Asset Management

OPINION OF THE WEEK: Same Ticket, Different Destination? – The View From ARC

The author of this article contends that senior managers in the wealth management industry must ensure equitable outcomes for clients who have, in essence, bought the same investment solution.

The following article, from Asset Risk Consultants (ARC), delves into how much risk wealth managers and private banks take when executing on their clients’ investment goals. The results, so ARC says, can be surprising, even worryingly so. This article is something of a call to arms on the industry to improve its performance.

This news service is publishing this article to coincide with the first birthday of the UK’s Consumer Duty. There are three broad legs to the Duty: a new Principle for Business: the "Consumer Principle which requires firms to "act to deliver good outcomes for retail customers"; there is a "Cross-cutting rule" setting out three overarching behavioural expectations that apply across all areas of a firm's conduct; and third, there are "Four Outcomes," which are rules and guidance setting more detailed expectations for firms. This publication has explored the Duty’s logic here.

At ARC, Paul Kearney (pictured), managing director, Asset Risk Consultants, takes a brief tour around the kind of data results that ARC collects and reflects on what it says about how well – or not – the sector delivers what is offered.

The editors of this news service are pleased to share these views and add to debate. The usual editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com

Investing is frequently likened to making a journey. Investors

select their destination (what they hope to achieve given their

goals and objectives), choose how arduous, or bumpy, their route

is going to be (their appetite and tolerance for risk) and their

method of travel (DIY, budget or all inclusive) and then set out

on their journey. So far, so straightforward.

But there is something else about this journey that many may not realise. Even if, as an investor, you select to take the same trip as others, you may end up at a very different destination. Some may feel that they have received a 5-star resort experience in the Maldives, others – unaware of their less delightful outcome – may have to settle for something more modest and closer to home, akin to a grey wet holiday on the UK coast.

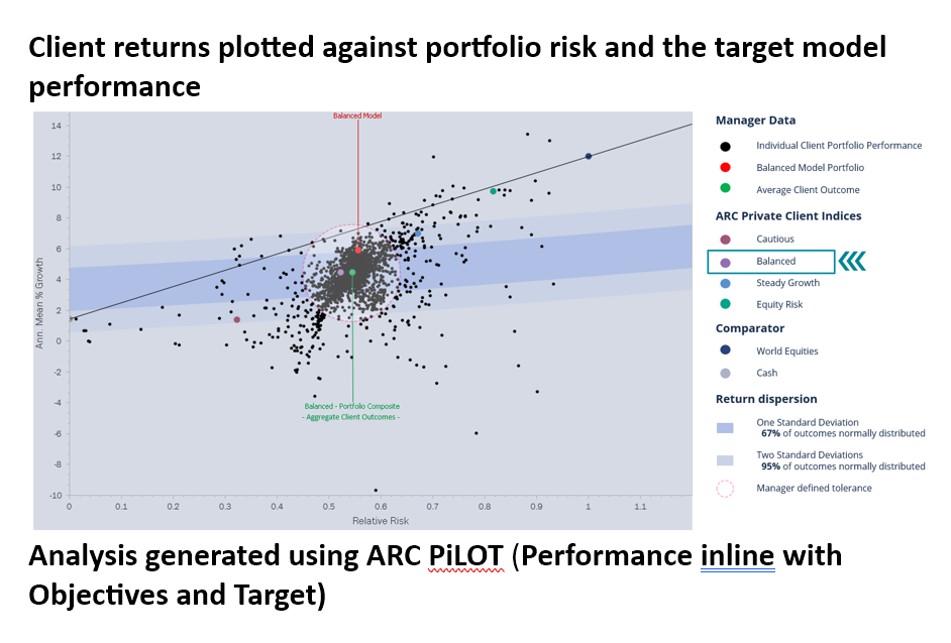

Put simply, there can be a huge difference in investment performance for clients essentially buying the same investment solution. The graph below is a real-life wealth manager’s performance dispersion for clients following a specific investment model.

ARC Research provides analysis to investment managers to [help them] quickly and effectively identify performance outliers using relevant cross-sectional factors including strategy, team/office, portfolio manager and client. By creating a private index series, or composite, wealth managers can identify, understand and resolve performance outliers and focus on consistent client outcomes.

It is important to acknowledge that returns can, of course, be materially impacted by clients' cherished holdings, new accounts with uninvested cash, underperforming in specie transfers and small or closing accounts with minimum fees being applied. Each of these [factors] will likely cause performance to be dragged away from that achieved by the model.

However, two things stand out immediately: the wide variability of returns and that the average performance of all portfolios is materially less than the performance of the model that they are ‘following’. If variability of returns between investors with identical requirements is a feature of the investment solution, this firm might reflect on whether the price and value outcome requirement of the UK Consumer Duty requirements are being met.

Investors may anticipate that they will achieve the same outcome as the model that was proposed to them as the solution that matched their needs. The key issue is whether it can be an acceptable outcome for two clients with the same needs, who deploy their money on the same day should have a wildly different investment outcome.

“… products and services that are poorly designed … are unlikely

to provide fair value.”

FCA Final non-Handbook Guidance for Firms on the Consumer Duty

It is generally the case that without tightly controlled, centrally implemented portfolios or a unitised solution, variability of returns will always exist. In addition, the bespoke tailoring of portfolios to specific client needs and requirements is a fundamental aspect of a wealth manager’s role.

The secondary question is whether the average of all the portfolios following a particular model aligns with the model performance. What variability of outcomes should be acceptable? How are managers identifying, understanding and, where necessary, resolving performance outliers?

So, you might be thinking that this is a made-up data set to dramatically illustrate a point. Or that it isn’t much of a problem in reality. However, the data shows that many wealth managers have significant portfolio return dispersion.

In the chart above the tall, thin boxes show the return outcomes experienced by 50 per cent of the client portfolios and the whiskers sticking out show the 10th to 90th percentile outcomes (the wider variability of returns for 20 per cent of client portfolios is not represented here).

The relevance of this is hopefully obvious. Envy – one of the seven deadly sins – is a terrible emotion to experience. If client investment outcomes are seen as arbitrary there will be a fundamental loss of trust in a core service that the wealth manager is providing.

Senior managers in the wealth management industry must ensure equitable outcomes for clients who have, in essence, bought the same investment solution.

Ralph Waldo Emerson famously said that “life is a journey, not a destination.” However, when it comes to investing, it is a journey and a destination.

(See here for a previous article about ARC and its approach.)