Alt Investments

Private Debt – An All-Weather Asset Class

The author of this article examines a sector known as private debt, an area defined in some ways as that which operates away from conventional lenders such as banks. Private credit also taps into investor hunger for yields in today's environment of low/negative interest rates.

The following article is about the market for what is called “private debt”, a term covering forms of credit that go outside loans provided by banks. Since the financial crash of 2008, rising capital requirements on banks and other changes led to a squeeze. But money, like water, has a habit of finding a natural level. And non-bank players, such as funds, have sought to fill the space. (Sometimes this area is called the “shadow banking” system, prompting concerns over whether regulators have a tight hold on what is going on in the sector.)

To discuss trends in the space is Kirsten Bode, co-head of private debt, for the Pan-European market, at Muzinich & Co, the London/New York-based firm focusing on public and private debt. The editors of this news service are pleased to share views of outside contributors. Remember, the usual editorial disclaimers apply. To respond, email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

Where might investors find yield, protection from

volatility and investment opportunities across the credit

cycle?

The European private debt market is a relatively new asset class,

having evolved as private lenders stepped into the gap left by

banks after the great financial crisis.

Today, while banks are still lending, they are becoming increasingly limited by ongoing regulation and capital constraints. (1)

Meanwhile private debt, or direct lending, is being assisted by a

relaxation of lending laws, such as in Germany and Italy, which

is enabling non-bank lenders to provide financing solutions. As a

result, direct lenders are now firmly established participants in

the market. (2)

Risk/return profile

Falling interest rates in 2019, combined with increasing amounts

of negative-yielding debt, reinforced investors’ hunt for yield.

(3) While some may be willing to move down the risk

spectrum to find yield, we believe that private debt can offer an

alternative likely to weather an ageing credit cycle,

particularly when managed as a responsible investment strategy.

In our view, private debt can provide investors the potential for higher yields, via an illiquidity premium, than is available in public markets.

The asset class also has a low correlation to public market fixed income and therefore tends to offer a less volatile return profile (the investments are fixed over several years and not publicly traded on open exchanges) as well as protection from duration risk (due to the floating rate nature of the loans).

ESG enhancements

In addition, we believe systematic review of environmental,

social and governance (ESG) factors can enhance the due diligence

and ongoing monitoring of private debt details.

Factors such as employee engagement or compliance with relevant environmental regulations, may ultimately impact the financial resilience of a company. We believe taking a more holistic view on so-called non-financial issues also helps investment managers to protect their reputation and those of their clients.

Opportunities in an underserved segment

There are over 100,000 companies in the middle market (€25-250

million EBITDA) Europe-wide, which offers a sizeable and diverse

opportunity set for investors. (4)

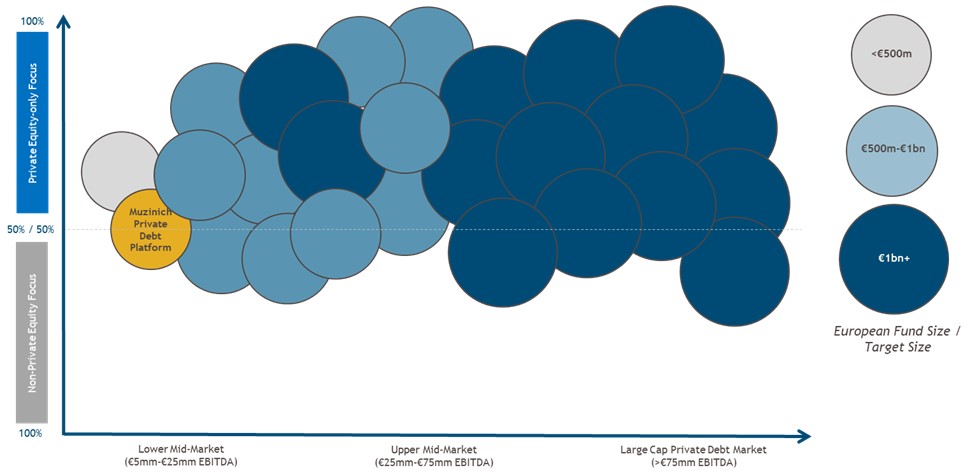

A large proportion of direct lenders tend to be focused on the middle and upper segments of this market (companies with €25->€75 million EBTIDA) (Fig. 1).

