Alt Investments

Hedge Funds Warm To The Private Markets Party

An international study takes a microscope to what issues are top of mind for hedge funds, and finds that they're increasingly keen to dig into the world of private markets. This is an area already very familiar to wealth managers, advisors and family offices.

IG Prime, the

UK-listed brokerage platform, says its international survey of

hedge funds – taking 102 responses – shows that 70 per cent of

them now invest in private markets.

Most of the hedge funds – a sector overseeing

a total of $$4.51 trillion (source: Hedge Fund Research),

invest in private equity and credit.

With the share of companies listing on markets declining relative

to those staying private, hedge funds realise they need to adjust

to keep a piece of the financial action. The number of public

companies in the US, for example, shrank from more than 8,000 in

1996 to about 4,500 in 2018, according to data from the World

Bank (source: adviservoice.com, 2021). There has been a

similar, if less severe, fall in the number of public companies

in the eurozone.

Hedge funds need to find fresh pastures to go hunting in.

“The growth of hedge funds has meant that there has been a

crowding of trades that have traditionally worked well for them,”

Chris Beauchamp, chief market analyst at IG Prime, said.

“Arguably some of the opportunities have been arbitraged away

which has driven funds to look for new ways of getting

index-beating returns. Many hedge funds are seeing private

markets as an answer.”

Private equity is the private market asset class with the fastest

growth amongst hedge funds, with 58 per cent of hedge funds

saying it’s the area they’ve most increased exposure during the

last year. Hedge fund managers are also increasing their exposure

in real estate (48 per cent), private credit (31 per cent),

infrastructure (30 per cent) and natural resources (34 per

cent).

Investor demand for hedge funds to improve their returns has led

to more of them to invest in a wider array of alternatives such

as private credit, private equity and private real estate as some

of the more “traditional” hedge fund strategies have failed to

deliver over the last few years, the report said.

Another force at work is that companies are

taking longer to list on stock markets, raising a need among

hedge funds to find other ways to invest.

“The question for hedge funds is what skills they bring to bear

in this private market that might give them the edge over

existing participants such as PE funds,” Beauchamp said. “Some

will be competing directly with PE and private credit funds for

the same investments. Others will be hoping that they can use the

current tariff-related disruption to pick up assets priced for

distress.”

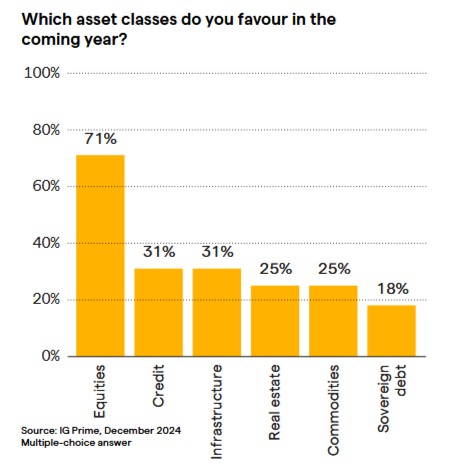

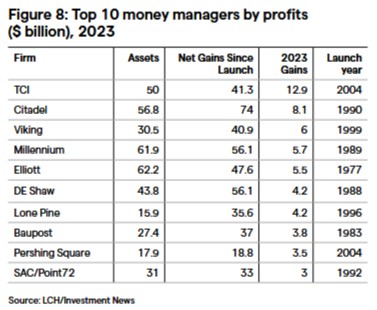

Besides private markets as an investment area, the IG Prime report, entitled The State Of The Hedge Fund Industry 2025, addressed topics such as hedge funds' overall most favoured asset classes for the coming year (see below); trends in marketing and products; revenue, profitability and performance (see chart below); fee structures; the fundraising environment; regulation; technology; AI; and forecasts.

Most favoured asset classes

Profitability

Regarding fees, to give one of the topics, the report,

citing data from Broadridge, said that the average hedge fund’s

management fee stands at 1.35 per cent, while its performance fee

is closer to 16.01 per cent, as competition for assets

intensifies and firms look for smarter ways to entice

investors.

In the survey, 31 per cent of respondents were in the US; 20 per

cent in the UK, 47 per cent in Europe, and 2 per cent in

Australia. There were none in Asia-Pacific.