WM Market Reports

New International HNW Life Insurance Sales Rose Strongly In 2024; Big Potential Seen – Study

The upside potential for HNW wealth solutions that harness life insurance is considerable, particularly if advisors and other players are aware of their value, the report said.

International new business sales of wealth management linked to

life insurance rose about 25 per cent in 2024 from a year earlier

as UK taxes and other forces came to bear. But while growth has

been strong, life insurance is still a relatively small field

globally, a study finds.

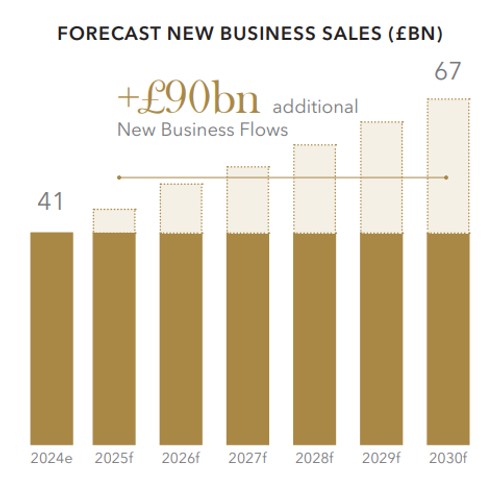

A 2024 Wealth Management Market Study for Utmost Group, carried

out by NMG Consulting, said that new business sales in the life

insurance space would rise to £67 billion ($76.7 billion) by

2030, delivering an additional £90 billion of new business sales

cumulatively between 2025 to 2030.

Source: Utmost Group, NMG Consulting: 2024 Wealth

Management Market Study

Areas such as private placement life insurance, still a relative

niche area, can be useful for HNW and ultra-HNW individuals

seeking ways of holding and transfering wealth in

tax-efficient ways. This news service has covered this

market for

some time. In the case of Utmost, the firm

acquired Lombard International Assurance at the end of 2024.

Lombard had been one of the more prominent players in that

field.

Tailwinds favouring the sector include a growing and

internationally mobile HNW/UHNW population; the significant wave

of intergenerational wealth transfer; and an increasing interest

in advisory and solution-based outcomes to meet client needs, the

report from Utmost said.

It appears that the wider wealth sector is not yet fully getting

the message: Insurance-based wealth solutions currently account

for around 2 per cent, or £543 billion, of the £28 trillion HNW

investable asset market.

“By increasing penetration of insurance-based wealth solutions by

1 per cent to 3 per cent, the global HNW international life

insurance market could add over £240 billion of additional

assets, growing the market by 50 per cent and surpassing £800

billion,” the report said.

Mark Fairbairn, head of strategy and corporate affairs at Utmost,

said: “This landmark Market Study unveils for the first time the

size of the rapidly-growing HNW and international life insurance

market. It is a market that is set to grow quickly in the coming

years as wealth transfer accelerates and the HNW population both

expands and becomes more internationally mobile. Insurance-based

wealth solutions are currently a small part of the market but are

expected to play an increasingly important role in an advisor’s

toolkit when serving HNW and UHNW clients over the coming

years.”

For the study, products include unit-linked (notably PPLI and

single premium bonds) and non-linked solutions (fonds en

euros and permanent insurance) designed to support HNW

individuals and families in wealth structuring and preservation,

inheritance tax planning, risk management and

diversification.

These products are often complex and tend to be distributed via

specialist financial advisors or brokers working with private

banks, family offices or professional service firms.