Alt Investments

It’s Getting Hot: VC Managers Fret Over Higher Valuations

.jpg)

Rising valuations for portfolio firms make venture capital managers nervous, suggesting this will make it harder to bring home the kind of returns investors expect.

Venture capital, like the private capital investment market in general, has seen strong fund-raising growth but managers are getting concerned about high valuations and how these will hit returns.

A study 221 VC managers at the end of 2017 by Preqin, the organization tracking alternative asset classes such as private equity and hedge funds, found that more than half of them (55 per cent) said pricing of portfolio companies was higher than 12 months’ ago.

Fund managers also reported more competition for transactions and investor capital, although at lower levels than in previous surveys. In June 2017, 49 per cent reported an increase in the level of competition for VC transactions compared to 12 months ago, but this proportion dropped slightly to 46 per cent in November 2017. Similarly, in June 86 per cent of fund managers believed that competition for investor capital had increased compared to 12 months prior, but this proportion dropped to 73 per cent as of November last year.

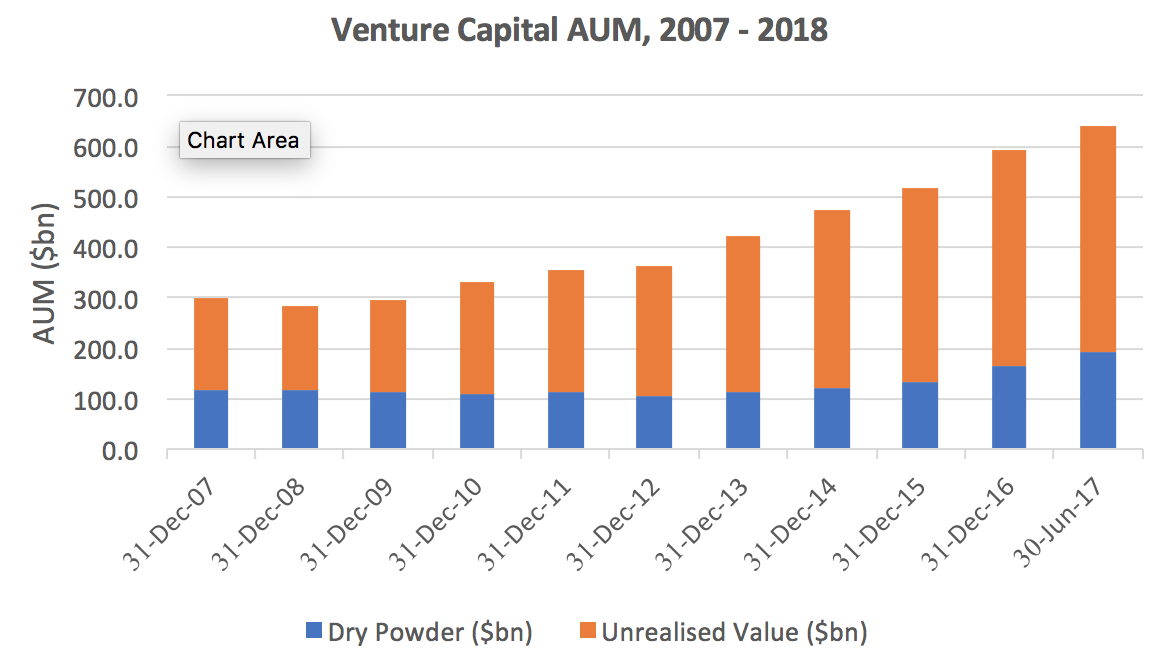

The VC sector, along with private capital more generally, has prospered in part because returns are considered worth the lack of liquidity when compared with public markets because of superior results, a key demand when ultra-low interest rates have hit yields. However, the Preqin result findings may suggest worries are building that VC is getting crowded. According to figures provided by Preqin to this publication, a total of $59 billion was raised for VC funds last year, down from $75.3 billion in 2016, and down from $63.4 billion in 2015. So far this year, the sector raised $10.5 billion. At the end of June 2017 (the latest date for which data is available), there was a total of $190.8 billion of VC “dry powder” (uncommitted capital), up from $166.1 billion at the end of 2016.

“The venture capital industry has seen incredible success over the past year, with 2017 marking a banner year for fundraising and deal activity. However, as the market becomes more crowded, fund managers are increasingly concerned over asset pricing and rising competition for transactions, a trend that has been reported across the whole private equity industry,” Felice Egidio, head of venture capital products, Preqin, said.

“At the same time, fund managers are reporting that investor appetite for ventures capital is rising, a sign of confidence in the industry. In particular, managers report that Asia-based investors are becoming more involved in venture capital, as the region becomes an ever more pivotal part of the global market,” Egidio continued. “This may indicate that 2018 could see robust fundraising as well, and fund managers will need to successfully make use of this further influx of capital,” Egidio added.

Among other findings, less than three-quarters (73 per cent) of managers reported increased competition for investor capital compared to 12 months ago, a drop from 86 per cent of which reported the same in the November 2017 survey.

However, greater proportions of fund managers felt that investor appetite has increased over the previous 12 months from 54 per cent in the June 2017 survey to 60 per cent in November 2017.

The largest proportion (58 per cent) of managers felt that

appetite has increased from Asia-based investors, while 97 per

cent reported appetite from North America- and Europe-based

investors had increased or stayed the same

.

Looking forward, two-thirds of venture capital fund managers

expect to deploy more capital in the next 12 months compared to

the past 12 months.