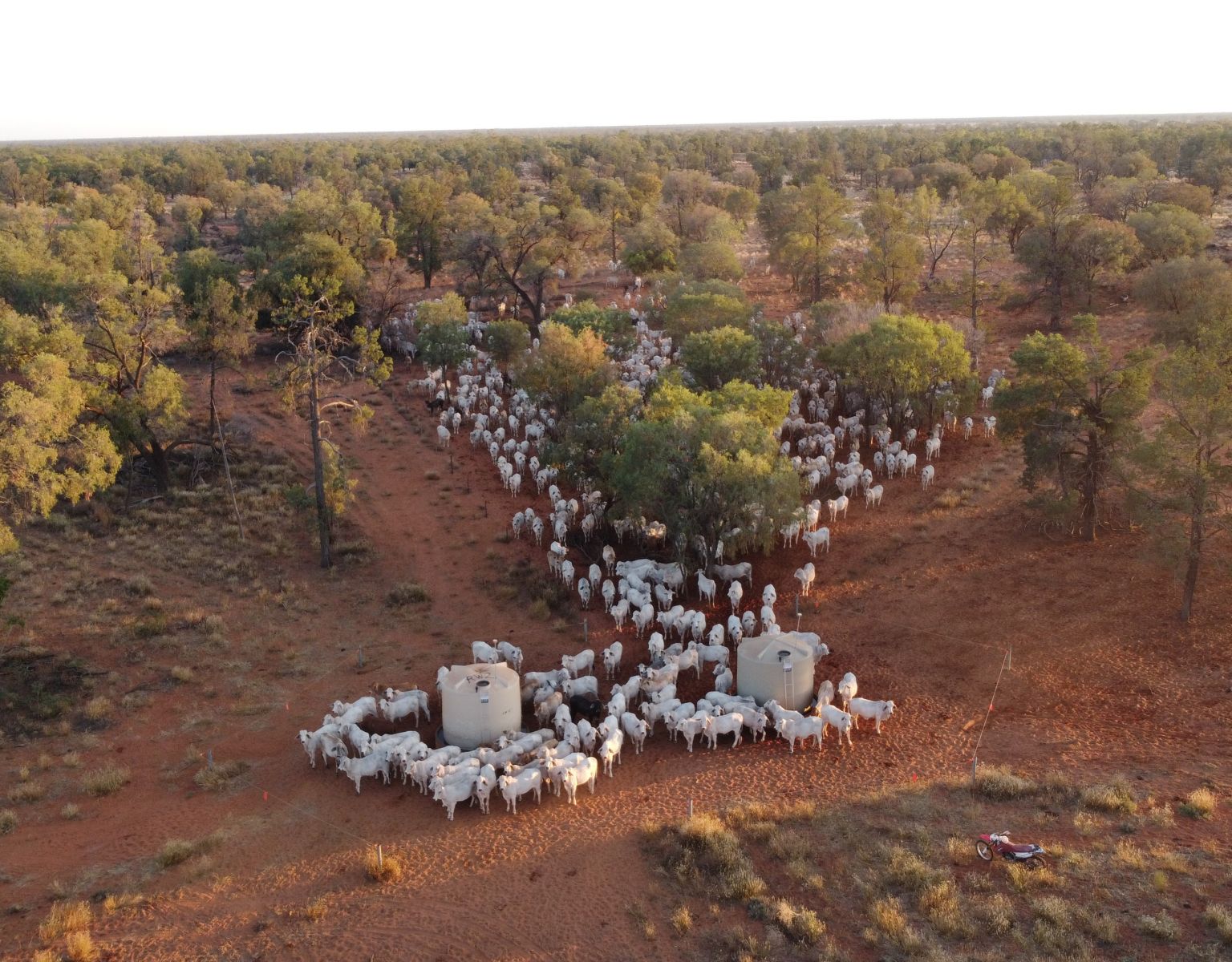

Garrawin (pictured) is an 80,000-hectare property in southwest Queensland, Australia. The Garrawin project has been published as a flagship case study in SLM Partners’ 2024 Impact Report. The report underlines SLM Partners' strong performance, reaching $75 5 million assets under management (AuM) in 2024 – a 24 per cent increase from 2023.

Located within an arid and semi-arid ecosystem – characterised by red sandy soils, low open woodland and limited rainfall – Garrawin demonstrates the benefits of planned grazing techniques. Since acquiring the land in 2013, SLM Partners said it has integrated livestock production with carbon sequestration and landscape regeneration. The introduction of planned grazing has increased stocking rates; the property supports a cattle herd of 340, entirely raised on natural pasture.

Ecological outcomes have also improved, the firm continued. After adopting planned grazing, ground cover increased across all rainfall levels, with gains of up to 8 per cent in years of higher rainfall. Perennial plant cover and distribution also improved, surpassing baseline levels in 2021 following a six-year drought.

Since its inception, the carbon project at Garrawin has issued 631,723 Australian Carbon Credit Units, generating an average annual net income of over A$800,000 ($517,000) since 2016, the firm said. This revenue proved critical during drought periods. With the planned grazing approach, managers must adapt the size of their herd based on the carrying capacity of the land. When the drought struck in 2014, stock levels had to decline and were reduced to zero at their lowest point. When livestock revenues were down, the business was supported by carbon credit sales. As a new source of cash flows, the carbon project generated an uplift of over 33 per cent in the asset’s valuation over a 25-year period, SLM said.

Looking to 2025, SLM said it is partnering with the European Investment Bank (EIB), using a technical facility grant to expand Continuous Cover Forestry (CCF) in Ireland and the UK. Sixty-four per cent of forests managed by SLM are under CCF. Through the EIB initiative, over 80 foresters have been trained in eight practical sessions, strengthening their national forestry knowledge bases, the firm added.

“The Garrawin case study in our 2024 Impact Report highlights a rare and powerful example of how regenerative agriculture can deliver long-term, measurable impact,” Paul McMahon, managing partner at SLM Partners, said. “With over a decade of data, it demonstrates our ability to successfully integrate cattle production with large-scale carbon sequestration and landscape regeneration.”

“By balancing livestock production with a significant carbon credit project, we’ve not only managed to enhance ecological outcomes but also diversify our revenue streams. This approach helps to mitigate both climate and market volatility, proving that sustainable land management can be both resilient and financially viable,” he added.

The 2024 Impact Report is the firm’s second report aligned with the Taskforce on Nature-related Financial Disclosures (TNFD) framework.

Founded in 2009, SLM Partners is a specialist real assets manager investing in agriculture and forestry; its investment programmes span Europe, the US and Australia. See more about the firm here and here.