M and A

North American Wealth M&A Increased In 2024 – Sector Is Weathering Volatility

.jpg)

Foreign buyers, including those linked to sovereign wealth funds, were among the players in the space. One trend has been the rise of "adjacent" areas such as trust services coming into the mix.

(An earlier version of this article appeared on Family Wealth

Report, sister news service of this one. Several of the M&A

deals involved non-US players, so we hope readers find the

content of value.)

North American mergers and acquisitions continued to increase in

number last year, with deals such as the UAE-backed purchase of

CI Financial,

and Bain Capital’s acquisition of Envestnet, among the

stand-outs.

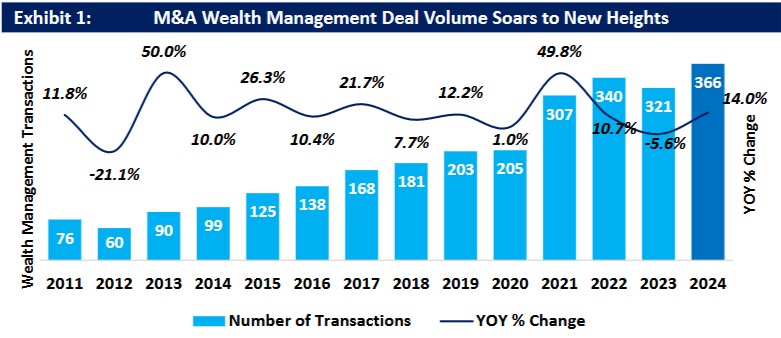

Total announced deals rose by 14 per cent last year to 366,

according to figures from ECHELON Partners,

the US investment bank that advises on wealth deals. The busiest

quarter of 2024 was the fourth, with 125 deals, up from 95 a year

earlier.

Source: ECHELON

The report noted that several deals involved overseas buyers,

while transactions are spilling over into adjacent areas such as

the trusts sector.

“With ample well-capitalised buyers, it remains a seller’s

market, particularly for firms with strong organic growth and

niche expertise,” Dan Seivert, managing partner and CEO at

ECHELON, said in his firm’s 37-page report.

“Despite rising M&A activity, the market remains fragmented,

attracting diverse capital providers. This influx is set to

heighten competition for quality assets, driving valuations

higher,” he wrote.

The report said that average assets per transaction fell slightly

from $1.7 billion in 2023 to $1.4 billion in 2024. There were 11

transactions involving more than $100 billion in AuM – a

record.

Among deal examples in 2024 was the Hightower Advisors’ purchase

of NEPC; TPG’s acquisition of Creative Planning; KKR’s purchase

of Janney Montgomery Scott; and the BlackRock, JP Morgan

Asset Management deal with Dynasty Financial Partners. Other

deals included the Allianz X, Constellation Wealth Capital deal

with AITI Tiedemann, and the Pathstone/Hall Capital Partners

transaction.

Buyer competition was intense between sponsor-backed strategics

for add-on acquisitions, Seivert said. Private equity continued

to pursue platform investments.

Seivert said that the consolidation is continuing, and strategic

buyers are dominating the space, making up about 70 per cent

of deals.

Wealthtech-related deals rose strongly last year, the report

said. There were 138 deal announcements, rising from 104 in 2023,

making a 37.2 per cent year-over-year increase.

Looking ahead, Sievert said he expects another “robust” year in

2025 for dealflow, noting that advisors’ succession plans and the

benefits of scale are making the wealth management

M&A landscape more resilient to short-term market

fluctuations and interest rate changes.

Seivert said wealth managers are expanding into “adjacent

verticals” such as accounting and trust services. In 2024, Cerity

Partners acquired FB&D LLP, an accounting firm for high net

worth clients, while F L Putnam bought Darwin Trust Co.