Legal

Japan Wealth Management - Latest Developments

Here is an outline of important recent legal, tax and regulatory developments affecting wealth managers conducting business with or in Japan.

Here are further guides to legal, regulatory and tax developments across Asia as they affect wealth managers, private client lawyers and their clients. The overviews come from Baker McKenzie.

The authors of this item are Edwin Whatley, partner,

and Akihiro Kawasaki, senior associate. The editors are

pleased to share these views and invite responses. The usual

editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com

See the previous overviews on

Singapore and

Malaysia and

Hong Kong here.

Reform of Inheritance Law

To solve issues related to inheritance, the Civil Code stipulates

basic rules, including on who will be the heir, what will be the

legacy, and how the rights and obligations of the decedent will

be succeeded. The part in the Civil Code that contains these

provisions is referred to as the "Inheritance Law (or Sozoku

Ho)."

There has been no major reform to the Inheritance Law since 1980.

Recently, the law was amended for the first time in order to

address issues related to the ageing population in Japan and

other changes in social circumstances.

The main elements of this amendment to the Inheritance Law are as

follows:

-- the new spousal residence right;

-- relaxation of the requirement to write by hand the

assets lists attached to a holographic will;

-- retention of holographic wills by the Legal Affairs

Bureau; and

-- compensation for family members who contributed to the

care or nursing of the decedent.

Spousal residence right (effective from 1 April

2020)

The spousal residence right allows the spouse of the deceased to

use a house owned by the deceased free of charge for the spouse's

entire life or for a certain period of time, if the spouse was

living in the house at the time of the death of the deceased.

Where there is more than one heir with regard to a house, the

regime enables a spouse to acquire the spousal residence right

and an heir other than the spouse to acquire onerous ownership

rights at the time of division of the estate. The spousal

residence right does not give rise to full ownership rights; the

spouse will not have a right to dispose the house or lend the

house to others at the spouse's discretion. As the value of a

spousal residence right is lower than that of a full ownership

right, the spouse may be entitled to more assets at the time of

division of the estate, ensuring the spouse's subsequent

financial stability.

Relaxation of the requirement to write by hand the assets

lists for holographic wills (effective from 13 January

2019)

Previously, for a holographic will, it was necessary for the

testator to prepare the assets list in handwriting. The assets

list may now be prepared in other ways (e.g., using a personal

computer or attaching a copy of a bankbook).

Retention of holographic wills at the Legal Affairs Bureau

(effective from 10 July 2020)

Holographic wills are often kept at home, where they may be lost,

abandoned, or rewritten. In order to prevent inheritance disputes

arising from these problems and make it easier to use holographic

wills, the Legal Affairs Bureau will be retaining holographic

wills.

Compensation for family members who contributed to the care

or nursing of the decedent (effective from 1 July 2019)

In some cases, non-heir relatives (e.g., a spouse of a child) may

have been involved in taking care of or nursing the decedent.

Before the reform of the Inheritance Law, it was not possible to

distribute inherited property to such non-heir relatives.

In order to eliminate such inequities, non-heir relatives can now

claim compensation from the heirs if the non-heir relatives

contributed to the care and nursing of the decedent free of

charge or made a special contribution to the maintenance or

increase in value of the decedent's property.

Implementation of CRS and information exchange in

Japan

Japan passed legislation giving effect to the Common Reporting

Standard (CRS) in 2015, under which certain financial

institutions operating in Japan are obliged to report certain

financial account information regarding account holders to the

Japanese tax authorities. (1) The CRS system came into effect in

Japan on 1 January 2017, and the first reports were submitted by

financial institutions by 20 April 2018.

According to an announcement from Japan's National Tax Agency

(NTA), the NTA had gathered information on 2,058,777 foreign

accounts held by Japanese residents, from 86 countries, primarily

in Asia and Europe, by the end of June 2020. The NTA had provided

information on about 473,699 accounts held in Japan to 65

countries and regions by the end of June 2020.

