Art

OPINION OF THE WEEK: What We Can Learn From Online Art Sales Data

The world of art auctions can be fascinating in its own right and also has lessons for the wider wealth management industry. The editor takes a look.

More than three years ago when the pandemic hit, in-person art

auctions, fairs and gallery exhibitions were slammed, and only a

part of that business was able to migrate to a virtual world. And

for all the breathless talk about how so much of our lives are

moving online, it turns out that people really do need to see and

enjoy art in the flesh.

The Art Basel and UBS Global Art Market Report,

published last week, noted that during 2022, the event-driven

market resumed its more regular schedule. Dealers and auction

houses reported a further cut in the share of their sales

accounted for by e-commerce in 2022. Following two years of

unprecedented growth, online-only sales fell to $11 billion in

2022, a 17 per cent decline year-on-year from their peak of $13.3

billion in 2021, although still 85 per cent higher than in

2019.

What such data suggests is that while the online auction and

sales channels are becoming more important, people in this sphere

are keen to enjoy the hustle and bustle of in-person events. That

doesn’t mean that some of the transactions they get involved with

won’t have an online element, but it does suggest that they want

to view art “in the flesh,” as it were, as much as is

feasible.

As we noted in the report when it came out, events such as art

auctions and exhibitions can be barometers for how prosperous –

or not – high net worth individuals think they are and how

willing they are to splash out and enjoy the wealth they have.

And beyond the aesthetic enjoyment, there’s also the investment

angle – returns on some forms of art can be strong in certain

periods.

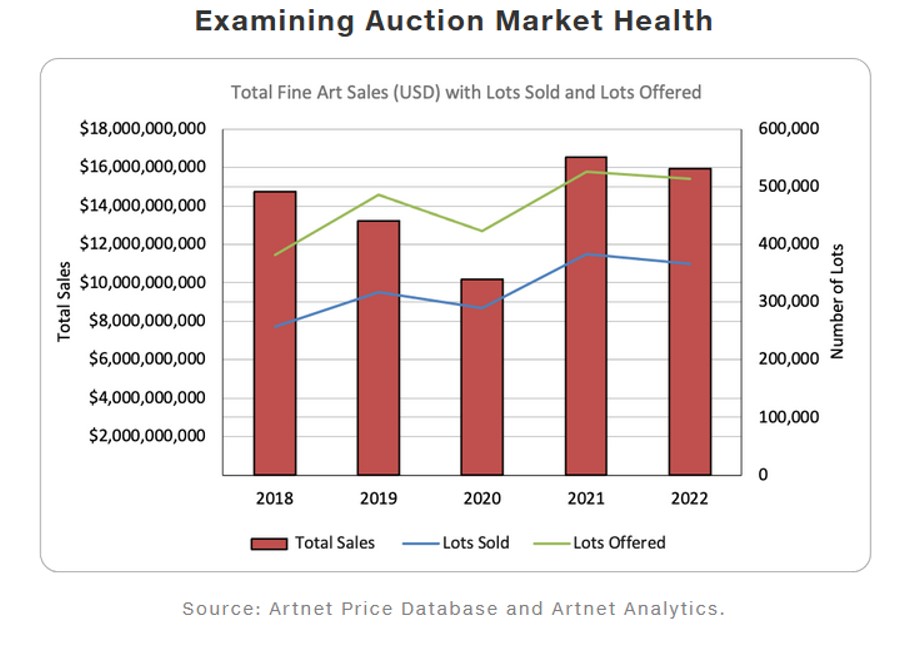

There’s been a recovery, for sure, in art sales since the

annus terriblis of 2020. In another report, by Morgan

Stanley and Artnet News (March, 2023), Total sales of

fine art reached $15.9 billion in 2022, a roughly four per cent

decline from the $16.4 billion sold in 2021 but still the second

highest annual total since 2018. The report’s authors said this

result is noteworthy because its five-year sample includes two

pre-pandemic years and two post-pandemic years bookending an

“anomalous” 2020.

The virtual model of exhibitions in the art and museum world

hasn’t gone away, however. Even without a pandemic, not everyone

can afford the time to fly to a museum or gallery, and technology

is now so good that it is possible to see artistic wonders over a

screen. I’ve taken a virtual tour around the Vatican, for

example. The Getty Research Institute has a suite of virtual

exhibitions on subjects as varied as Indian cities to Bauhaus

archictecture. You can also go on a virtual tour of spaces such

as the National Gallery in London or some of the houses

designed by Frank Lloyd Wright.

Beyond marveling at the technical wizardry of all this, what

lessons are there for wealth managers? Even before Covid-19

struck, there was much talk and some action on

the digitalization of value chains, wider use of interactive

videos, “gamification” of the client experience, and augmentation

of RMs with more tools. None of these developments have lost

force. And the pandemic accelerated them. There has also been a

squeeze of sorts – people think that bit harder about whether a

business trip or an in-person meeting is worth the time on the

road or the flight. Where budgets are tight, in-person events

will have to be more fun, and generate more return on investment

than before.

Gone are the days, I suspect, of interminable business

conferences where you had to listen to people drone on about

“client-centric offerings” and the like, and rush for the

networking break over bad coffee. Family offices will have

meetings among members to discuss the financial stuff over Zoom

or Teams, but go for the quality time together for a bit of fun

instead. I see this happening in our industry quite a lot: wealth

managers love to hang out with others and swap stories and

gossip, but they want more value out of this than, say, 10 years

ago. It means that putting on events requires more work, more

imagination, and more willingness to try something different.

Back in the early weeks of the pandemic, it was possible to buy

into the whole idea that physical events would be off-limits for

years, and that people would only reluctantly attend them.

The psychological as well as economic impact of lockdowns cannot

be underestimated. But it does appear, from where I sit now in

April 2023, that the appetite to "get out there" and meet

people has largely returned. That's an optimistic note on which

to conclude.

As ever, if you have reactions, suggestions or stories for us, email me at tom.burroughes@wealthbriefing.com