However, with greater competition comes the potential for increased pressures on pricing, deal sourcing and capital deployment.

Fig. 1 – The lower middle market is underserved

Note: Muzinich’s opinion of a representative competitive landscape. Analysis based on Muzinich review of publicly available information and institutional insight. Investment strategies of the above referenced firms may change. For illustrative purposes only. As of 19 September, 2019. Investment strategies of firms included in the above analysis may change.

In our view, the European lower middle market (companies with €5-25 million EBITDA) is underserved from a lending perspective.

Small and medium-sized enterprises (SMEs), which broadly comprise this segment, are the growth engine of Europe. (5)

We believe that these companies offer an array of lending opportunities, specifically within family and founder-owned businesses looking for funding solutions.

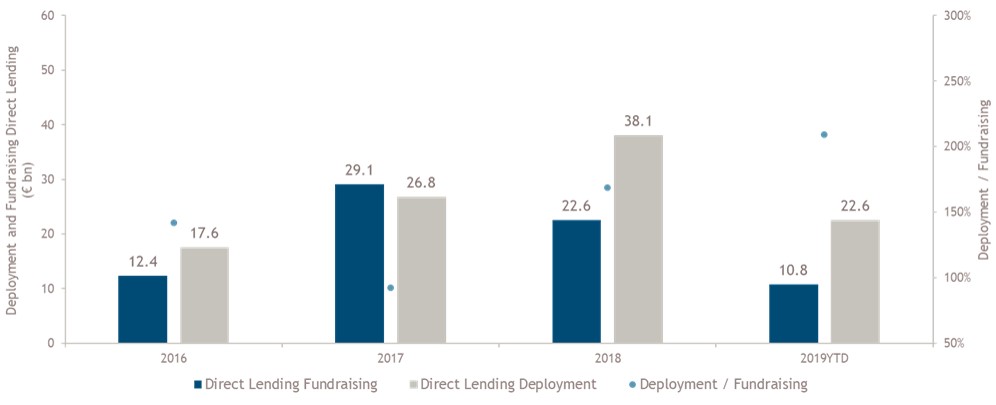

Significant growth in the European private debt market over the last 10 years has created some concerns that lenders have built large supplies of so-called “dry powder” (capital raised but not deployed). (6)

However, as Fig. 2 shows, lenders are not experiencing challenges in finding investment opportunities.

Fig. 2 – Capital continues to be deployed

Source: Annual Europe-Focused Direct Lending Fundraising and

Deployment. Deloitte Alternative Lender Deal Tracker, Autumn

2019. Europe Direct Lending fundraising by quarter. H1 YTD

2019.

(Muzinich views and opinions for illustrative purposes only,

not to be construed as investment advice.

https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/private-equity/lu-deloitte-alternative-lender-tracker-autumn-2019.pdf)

A local, flexible approach

The size of the market and number of jurisdictions does present

challenges. We believe accessing this area benefits from

specialist local knowledge, and an on-the-ground presence in each

of these markets is therefore key for deal sourcing.

In our view, it is important to have a robust investment approach with a deep focus on fundamental analysis, including ESG issues, to identify solid businesses with which a lender can partner and advise on their growth journey.

As each business has different requirements, we believe the flexibility to customise a lending solution specifically for each company is also integral for a successful strategy. In our experience, as companies look to grow and mature, they typically become more receptive to guidance on both financial and ESG aspects of their business.

While private equity firms provide sponsorship on deals, there are also opportunities for sponsor-less transactions where lenders can work directly with borrowers – again made easier by a local presence, in our view.

Banks are often the first port of call for a company looking for additional funding. However, for smaller businesses which are keen to move quickly, working with a bank can prove a lengthy and restrictive process.

Direct lenders can customise lending solutions to fit the specific needs of each borrower over a shorter time frame; execution may be as short as one month.

We believe ongoing monitoring is also easier for direct lenders who can develop strong relationships through direct dialogue with senior management.

On some occasions it may be appropriate to integrate ESG considerations, such as disclosures on regulatory compliance or governance, into the terms of the loan agreement.

