Wealth Strategies

GUEST ARTICLE: Opportunities In High-Yield Debt?

.jpg)

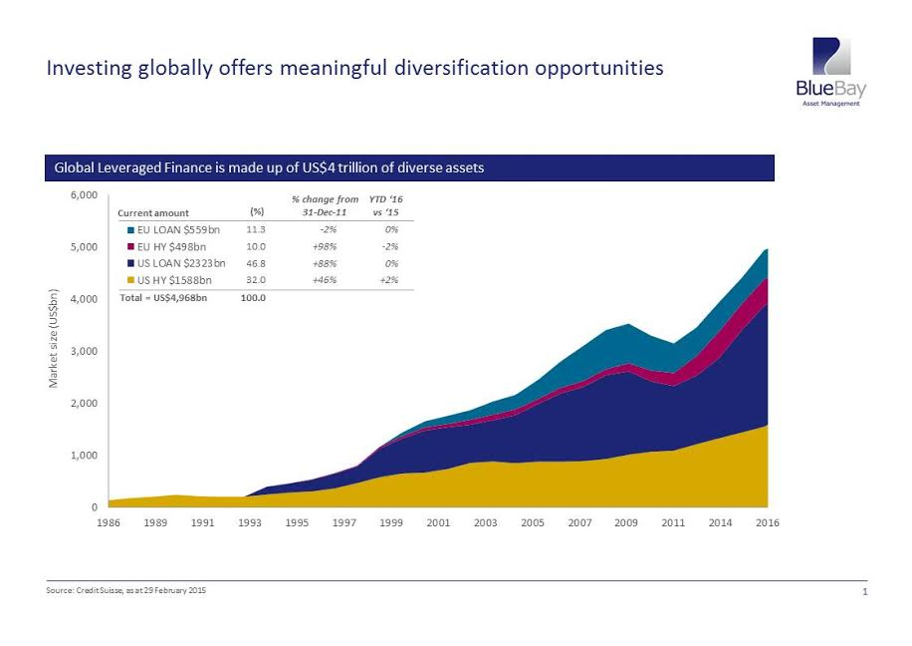

What are the opportunities in high-yield credit? As wealth managers are only too aware, we are living in a low-return world, so any prospect of a better return will be seized. But there are no free lunches in markets.

The following guest article concerns the high-yield bond market, sometimes known in less delicate terms as “junk”, although that term might be misleading in terms of the quality issues concerned. This is an era characterised by low yields and wafer-thin, or even negative, interest rates. Some borrowers in the high-yield market have not had an easy time lately – think of some of the borrowers in the energy market, for example, in the wake of sharp falls to crude oil prices. The author of this article, Marc Kemp, an institutional portfolio manager for BlueBay Asset Management, says there remain opportunities in high-yield securities. The editors here are pleased to share these views with readers, invite responses, and do not necessarily share all the views of guest contributors.

Doing your credit homework

Global financial markets are currently dominated by risk and

uncertainty. We believe investment opportunities are masked by

fears of economic slowdown in China and of a US recession, the

low oil price and negative interest rates in Japan. In addition,

the dramatic fall in oil and commodity prices has kicked off the

default cycle in resource and energy-related names, notably

within the US high-yield market, (although we don’t believe this

is likely to result in contagion and a flood of defaults within

other sectors of the market). Nevertheless, within this

environment we believe there are attractive opportunities within

the high yield market, but investors must tread carefully and

look globally in order to find value.

In these challenging market conditions, central bank policy has commanded markets. The Bank of Japan, Swiss National Bank, and European Central bank (ECB) have all adopted negative interest rates; for the first time we have seen the yield on the 10-year Japanese government bond turn negative while the Japanese Ministry of Finance recently sold a five-year bond that pays back less than it was sold at.

Now the European government bond market seems to be following Japan’s lead. One of the fastest growing asset classes in Europe is negative yielding government debt. If the ECB cuts interest rates and increases quantitative easing then the 10-year German bund could move into negative territory. This is worrying for fixed income investors as they could be buying a bond with negative or zero income. However, just because there is no yield in core government fixed income does not mean that there is no yield in fixed income.

Balancing risks with reward

Some emerging market (EM) local currency denominated bonds are

offering double-digit yields such as Brazil (circa 14 per

cent) and Russia and Turkey (circa 10 per cent).This

highlights that there is yield if you are willing to look more

broadly, whilst taking on credit risk and swapping it for

interest rate or duration risk. In our view, high yield

offers a good balance. Although off the wider spreads the market

mentally is attuned to lower growth/lower profitability, if you

pick your spots there are assets that are less exposed to these

vagaries.

We are entering a new post QE environment characterised by volatility, and greater divergence in performance across and within asset classes. To generate positive net gains within this environment we believe investors need to return to basics and not just follow the flow of central bank liquidity; focusing not just on fundamentals, but also on value and diversification.

In our view, high-yield credit appears robust, particularly in Europe. However, as always there are risks and it’s important to carry out in-depth fundamental analysis to get credit and country selection right. We believe if you tread carefully, look globally, and focus on fundamentals and value there are attractive opportunities within global high yield.

Careful credit selection

In order to realise gains overall, we believe investors must

concentrate on being selective about which markets and assets

they invest in and accept that yields are lower. Investors need

to be cognisant and not reach for the excess yield

which might appear to be there and instead focus on

conserving the income which is available from high quality

assets.

There are some high-quality assets that offer long-term value; however, with the overhang from defaults likely to come in the US and with the general uncertainty of outlook for earnings as a whole, we do not believe we are in an environment where investors should be seeking excess risk in the bonds they buy. This is an environment in which to focus on preserving capital and making a small positive return over the course of the year; we are not in an environment where we expect to see substantial high returns.