Alt Investments

Private Equity Funds' New Deal Appetite Wanes - Study

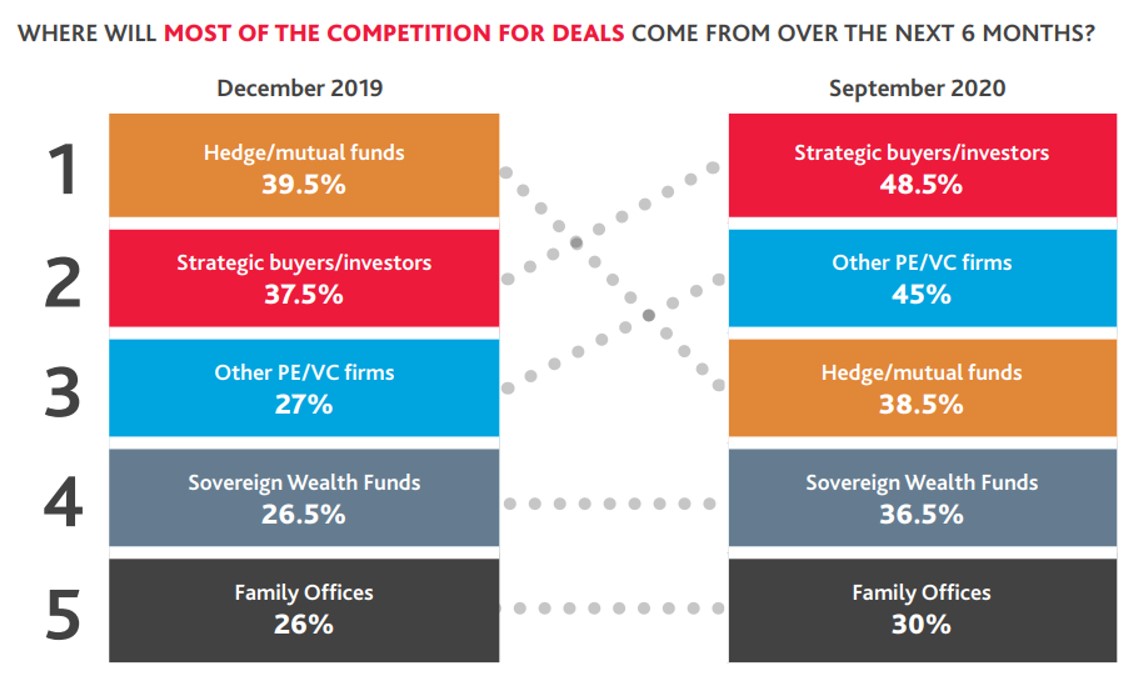

Family offices are growing more important in competing for a seat at the private equity table than was the case a year ago, highlighting how these institutions view the asset class. This is one of the insights from a new study exploring the private equity space in the US.

Private equity funds have become far more cautious about seeking

new deals over the next six months than was the case a year ago,

chastened by worries about COVID-19’s economic fall-out, a study

shows. Separately, family offices have gotten more important as a

source of competition for private equity deals.

The US Private Capital Pulse Fall 2020 Survey from BDO USA, the

accountancy and professional services firm, said that “funds

today are decidedly more bearish on pursuing new deals than they

were last winter.” Some 23.5 per cent of fund managers say they

will direct the most capital toward new deals or investments in

the next six months. That represents nearly a 20 per cent decline

from BDO’s last survey released in December.

The firm surveyed 100 private equity fund managers and 100

venture capital fund managers at US firms. The survey was

conducted by Rabin Research Company, an independent marketing

research firm, in August 2020.

Family offices, ultra-high net worth and some HNW individuals

(depending on wealth minimums) have increasingly pushed into

private equity and other illiquid asset classes, chasing the

superior yields that can come with lower liquidity. Disruption to

global economies caused by the pandemic has created distressed

valuations – which can be opportunities – and hampered some of

the due diligence checks investors make, so this publication

understands.

The chart below shows how family offices' involvement in private equity has increased:

Source: BDO.

Among other findings in the BDO report, three quarters (74.5

per cent) of fund managers believe the economy will be “better”

to “much better” in 2021. On the other hand, only 4.5 per cent of

respondents said that they are not preparing for a second wave of

the pandemic; the rest are taking action, including conducting

business continuity risk assessments (55 per cent), changing

forward-looking valuation metrics (47 per cent) and considering

applying for a government loan (36.5 per cent).

“With the road to recovery shrouded in uncertainty, deal makers

are grappling with an unfamiliar landscape,” Scott Hendon,

national leader of private equity at BDO, said. “Deal flow will

remain comparatively muted for the balance of 2020, but, in line

with industry expectations, we believe M&A will pick up as

the economy turns around in 2021.”

The report delved into what drives deal flow. It said that while

activity during the balance of 2020 is unlikely to catch up with

the deal flow in 2019, transactions are picking up steam, and

nearly half (49.5 per cent) of survey respondents expect private

company sales and capital raises will be the key driver of deal

flow in the next six months. Among other top key drivers of deal

flow are public to private transactions (39 per cent), succession

planning (37 per cent), exiting investments (34 per cent) and

corporate divestitures (32 per cent).

More fund managers unsurprisingly think that distressed business

deals will drive deal flow. In the latest survey, 46.5 per cent

of managers think these areas will be a big source of

transactions, up from 40 per cent a year ago.

“We expect to see distressed deal activity pick up in Q4 2020 and

into 2021 as businesses that are still experiencing disruption

deplete their coronavirus federal relief loans,” the study

said.

Other details

Asset prices in private equity deals have fallen by 10 to 20 per

cent from pre-COVID levels, except for some sectors.

New deals/investments are still the top choice for capital

deployment (23.5 per cent), down by 18 per cent from last winter,

and only slightly edge out add-on acquisitions/follow-on

investments (22.5 per cent).

Investing in distressed businesses (20 per cent) and applying

equity relief to portfolio companies (19.5 per cent) closely

follow. The close results point to funds diversifying strategies

in the pandemic economy. In the next six months, just 13.5 per

cent say they are de-levering portfolio companies’ balance

sheets.

General partners are pivoting to venture-focused investments of

early stage VC (62 per cent) and late stage VC (45 per cent), as

well as growth equity (57 per cent). Other popular investment

strategies being employed are structured credit (31 per cent),

leveraged buyout (24.5 per cent), private investment in public

equity (20 per cent), investments, and mezzanine deals (12 per

cent).