This compares with a paltry 10,652 filings made in 2019 in

compliance with Japan's overseas asset requirement, under which

individuals holding assets with a value of JPY 50 million or more

($462,000), including assets held in trusts, are required to

report information regarding such assets in their tax returns.

This data may be a sign that there were many assets that Japanese

residents have failed to properly declare.

It still remains to be seen precisely how the Japanese tax

authorities will use the data collected from information exchange

under the CRS during audits. The first case of criminal

accusation occurred in May 2019. In this case, the taxpayer did

not declare income tax on sales proceeds that were remitted to

the taxpayer's overseas bank accounts (as well as bank accounts

where the nominees were not the taxpayer). Although there was a

considerable amount of cash in the overseas bank accounts,

exceeding the reporting threshold of $462,000, the taxpayer

failed to submit the overseas assets report (or Kokugai Zaisan

Chosho) by the due date, without a justifiable reason. The tax

authority imposed penalties on the taxpayer for non-compliance

with the overseas assets report requirement.

Additionally, the NTA has publicly announced through its website

that it is focusing on undertaking audits of high net worth

individuals and their international transactions. Given the

consequences of non-compliance, there is clearly an incentive now

for Japanese resident persons to comply with the Japanese

overseas asset reporting requirements (and for non-residents

holding assets in Japan to comply with their local country's

asset reporting requirements).

Japanese gift and inheritance tax rules

In 2017, the Japanese inheritance tax rules were amended such

that, where a foreign national who had lived in Japan for 10

years (in the aggregate) out of the last 15 years died outside

Japan, the foreigner national's heirs would be subject to

Japanese inheritance tax on the foreign national's assets located

both in Japan and elsewhere (a similar rule also applies for gift

tax purposes).

This rule resulted in a situation where Japanese inheritance tax

may still apply to a foreign national's worldwide assets even if

the foreign national had left Japan, for up to five years after

the expatriation. The fact that Japanese inheritance tax could

"follow" a foreign national for up to five years after they left

Japan caused great concern among Japan's expatriate community and

threatened to derail the Japanese Government's efforts to attract

successful foreign talent to live and work in Japan.

In Japan's 2018 Tax Reform, the Japanese Government abolished the

above rule applying to foreign nationals (2), subject to certain

anti-avoidance measures in the context of gift tax. This change

applies to inheritance taxable events that occur on or after 1

April 2018.

Japanese exit tax (effective in 2020)

Under Japan's 2015 tax legislation, which was passed by Japan's

Diet and promulgated on 31 March 2015, a new "exit tax" came into

effect. Under the new tax regime, which applies to both

expatriating Japanese nationals and certain long-term foreign

residents, an individual subject to the exit tax must pay tax on

the deemed gain realised on the sale of assets at applicable

individual income tax rates. (3) The exit tax applies where: (a)

the individual has financial assets with a total aggregate value

of JPY 100 million or more; and (b) the individual has maintained

their place of residence or place of abode in Japan for five

years or more during the 10-year period immediately prior to

departure from Japan.

In order to determine whether the JPY 100 million threshold is

met, the law considers assets such as certain securities, as

defined under the Income Tax Law (including foreign stocks and

bonds and stock option certificates), interests held in a silent

partnership (i.e., a Tokumei Kumiai or "TK") contract, unsettled

credit transactions or when-issued transactions, and unsettled

derivatives.

With respect to foreign nationals, the five-year period does not

include time spent in Japan under a visa status specified under

Table 1 of the Immigration Control and Refugee Recognition Act

which includes work status visas, such as intra-company

transferee visas or business investor/manager visas, under which

expatriate employees are typically assigned to Japan. It will

apply to non-Japanese persons present in Japan under a visa

status specified under Table 2 of the Immigration Control and

Refugee Recognition Act, including permanent residents and

spouses of Japanese nationals.

The persons subject to the above law include those who (a) own

certain assets with a combined value of JPY 100 million at the

time of the inheritance, and (b) have had a principal place of

residence (jusho) or temporary place of residence (kyosho) in

Japan for at least five out of the last 10 years, as of the date

before the inheritance.

