Investment Strategies

Investors Put Chips Back On The Table; Worries Linger – State Street

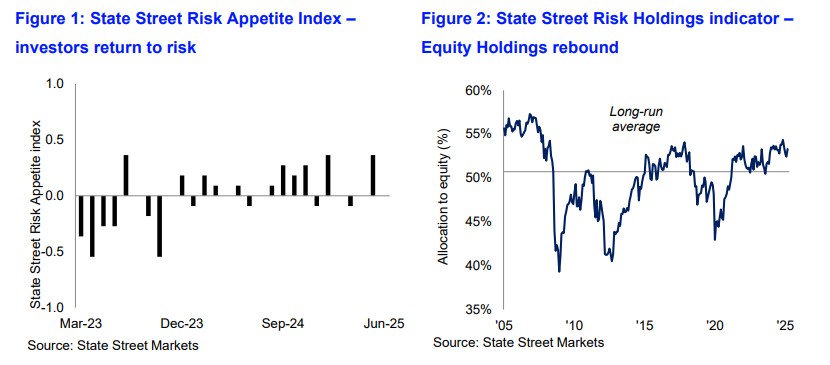

Equity exposure and sentiment has gyrated since the November elections. Recent measures of worry suggest confidence is improving. The State Street indices of sentiment measure what investors are actually doing.

The US administration’s delay in imposing the sweeping

“Liberation Day” tariffs has emboldened investors to put chips

back on the table in equity markets. A State Street risk

barometer suggests that appetite for equities rose in May.

The State Street Risk Appetite Index rose to 0.36 at end-May. The

State Street Holdings indicators show that long-term investor

allocations to equities rose anew in May to levels last seen just

before the 2 April tariff announcement.

During May, exposure to equities rose by 0.9 per cent relative to

a 0.8 per cent fall in bond holdings.

Equity exposure has whipsawed since Donald Trump was elected

President last November. Initially, stocks rose, then fell –

particularly among tech stocks – after revelations about China’s

DeepSeek AI app – and fell dramatically after the tariff

announcement. They’ve subsequently made up ground, although

sentiment remains relatively skittish.

“Fear gauges” such as the VIX Index, which measures options

volatility on the US S&P 500 Index of major stocks, started

at 17.93 per cent on 2 January 2025, rose to almost 28 at

one point in March, and skyrocketed to 52.33 on 8

April after the tariff announcement. Since then, the VIX has

gradually fallen, and was last seen around 17.57 yesterday

late-morning in the UK.

“While the narrative around trade tariffs remains ubiquitous,

implementation delays allied to lower effective tariff rates than

initially envisaged helped lift sentiment towards risk as did the

(still) largely benign environment for inflation that undermines

fears around stagflation,” Dwyfor Evans, head of APAC macro

strategy, State Street Markets, said.

“Protectionism and trade tariffs likely exert a greater impact on

mercantilist Asia than anywhere in the global economy,

particularly given the regional build-up of (predominantly)

dollar reserves. A weaker dollar and higher US yields thus

matter, as do tariffs,” he said.

The State Street risk indicator measures investor confidence or

risk appetite quantitatively by analysing the actual buying and

selling patterns of institutional investors derived from State

Street’s $44 trillion in assets under custody and

administration.

The Risk Appetite Index is derived from measuring investor flows

in 22 different dimensions of risk across equities, foreign

exchange, fixed income, commodity-linked assets, and asset

allocation trends. The index captures the proportion of the

22 risk elements that saw either risk seeking or risk

reducing behaviour. A positive reading suggests that on balance

investors are adding to their risk exposures, while a negative

reading suggests risk reduction. State Street’s holdings

indicators capture the share of investor portfolios allocated

towards equity, fixed income and cash going back to 1998.

ETFs

There are other indications that sentiment about equities – and

US equities in particular – has recovered to some degree.

Although inflows in exchanged-traded funds in May were still well

below the 12-month average, they were positive for the first time

on a three-month view. ETFs focused on Europe saw

lower growth than recently (source: etfbook.com, as

of 30 May).

"Relaxing signals in the trade dispute between China and the USA

impacted the ETF market in May. Investors turned more towards the

USA again," Stefan Kuhn, head of ETF distribution for Europe at

Fidelity International, said.

"It is quite conceivable that Trump's renewed tariff threats

against the EU are already affecting net inflows into European

equity ETFs," he said. Additionally, the markets in Europe have

performed very well this year, Kuhn said: "Investors are asking

themselves how much upside potential European stocks still

have."

Overall, the ETF market grew by $30 billion in May, stronger than

in April.