Asset Management

Microstate Bank Says Crypto Offering Breaks Fresh Ground

One bank in the microstate is hoping to normalise crypto-currency trading, bringing it on par with traditional investing.

A Liechtenstein-based bank now allows its clients to invest

directly in crypto-currencies like bitcoin, in what is reportedly

a first in the microstate.

Bank Frick is the

first financial institution in Liechtenstein to offer trading in

five crypto-currencies – bitcoin, bitcoin cash, litecoin, ripple

and ether – and “secure safekeeping” in offline storage, the bank

said last week.

Bank Frick, which offers private banking services, is somewhat an

anomaly in its sector, as its rivals across the world have

largely steered clear of crypto-currencies due to regulatory

ambiguity, money laundering concerns and lacking

fundamentals.

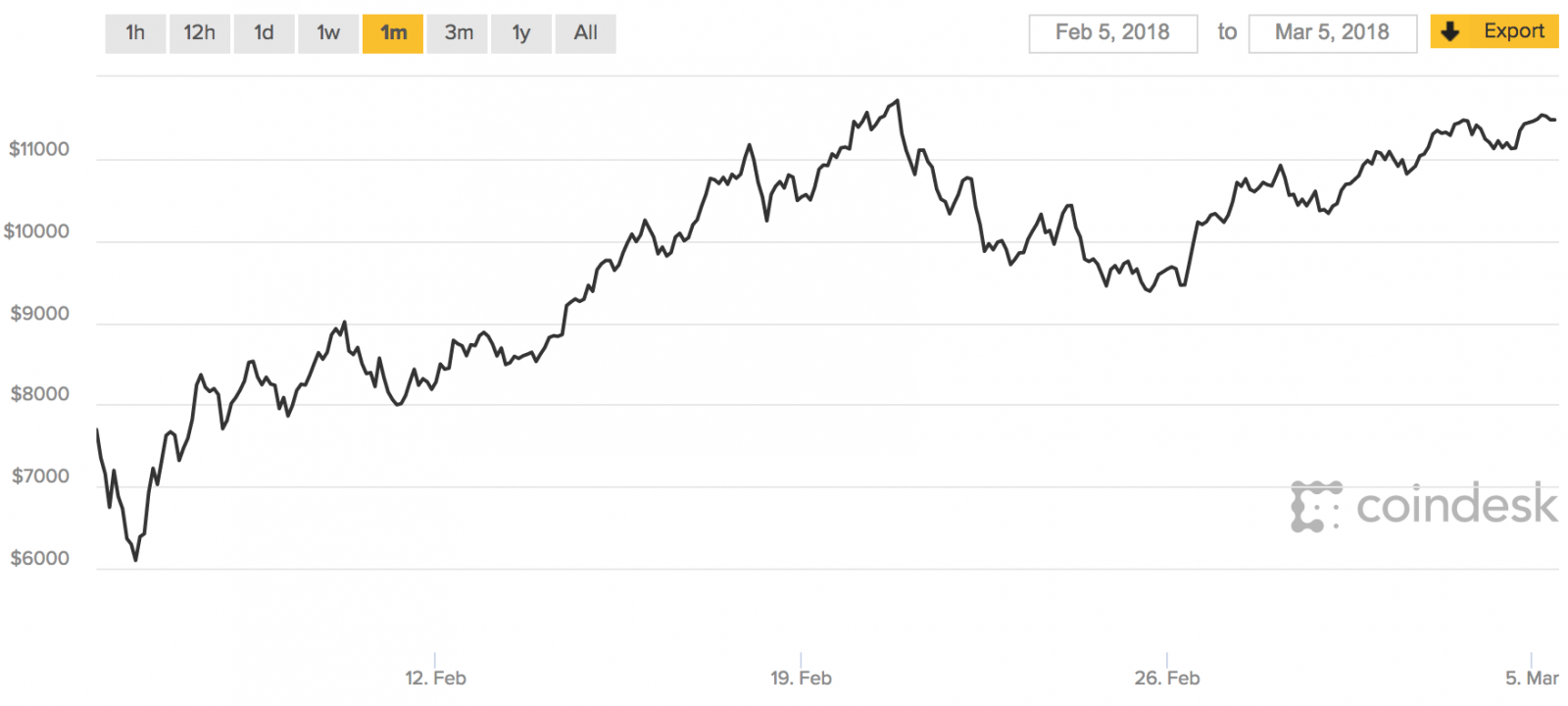

Bitcoin's price movements over the past month. Source:

Coindesk

But crypto-currency investments made with the bank are “subject

to the same strict statutory measures as traditional financial

transactions,” it said, adding that clients can only invest in

digital coins “once they have been fully identified and

verified”. Verification involves origin-of-funds checks, Bank

Frick said.

“Financial intermediaries, such as asset managers and

fiduciaries, can make use of our new offering to successfully

differentiate themselves in the market and add value for their

clients,” Hubert Büchel, chief client officer, said. “We aim to

place crypto-banking on at least the same level of quality as

traditional banking.”