It should be noted that the Japanese Exit Tax and Inheritance Tax

work in tandem at the time of the death of a person, where

applicable. Specifically, where certain residents of Japan have

certain assets at the time of their passing worth JPY 100 million

or more (i.e., they are subject to the Exit Tax), and a

non-resident receives through inheritance all or some of such

assets, the assets will be deemed to have been transferred as of

the inheritance date, and the decedent will be assessed for

income tax on any built-in gain in such assets. Thus, the estate

of the decedent would be subject to Exit Tax on the expatriation,

and the recipient subject to Inheritance Tax on the same

assets.

The law was promulgated with respect to non-Japanese nationals to

apply prospectively; thus, the five-year count for foreign

nationals began in July 2015, such that the five-year period will

not come into effect until (at the earliest) July 2020, for

foreign nationals resident in Japan with a permanent resident or

similar visa status. As a practical matter, the prospect of being

taxed on capital gains on securities and similar assets has

caused a number of long-term residents to expatriate from Japan

prior to the effective date of the exit tax. Likewise, another

strategy to avoid the effect of the tax is for an expatriate

currently in Japan on a "permanent resident" or spousal visa to

relinquish such visa status and switch to a work visa.

In any event, the upcoming effective date of the law as it

applies to non-Japanese national should be considered with

respect to any Japan expatriation planning going forward and

should be considered prior to a move to Japan by either a

Japanese national or non-national.

Inheritance and gift tax rates

Inheritance and gift tax rates – scope of inheritance tax was

changed in 2021

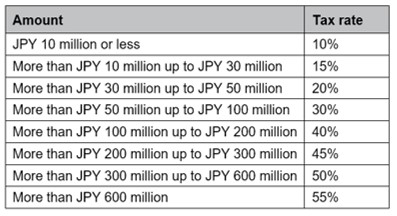

Japanese gift tax

Japanese gift tax rates, imposed at progressive rates ranging up

to 55 per cent, have remained the same since 2018. Gift tax is

assessed on the total value of gifts received annually. For this

purpose, gifts from all donors are aggregated subject to an

annual exemption of JPY 1.1 million. Rates can be summarised as

follows.

Note that special gift tax rates apply to gifts made from lineal

ascendants including parents and grandparents to their lineal

descendants, including children or grandchildren who are 20 years

old or older as of 1 January of the year in which the gift is

made.

Japanese inheritance tax

As with gift tax, the taxpayer for inheritance taxes is the

individual who acquired property by inheritance or by

bequest.

Inheritance tax rates and available deductions in effect in 2019

are as shown in the following table:

The analysis to determine whether heirs will be subject to

inheritance tax on domestic assets, foreign assets, or both, can

be complex and, in the case of a non-national, will depend on the

length of time such person has resided in Japan. In the 2021 tax

reform, the scope of taxable assets for inheritance (or gift) tax

purposes in the case that a non-national (limited to those who

have certain visas, such as working visa, etc., but excluding

those who have a spousal visa, etc.) is an antecessor (or a

donor) is narrowed down to domestic assets in order to remove a

barrier for highly skilled non-national workers to work in Japan.

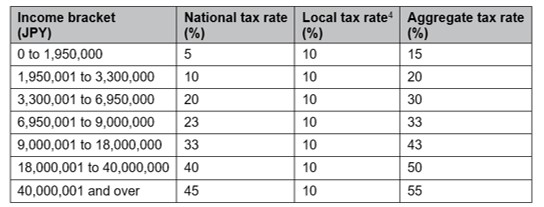

Individual income tax rates – unchanged from 2018

Japanese individual income tax rates are summarised below. Note

that a 2.1 per cent surtax is levied on the national income tax

until 2037, thus the maximum marginal rate is 55.945 per cent.

The following tax rates are applicable to the aggregate income of

the taxpayer.

