Investment Strategies

Private Credit For Private Wealth Portfolios

The author argues that in an environment of shifting inflation dynamics, true diversification increasingly depends on assets grounded in measurable cashflows rather than market cycles.

The following article is from Francesca Filia (pictured below), who is chief executive and founder of Fasanara Capital, a company this publication has interviewed before. He examines a number of issues in today’s fixed income markets and where private credit sits in the portfolios of private clients. The editors are pleased to share these views; the usual editorial disclaimers apply to views of guest contributors. To comment, please email tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

Francesca Filia

Inflation patterns are diverging across Southern Europe. This is

leading fixed income investors to refocus on stability,

liquidity, and diversification with asset-based finance and its

exposure to the real economy emerging as a complementary

component in their portfolios.

Italy provides an instructive case. For decades, Italian private

banking portfolios were built on a simple foundation: government

bonds that offered safety, yield, and predictability – the

pillars of post-war wealth management. That foundation, however,

is evolving. As Europe transitions into a new equilibrium after

years of volatility, the macroeconomic backdrop – and with

it, investors’ priorities – is shifting.

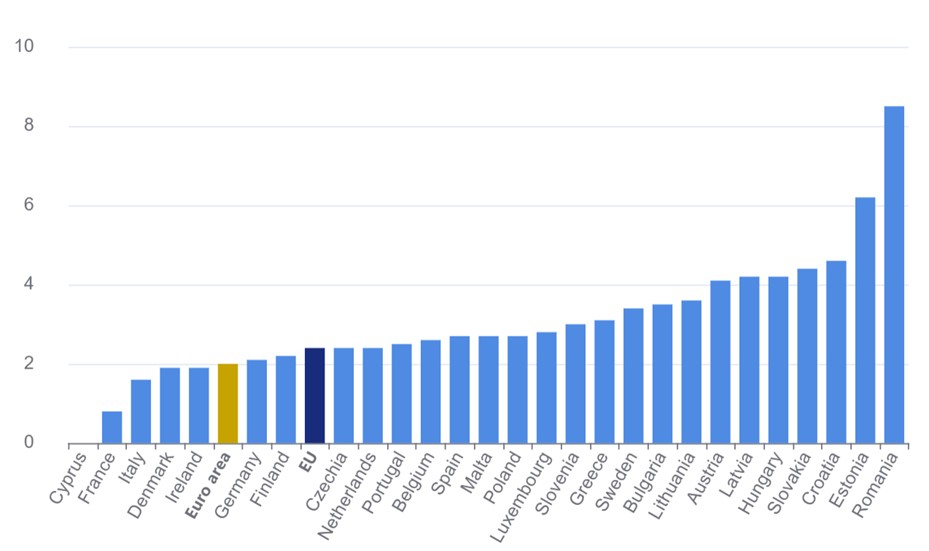

One key area of divergence is inflation. In Italy, inflation has

moderated to around 1.6 per cent as of August 2025 (Figure 1).

Falling import prices, moderate wage growth, and a firmer euro

have restored price stability. Energy, once inflationary, is now

broadly disinflationary.

However, in Spain, the picture is more complex: headline HICP is

expected to remain at around 2.3 per cent, while core inflation

recently rose to 2.7 per cent – its highest level in 10 months. A

tight labour market and rising housing costs have made Spain one

of the eurozone’s more inflationary economies.

This disjunction is increasingly shaping portfolio design across

Southern Europe. With inflation normalising in Italy but

lingering in Spain, investors are refocusing on real yield,

diversification, and liquidity – priorities that extend

beyond traditional fixed income.

Figure 1: Annual inflation rates (%) across Europe in August 2025

Source: eurostat

From bonds to broader diversification

Italian private banking portfolios still reflect their heritage:

large allocations to sovereign and bank bonds, complemented by

equities and cash. Yet as yields fluctuate and spreads narrow,

investors are broadening their horizons. Typical allocations now

combine:

-- Fixed income: shorter duration, stronger credit

focus;

-- Equities: more global and thematic, from AI to

semiconductors and defence;

-- Private markets: including private equity, private debt,

and infrastructure; and

-- Cash: retained for flexibility, but less central to

long-term returns.

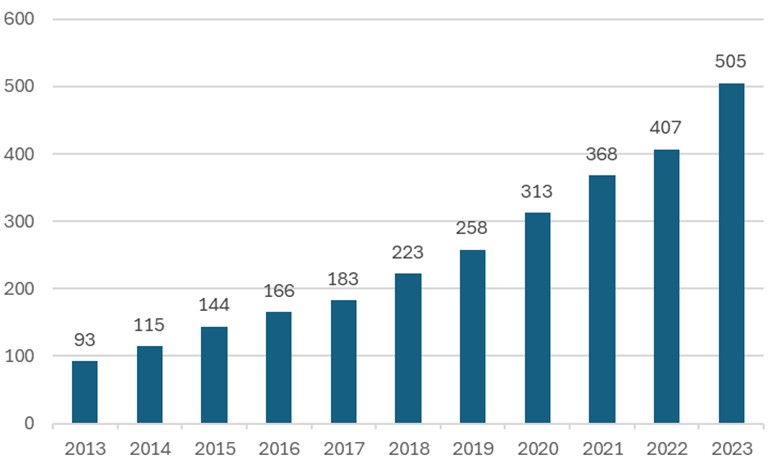

Across both Italy and Spain, one trend stands out – rising

interest in private credit (Figure 2), particularly strategies

offering real-economy exposure with short durations and limited

lock-ups.