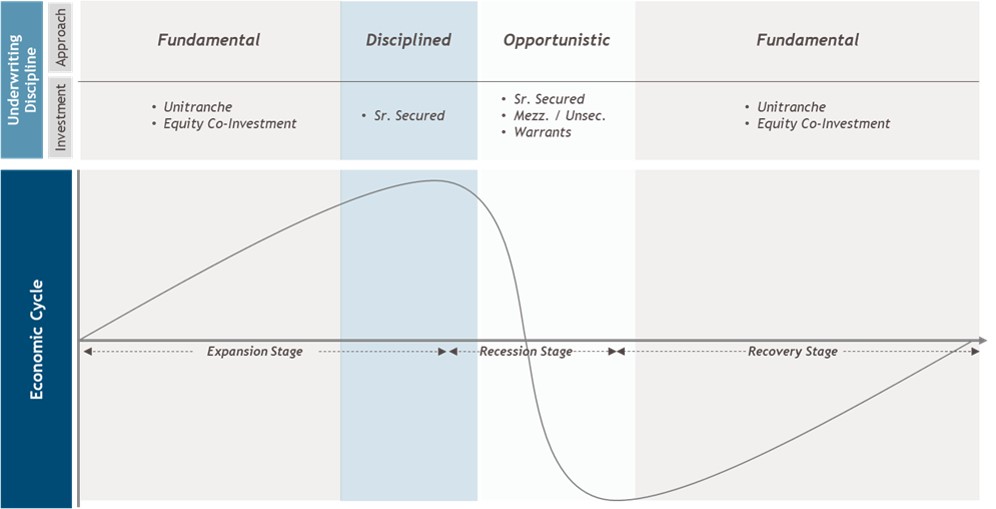

Fig. 3 – Opportunities across the cycle

Source: Muzinich & Co. For illustrative purposes

only

In our view, the current credit cycle might be nearing its conclusion, having been only marginally extended by looser monetary policy. This is likely to influence investors’ short and medium-term allocation decisions.

Private debt incorporates a range of instruments (from senior to

mezzanine through to distressed), making it what we believe is an

“all weather” asset class.

Senior debt can offer greater security for late cycle investing.

These debt instruments are higher up the capital structure and

money will be recovered before subordinated lenders and equity.

Senior debt also tends to have stronger documentation and

covenants to protect investors in the event of default.

However, as the cycle turns, there tends to be a greater number of distressed opportunities as businesses default; in these instances, lenders can find opportunities to work closely with borrowers and help turn those companies around.

Given where we are in the credit cycle, we believe it makes sense to look for direct lending opportunities in the senior secured segment of the market.

However, as the credit cycle continues to age, lenders could find more attractive opportunities in the subordinated parts of the capital structure.

For fixed income investors, private debt may provide an

interesting alternative investment to public market debt by

providing yield, but in what we believe is a less risky

instrument than private equity for example.

We believe it offers the opportunity for the diversification

benefits of higher yields and lower volatility than public debt,

as well as the chance to contribute towards economic

growth.

While the European private debt market originated from the financial crisis, it has continued to develop due to the demand for alternative risk assets. We believe private debt is an all-weather asset class that is here to stay.

Sources:

1.

https://www.bis.org/bcbs/publ/d424_hlsummary.pdf

2. Preqin, Markets in Focus: Alternative Assets

in Europe. As of 30 September 2019. Most recent data available

used.

3.

https://www.federalreserve.gov/monetarypolicy.htm;

https://www.ecb.europa.eu/mopo/decisions/html/index.en.html;

Barclays Global Aggregate Negative Yielding Debt Market Value

(BNYDMVU Index) total of US$13trn, as of 31 January

2019.

4. Amadeus BVD 14 September 2018. Criteria:

Excluding UK, last available year, Operating Revenue min = €25m,

max = €250m

5. https://ec.europa.eu/growth/smes_en

6.

https://www.preqin.com/insights/blogs/alternatives-in-2019-private-capital-dry-powder-reaches-2tn/25289

, as of 28 January 2019

About the author

Prior to joining Muzinich, Kirsten worked for six years as a Managing Director in the principal debt investing team at Macquarie, responsible for sourcing and executing transactions ranging from leveraged senior, unitranche and mezzanine debt to equity in the U.K., Germany and Benelux. Previously, she worked for Silver Point Capital, a U.S. based credit/distressed fund, in the private debt team in Europe. Kirsten started her career at Morgan Stanley in 1999, working in the generalist M&A and Leveraged Finance teams in Germany and London. Kirsten graduated from ESB Reutlingen and Middlesex University London with a B.A. Honors in European Business Administration.