WM Market Reports

Private Market Revenue To Increasingly Power Global Asset Management – PwC Study

.jpg)

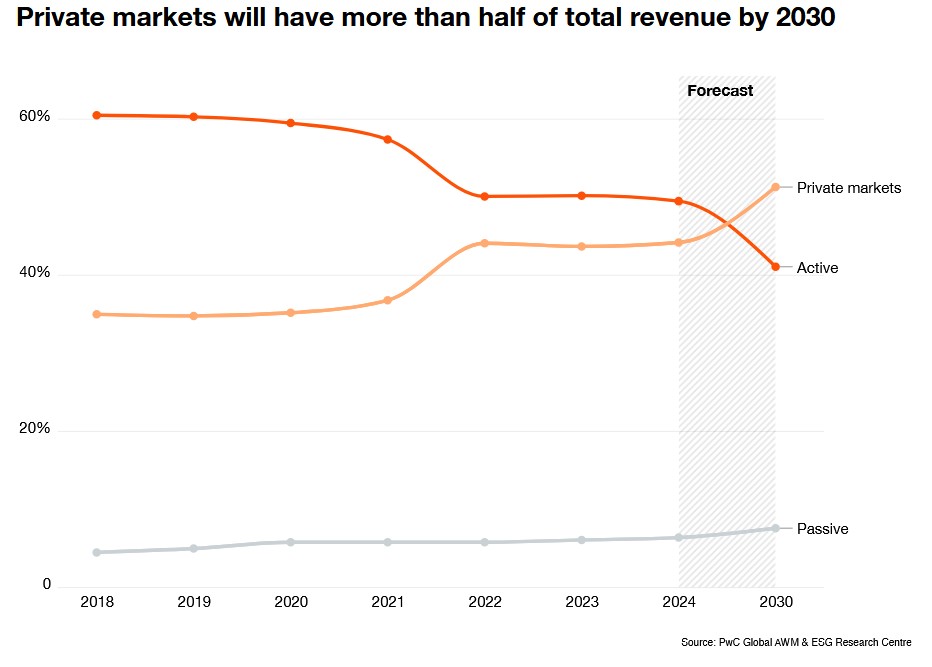

The report, which cuts across wealth as well as asset management, shows how important a revenue driver private market investment is now. Even so, cost pressures will not abate. They help explain forces at work, such as sector consolidation.

Private market revenues are set to reach $432.2 billion,

accounting for more than half of the total global asset

management industry’s revenues by 2030, a report from PwC released today finds.

PwC’s 2025 Global Asset & Wealth Management Report,

based on a survey of 300 asset managers, institutional investors

and distributors from 19 countries and 10 territories, also said

that global assets under management (AuM) are projected to

rise to $200 trillion by the end of the decade. It stood at $139

trillion in 2024. That equates to a compound annual growth rate

of 6.2 per cent; total investable wealth worldwide is expected to

exceed $481 trillion, the report said.

The expansion of private market investing has been a dominant

wealth management theme in recent years, fuelled by more than 10

years of ultra-low interest rates after the 2008 financial

crisis, a structural shift from listed equities, and a desire for

more diversification. A rising use of “passive” investment

entities such as exchange-traded funds has squeezed asset

managers’ fees, while private market investment fees tend to be

higher – understandably encouraging fund distributors to sell

them to clients such as wealth managers, family offices and

private banks.

PwC said private markets are set to “remain the industry’s most

profitable engine.”

Private markets generate roughly four times more profit per

billion dollars of AuM than traditional managers today. By 2030,

private markets revenues are set to reach $432.2 billion and

deliver over half of the total asset management industry’s

revenues by 2030.

The squeeze

In general, however, profitability pressures and narrowing

margins amid tough competition, fee pressure, a premium on talent

and expensive investments to increasingly diverse and

sophisticated client origins create challenges, the 20-page

report said.

A large majority – 89 per cent – of asset managers reported

profitability pressure over the past five years – with PwC

analysis finding that profit per AuM has declined by 19 per cent

since 2018, with a further market-wide 9 per cent decline

expected by 2030.

Costs remain the most visible driver of the squeeze – with more

than two-thirds (68 per cent) of every dollar consumed by such

costs, the report said. Almost three-fifths of institutional

investors say they are likely (41 per cent) or very likely (16

per cent) to replace managers purely due to high fees.

The report helps illuminate why there has been considerable

wealth management industry M&A in parts of the world. In the

US registered investment advisor sector, to take just one case,

there were 273 transactions completed in 2025 as of 28 October,

DeVoe & Company said a few days ago, confirming that this year

has already beaten the full-year record of 272 transactions.

Extending to other parts of the world, Miami-headquartered

Corient has agreed to buy UK-headquartered family offices/wealth

managers Stonehage Fleming and Stanhope Capital. There has been a

consolidation trend in the UK's wealth advisor space,

as discussed

here.

Convergence

The PwC report said that in such a challenging environment, asset

managers are “targeting convergence” with wealth managers and

fintech firms to build “technology-enabled ecosystems”; they see

integrating AI and automation as the most significant way

of making their businesses more resilient by 2030.

“Asset managers are evolving in the Intelligence Age, as new

technologies – from generative AI to agentic AI – re-shape how

value is created and delivered. The winners won’t be those who

gather the most assets, but those who rewire fastest, translating

innovation into digital ecosystems that serve more diverse

investors, more personally and efficiently than ever before,”

Albertha Charles, global asset and wealth management leader, PwC

UK, said.

North American dominance

In estimating the likely growth of AuM, the study said North

America will remain the dominant market, rising at a CAGR of

6.2 per cent. However, Asia-Pacific is projected to grow fastest

at a CAGR of 6.8 per cent. Latin America (6.6 per cent), the

Middle East and Africa (6.3 per cent) and Europe (5.6 per cent)

are also expanding, it said.

The total pool of global investable wealth is set to climb from

$345 trillion in 2024 to $482 trillion by the end of the decade –

a CAGR of 5.7 per cent.

Two-thirds of this growth will be driven by structural and

demographic shifts among mass-affluent individuals and high net

worth individuals.

Tokenization

PwC said that besides the revenue allure of private markets,

another bright spot includes tokenized funds. AuM is projected to

grow at a staggering 41 per cent CAGR, from about $90 billion in

2024 to $715 billion by 2030, driven by the maturation of

blockchain infrastructure, institutional adoption, as well as the

democratisation of private markets.

Elsewhere, passive AuM is projected to rise at a CAGR of 10 per

cent, reaching $70 trillion by 2030.

Archetypes of success

Businesses best positioned to outpace and outcompete are

clustering around four distinct models – yet only 42 per cent of

firms today fit one of four winning archetypes, PwC

said.

The four models are “full scale private-to-public hypermarkets

(projected to account for 49.5 per cent of the increase in asset

and wealth management revenues by 2030); solutions platforms

(estimated to account for 14 per cent of revenues); low-cost

manufacturers (predicted to account for 12.2 per cent); and

niche champions (18.2 per cent).

The report said that other models outside the four main

categories will only be able to capture 6.1 per cent.