Figure 2: European private credit AuM, 2013-2023 (US$ billion)

Source: Preqin

Understanding private credit’s resilience

Private credit’s defining feature is its cashflow-based

valuation. Unlike private equity – where returns depend on

multiple expansion or exit markets – private credit derives

value from contractual repayments. Portfolios that hold

short-term receivables backed by large corporate obligors, with a

focus on repayment performance, can help mitigate key risks

by:

-- Aiming to moderate mark-to-market volatility; though

valuations can still fluctuate;

-- Lower sensitivity to public-market valuation multiples;

macro conditions can still affect borrower performance and

collateral values;

-- Reduced dependence on external refinancing/IPO markets;

and

-- Regular amortisation as receivables repay and proceeds

are typically recycled; timing and liquidity are not assured.

In private credit, returns compound through repayment rather than

re-rating – a feature that underpins resilience during

periods of market stress. For private wealth investors, this

could potentially make private credit a natural counterweight to

private equity: less cyclical, less correlated, and more

predictable.

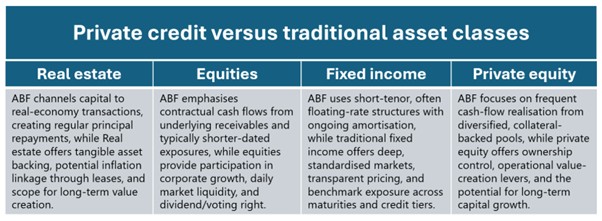

Integrating private credit alongside real estate, bonds,

and equities

When viewed alongside traditional portfolio pillars, private

credit serves a distinct function – complementing real estate,

equities, and fixed income rather than competing with them

(Figure 3).

Figure 3: Private credit characteristics relative to major asset

classes

Source: Fasanara Capital

As portfolios evolve beyond the traditional triad of equities,

bonds, and real assets, private credit is increasingly seen as a

fourth pillar – grounded in contractual cashflows rather

than market valuations.

ELTIF: the bridge to private credit

democratisation

The introduction of the European Long-Term Investment Fund or

ELTIF marked a key milestone for Europe’s private-markets

landscape. The revised framework streamlines eligibility rules,

broadens investor access, and increases flexibility in portfolio

composition. Under this regime, private-credit strategies

–including short-duration, asset-backed lending vehicles

– can be offered through regulated structures for qualified

investors.

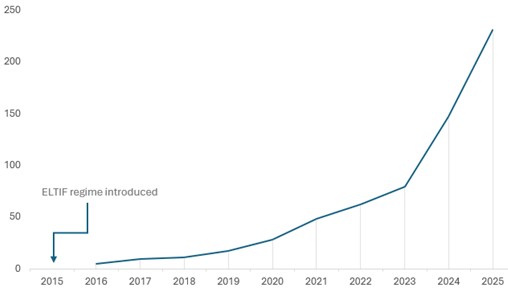

Since implementation, the number of authorised ELTIFs has risen

sharply. According to ESMA data, active vehicles have grown from

just five in 2016 to more than 230 in 2025 (Figure 4), with the

steepest increase following the reform in January 2024

– fund numbers nearly doubling between 2023 and 2024.

Figure 4: Number of ELTIFs launched

Source: European Securities and Markets Authority. Data

correct as of 31 October 2025.

This acceleration reflects growing demand for long-term

private-market exposure and the accessibility introduced under

ELTIF. For private banks and wealth managers, it represents a

structural broadening of opportunity.

The future of fixed income is private, short term, and

real (1)

With inflation patterns diverging across Southern Europe,

investors are refocusing on stability, liquidity, and

diversification within income-generating portfolios. Asset-based

finance is emerging as a complementary component within modern

fixed-income allocations – offering exposure to real-economy

repayments.

For private banks and family offices, this marks an important

evolution in portfolio design. In an environment of shifting

inflation dynamics, true diversification increasingly depends on

assets grounded in measurable cashflows rather than market

cycles.

About Fasanara Capital

Fasanara Capital is an independent London-based asset manager and

fintech platform specialising in alternative credit and

quantitative strategies. Founded in 2011, the firm manages over

$5.5 billion on behalf of institutional and professional

investors globally.

Footnote:

1, The views expressed are of Fasanara Capital Ltd.