Alt Investments

Gold: Why Modern Wealth Managers Haven't Missed The Boat

As central banks push systems to the limit to stimulate flailing economies, the environment remains good for gold, this guest article argues. It also explores the diverse sources of demand for the precious metal.

As alternative assets take on even greater meaning in these turbulent times, this author examines the role of gold in an investment portfolio in a year when prices of the precious metal have hit record highs. The asset topped $2,000 an ounce in early August, up by around 30 per cent for the year. Krishan Gopaul, market intelligence manager at the World Gold Council, explains why gold remains a good hedge. The editors welcome outside contributions, where the usual editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com.

Perhaps the most diplomatic way to describe 2020 is that it has been a year of uncertainty; a state of play that is anathema to most investors. Putting aside the not insignificant matter of a global pandemic, which has sent unpredictability soaring to unprecedented levels, a state of flux and ambiguity has been around for some time now.

Investors already faced an expanding list of challenges around asset management and portfolio construction, including low interest rates, geopolitical tensions, and an increase in asset volatility. In fact, one of the latest high-profile, global news events – the US presidential election – encapsulates the ongoing uncertainty in a nutshell; glimmers of hope, setbacks and the realisation that things won’t be decided as quickly as we might expect.

But, as central banks push systems to the limit to stimulate flat-lining economies, the environment continues to be conducive for gold as an investment consideration.

The key gold price drivers – such as economic expansion and risk and uncertainty – dovetail with many of today’s main risks affecting the loss of monetary and financial discipline, and gold is a highly liquid financial asset, which outperforms on both inflationary and deflationary cycles while carrying no counterparty risk.

It can enhance a portfolio in four key ways, namely: generating long-term returns; acting as a diversifier and mitigating losses in times of market stress; providing liquidity with no credit risk; and improving overall portfolio performance. It is an asset four all seasons.

So why particularly now?

Many people invest in gold as it is often considered a safe haven

and recognised for generating long-term returns during periods of

uncertainty. Over the past half-century, the price of gold has

increased by an average of nearly 12 per cent a year in pound

sterling since 1971. During this period, gold’s long-term return

was comparable to stocks and higher than bonds, and it has also

outperformed other major asset classes over the past two decades.

Investing in gold can also prove beneficial at a time when other income streams are not delivering historical returns due to a low inflationary environment; dividends have been cut and bond returns are so low that investors are buying them for capital appreciation rather than genuine income.

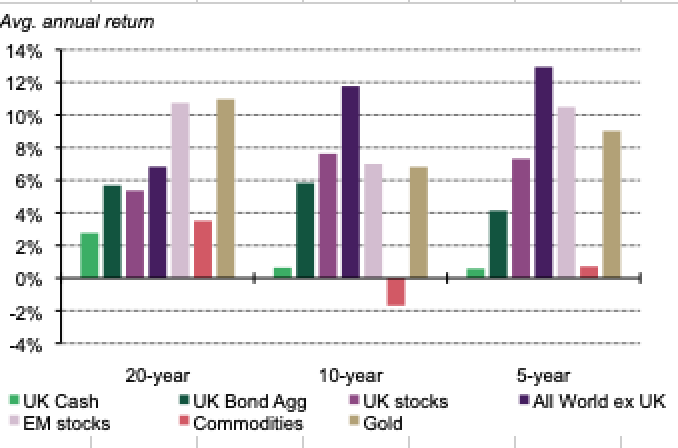

The World Gold Council's analysis of investment performance over the past five, 10 and 20 years (shown) underlines gold’s positive impact on a typical portfolio and the higher risk-adjusted returns achieved if 2.5 per cent, 7.5 per cent or 12.5 per cent of the portfolio were allocated to gold; with the benefits particularly marked since the global financial crisis. The amount of gold varies according to individual asset allocation, but in broad terms, the higher the risk in the portfolio – whether in terms of volatility, illiquidity or concentration of assets – the larger the required allocation to gold.

Also, a mindshift is underway in terms of how investors consider

asset allocation and what role each asset class plays in meeting

their objectives, evidenced by the traditional 60/40 split

starting to fall out of fashion. With this in mind, a significant

opportunity is created for alternative assets – such as gold – to

play an enhanced role in portfolios as investors increase their

exposure to risk in an attempt to reap more lucrative yields.

Challenges in the gold market

As with any form of investment, gold carries associated risks and

challenges. One of the main claims levelled at gold is its

volatility in price and the fluctuations in demand. Perceptions

of the latter can be coloured by suppressed consumer demand – a

pandemic side-effect owing to restrictions on people entering

public places such as shopping malls and jewellery shops – but

gold benefits from diverse sources of demand; not least as an

investment, a reserve asset and, often overlooked; as a

technology component. Its relative scarcity also historically

preserves its value over time.

Nowadays, investors are increasingly more conscious of environmental, social and corporate governance and historically mining companies might not have necessarily been associated with standard bearing on this front. However, a recent council report looking at the actions mining companies are taking to meet the UN’s Sustainable Development Goals found that significant contributions had been made towards 15 of the targets covering key pillars, including social inclusion, economic development and the environment.

Many asset classes are subject to short-term fluctuations in value, which is why it pays to think of gold as a longer-term investment and a strategic component for portfolios. It is not only one of the best-performing asset classes of the last five years, but also allows investors to meet liabilities when less liquid assets in their portfolios are difficult to sell, undervalued and possibly mis-priced. Furthermore, it has a track record of outperforming equitable markets at various stages of inflationary and deflationary cycles, making it worth consideration as part of a balanced portfolio.

About the author: Krishan Gopaul (pictured above) joined the World Gold Council in 2011 and works in its Market Intelligence Group. Prior to that he held roles at Barclays Global Investors, Royal Bank of Canada and Bank of New York Mellon, focusing on investment and market data analysis for both asset management and servicing. He holds a masters in finance from the London School of Economics.