Alt Investments

Major Economic Powers Must Ramp Up Infrastructure Spending – Study

With a number of large asset and wealth managers becoming more involved in the infrastructure investment arena, a new report from a fund management house explains the reason why. Growth, it says, will have to be dramatic for countries to solve energy, transport and other needs.

UK- based Aberdeen

Investments has underscored the reasons why

infrastructure-related asset management is a strong trend by

predicting that the world’s largest economies will need to spend

around $64 trillion on physical infrastructure by 2050 to keep

modern economies moving.

The spending target must be met by the middle of this century.

The rise equals 1.7 per cent of global gross domestic product per

annum and is almost two-thirds higher than the $39 billion

spent on infrastructure investment between 2000 and 2024.

Aberdeen looked at 47 countries, modelling how their economies’

infrastructure needs would change by 2050 based on a range of

factors including productivity, demographic change and

urbanisation. It then calculated the cost of meeting those

infrastructure needs.

Several firms, such as BlackRock and Vontobel (see an example

about the latter firm here) have

made a point about intensifying their focus on infrastructure

investment. Infrastructure covers a wide range of activities.

There is often (but by no means always) an association with

government. Roads, railways, ports, docks, airports, student

accommodation, sports facilities, power stations and grids tend

to be built either by states, or the state regulates the pricing

at the retail end, as well as dealing with matters such as

compulsory purchases and planning. (See an analysis

here.)

“Physical infrastructure – such as road and rail, power

generation and utilities – is a ‘keystone’ within the

building blocks of growth. Good infrastructure cuts the cost of

doing business, for example by lowering the cost of producing

goods and moving them around the country,” Robert Gilhooly,

senior emerging markets economist at Aberdeen, said. “But the

sums needed just to ‘keep the lights on and wheels turning’ are

enormous. We expect that the private sector will be increasingly

required to help finance these infrastructure needs, as

governments are squeezed by high debt levels and geopolitical

pressures to spend more on defence.”

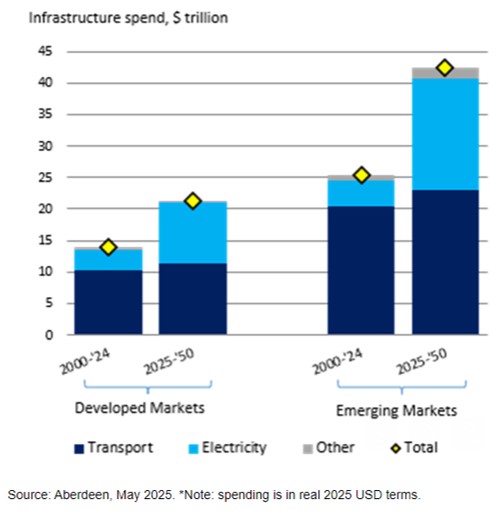

Emerging markets account for $43 trillion of the total required

spend, reflecting their greater development needs and faster

economic growth. Developed markets, the report said, must spend

$21 trillion. Transportation and power generation make up the

bulk of physical investment needs.

The study said that investment in global road networks, which

need to expand by 7 million kilometres, remains the single

largest infrastructure expense. This expansion, alongside

substantial maintenance costs of existing roads, is likely to

total $28 trillion, little changed vs the prior 25 years (only

$1.7 trillion more).

Power is the area requiring the next biggest new investment

injection. Rising power needs, the electrification of transport,

and the pivot towards renewable energy, mean that global power

generation capacity will need to rise from 8,000 Gigawatts (GW)

to over 21,000 GW (+165 per cent) by the middle of this century,

at a cost of $27 trillion. This is almost $20 trillion more than

the cost over the prior 25 years and could be pushed higher still

by power-hungry new technologies, such as artificial intelligence

data centres, the report said.