Real Estate

London's Property Market Could Sag As Foreigners, Locals Look Elsewhere

London's property market is not as red-hot as it has been and net migration levels to the UK capital are at the weakest levels in more than a decade. A think tank predicts what could happen next.

While certain commentators might wax indignant about high net worth people buying London homes and inflating property prices, the reality is very different, according to a report predicting a softer market in the UK capital.

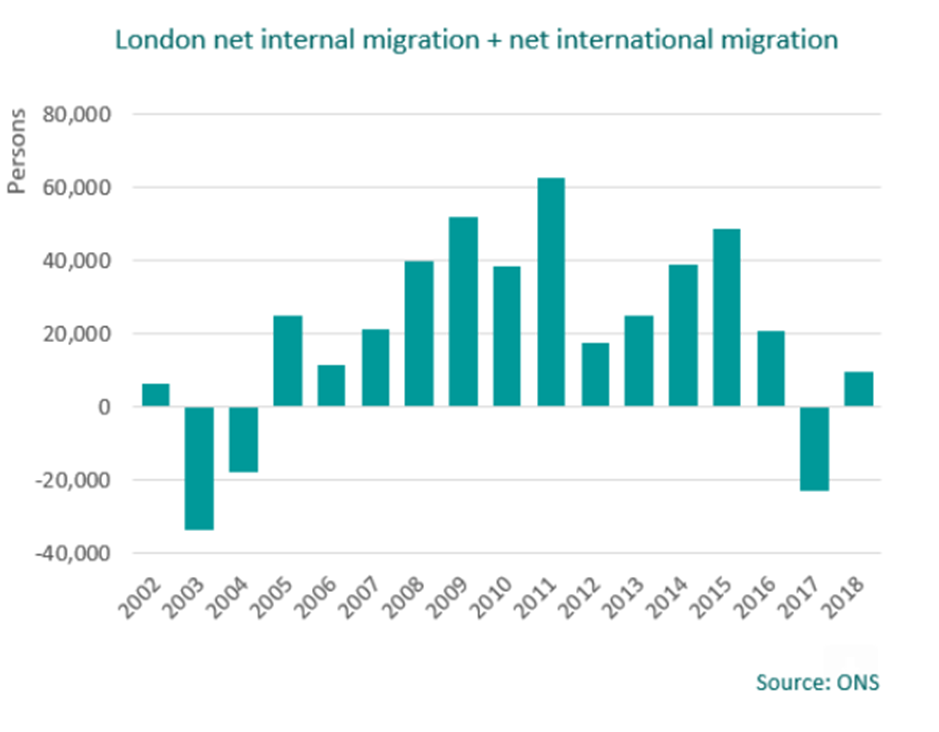

International migrants are not coming to London as much as before, and locals have also been moving out, with the trend adjusting only slightly over the past year. These trends tally with a softening housing market in the capital, a report by the UK-based Centre for Economics and Business Research said.

Official UK data shows that net migration into London for the 12 months to June last year was at the lowest level since 2002.

Under its “central scenario” of there being no global recession and an “orderly” departure from the European Union, the CEBR predicts that London house prices could fall by 1.6 per cent in 2019 before returning to a growth of 1.5 per cent next year. But it warns that the risks are “very much to the downside” and its more negative scenario forecast is for prices to fall by about 10 per cent by the end of 2020.

The report noted that the drop in net migration is not just due to foreigners' cooling enthusiasm for London; local people are also moving out for bigger properties and a superior quality of life, amongst other factors.

The UK capital is one of the world's most important wealth management centres. Brexit, along with the recent UK government rule tightening foreign-owned real estate, changes to the non-domiciled residency regime, UK high net worth visas and other factors have weighed on prices for prime properties. Ironically, high property prices have been politically contentious, raising worries about the lack of affordable housing for the wider population, so weaker London prices might lower the heat over that topic.

Every year since 2002 (when comparable records began), London has seen net negative internal migration i.e. more people have left London than have moved in from other parts of the country. Since 2011 the net figure has been persistently getting more negative, until now. In the year to June 2018, London’s net internal migration stood at -103,230, up from -106,610 in the prior 12-month period, the CEBR said.

One reason behind this shift is a drop in the cost of living across London, led by a softening housing market. In previous years, for many people living in other parts of the country moving to London was out of the question as a result of the high property prices. Similarly, a common reason for people relocating out of London is the desire to live in a bigger property or to become a homeowner.

Over much of 2018 and 2019 average property prices in London have been in decline. This is in sharp contrast with the period between 2014 to 2016 when the annual price growth averaged more than 10 per cent. In line with this, the rental market has also been more subdued.

“Part of the explanation behind the housing market slowdown is a slump in demand arising from lower international immigration flows into London, which have recovered only partially since a substantial drop in the year to June 2017,” the CEBR continued. “A slight increase in the number of people moving to London from the rest of the country has not been able to make up for this, putting the overall (internal + international) net migration figure at just 9,560 in 2018 compared to a peak of 62,670 in 2011.”

The CEBR continued: “The barely positive net migration figure poses a number of risks for London’s economy. Many of the capital’s industries, for example tech and creative have thrived as a result of the constant inflow of people and ideas. Furthermore, London has a certain dynamism stemming from migration that drives innovation, the benefits of which are felt far and wide.”

Besides the effect of weaker international migration, other downward pressures on the housing market have been recent rises in Stamp Duty Land Tax, over supply of housing units at the prime end of the market and the deterioration of London housing’s status as a “safe-haven” asset.

“The price drops seen over the last couple of years may very well become more extreme should the Brexit process take a turn for the worse or as a result of a broader global downturn,” it said.