Company Profiles

INTERVIEW: TIM Group Sees Big Opportunity In Change In How Research Is Paid For

Rules changing how wealth managers and advisors fork out for research is also a chance for businesses collating trade ideas to make a difference and win new markets, a UK-based practitioner in the space argues.

The business of promoting investment ideas and research has been

turned upside down by established and potential new rules hitting

London and other European centres. But as the saying goes when it

comes to seeing opportunities amidst the pain, where there’s

muck, there’s brass.

The business of collating trade ideas into one, easy-to-find

space and then acting on them is what the firm TIM Group says is all

about. And its offering of a one-stop-shop for trade ideas,

research and commentary around hot investment tips is already

drawing in large institutions fretting about the effects of

“unbundling” of research fees. From the start of January 2018,

payment for research can no longer be bundled along with other

services and paid for using an execution commission. Such

research has to be paid for separately.

“Wealth managers now have to really think about what they value

from their brokers,” Colin Berthoud, founding partner at TIM

Group, told this publication at his firm’s offices in the Aldgate

area of the City recently.

TIM Group has, since about 2005, been harvesting trade ideas from

brokers, putting them onto a platform where institutional wealth

and asset management houses can read them. More than 4,000 equity

sell-side brokers, at around 300 investment banks and brokerages,

feed ideas onto the platform. Over time, users can track those

ideas which have worked, and monitor the brokers with the best

records, ranking them, for example, by geography and sector.

Estimize, which gathers earnings estimates from research

analysts, is another firm operating in this space. There are also

resources such as the Extel Awards, which each year give the

buy-side's votes on the best analysts; the annual prizes are one

of the most sought-after in the City.

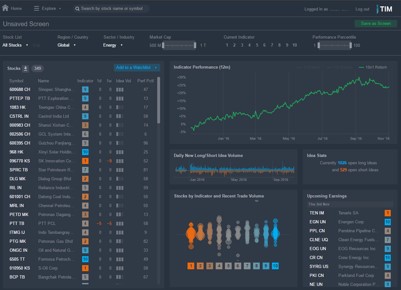

An example here of how these ideas appear on screen:

Berthoud and his colleagues started out doing other projects for

clients but the trade ideas platform has become so successful

that TIM Group now focuses entirely on this side of the business.

The firm now employs around 80 people, of whom 15 are in New

York, six in Hong Kong and the remainder in London.

This “shop window” of brokers’ trade ideas can be viewed on a

desktop or a mobile device, he said. As far as the revenue model

is concerned, brokers pay the firm an annual subscription to

get on the platform. The buyers of these ideas pay the

contributors for the ideas they provide, but don’t pay a fee to

TIM Group unless they use the analytics and advice that TIM Group

can provide, Berthoud said.

“Every idea that goes into the system we log it, time-stamp it

and when the idea is closed we can assess it. We can look at the

performance of a broker in any way that a broker or client

likes,” he said. Each year TIM Group is able to pick the

top-performers.

Business is brisk; the US market is busy and TIM Group opened its

office in the US in 2008. The firm – for the moment – has more

visibility in the European market and there is definitely more

upside potential in the US, he said.

TIM Group is a prominent player in this field of collating trade

ideas; another example of such a platform is Estimize, which

gathers earnings estimates from research analysts.

Range of ideas

Beyond trade ideas around individual securities such as equities,

where the bulk of the ideas are, the platform can also highlight

ideas around exchange-traded funds and specific indices that they

track, for example, he said. Another part of the TIM Group

service is how it shows if there is a potential conflict of

interest involving a broker – the platform aids transparency,

which is very much in the spirit of what current regulatory

programmes are after. In any event, disclosure of potential

conflicts is required under European market abuse rules, he

continued.

Brokers also contribute “short-term” research through TIM Group’s

platform. Analyst research is usually based on a 12-month

forecast while sales ideas may only require a few days to bear

fruit. “There’s a kind of gap in the middle for short-term

research that says that `in the next two to three months this

will move’,” Berthoud said.

With regulations about fee payments for research biting from the

start of next year across Europe, there is renewed focus on what

“research” actually is. Even a short term idea, if it

incorporates some sort of intellectual process, will count as

“research”, allowing clients to pay for the ideas from client

funds. This is where TIM Group’s trade ideas platform is so

useful because the infrastructure is already there,

Berthoud said.

So where do wealth managers fit into this equation? “Wealth

managers will generally take advice from their central research

unit, which informs their recommendations to clients. Where

the wealth manager is in the same organisation as a broker, that

broker’s ideas can be made available to the central research unit

through TIM. We have seen some demand for this approach

already. In addition, we expect that wealth managers will

want to pay for access to ideas under MiFID II rules, as from the

start of next year they will not be allowed to receive “free”

research,” Berthoud said.

The Markets In Financial Instruments Directive II, or MiFID II,

adds to moves by the UK regulator to stamp out conflicts of

interest and protect investors, ensuring investment

products/services sold to them suit their actual needs. And the

actions of such regulators are already making themselves felt.

The Centre for the Study of Financial Innovation, a think tank,

along with the European Association of Independent Research

Providers, reported back in 2012 that fund management commission

pots were shrinking, as much as 40 per cent under the peak before

the 2008 financial crisis, and further, that sell-side research

has been contracting.

As an aside, Integrity Research Associates, which tracks this

area of the market, noted that what is called the “Alpha capture

business” is likely to increase further in Europe, citing a new

report from the organisation TABB. So-called Alpha capture,

in which brokers send high conviction trading ideas to

quantitative funds, is being embraced by upper management at

large brokerage firms, and these firms are working to

institutionalize alpha capture throughout the business.

In light all of this activity, there will therefore be a need for

firms to offer solutions that fit with this new world, taking

effect from the start of next year. TIM Group, it appears, is

ready and waiting.