Other changes

MLI has come into effect with respect to Japanese

treaties

Japan signed the Multilateral Convention to Implement Tax Treaty

Related Measures to Prevent Base Erosion and Profit Shifting

(MLI) in June 2017, and the document was ratified by Japan's Diet

on 18 May 2018. The MLI has already come into effect with respect

to 31 of Japan's bilateral tax treaties (including the UK, New

Zealand, Australia, Sweden and others) as of May 2021. Some of

the provisions to which Japan has "opted in" that are

particularly notable are Articles 12 and 13, involving permanent

establishments (PE), and Article 7, which incorporates the

principal purpose test (PPT). Where the PPT applies, taxpayers

should consider whether this will potentially affect their

entitlement to the benefits of the treaty.

Articles 12 and 13 of the MLI expand the scope of a PE to more

broadly encompass activities undertaken by a commissionaire

(toiya) and prevent taxpayers from relying on multiple specific

activity exemptions in order to avoid a PE. It remains unclear at

this time how the Japanese tax authorities will apply these

provisions in practice, and whether the tax authorities will

broaden the scope of structures that they challenge in audits.

Currently, Japan has tended to rely on transfer pricing

provisions to challenge transactions, but the Japanese tax

authorities may treat the implementation of the MLI as an

opportunity to also challenge structures from a PE perspective

going forward.

Changes to Japanese cryptocurrency rules

The Financial Action Task Force (FATF) amended the FATF

Recommendations in October 2018. As a result of the amendments,

crypto assets exchangers, custodians of crypto assets, etc. will

be required to implement anti-money laundering and countering the

financing of terrorism controls. Amendments to the Payment

Service Act were made in 1 May 2020, which takes into account

such FATF Recommendations.

The main elements of the amendments to the Payment Service

Act are as follows.

-- Characterising cryptocurrencies as "crypto assets"

rather than "virtual currencies" in light of the fact that most

crypto assets are not used as currencies and restricting

advertisements for "speculative investments" in the

cryptocurrency space.

-- Provisions concerning the in-advance notification, etc.,

have been prescribed, which pertain to applications for

registration of a crypto asset exchanger, the name of the crypto

assets to be handled by crypto asset exchangers, and changes to

the business of the crypto asset exchangers.

-- Provisions concerning the service of crypto assets

exchangers have been prescribed, such as the method for

displaying advertisements of crypto assets exchangers, prohibited

activities, provision of information to users and other measures

for ensuring user protection, and methods for managing users'

monetary and crypto assets.

-- Provisions concerning the transaction of Financial

Instruments Service Operators, etc., which engage in derivative

transactions using crypto assets and fundraising transactions in

the course of trade have been prescribed. These include the

development of business management systems, methods for

displaying advertisements, provision of information to customers,

prohibited acts, and methods for managing rights to transfer

electronic records of customers, etc., for Financial Instruments

Service Operators.

While the amendments to the Payment Service Act are not directly

related to tax, it is hoped that new tax regulations will also be

implemented with respect to cryptocurrency. For example,

currently individuals are taxed at regular individual tax rates

on gains arising from the sale of crypto assets; if more

favourable rates were implemented, this may encourage further

development in the area and promote Japan as a digital asset

"hub" in Asia.

Footnotes:

1, The Act on Special Provisions of the Income Tax Act, the

Corporation Tax Act and the Local Tax Act Incidental to

Enforcement of Tax Treaties (Act on Special Provisions).

2, Although the heirs of a foreign national who had resided in

Japan for a long term are no longer subject to inheritance tax

with respect to non-Japan situs assets after the non-resident

leaves Japan under the 2018 tax proposal, the rules do not

eliminate gift or inheritance tax in those circumstances with

respect to Japan-situs assets.

3, The specific rate at which tax will be owed depends on the tax

category of the income realised; Japan's individual income tax is

made up of several income categories, with varying rates. For

example, a capital gain arising on the transfer of listed or

non-listed stocks is generally subject to tax at a flat 15.315

per cent.

4, The local tax rate is the sum of prefectural and municipal

taxes.