Industry Surveys

Generation Impact: Who Leads On Gifts, Recipients

A new report suggests non-profits should gain handsomely over the coming decades as ranks of under-45s put charities and good causes at the heart of their investment and gifting plans. Millennials are not alone in this.

The survey, dubbed The Generation Game, commissioned by UK financial services group Sanlam, found that 5.1 million Britons are likely to receive an inheritance of more than £50,000 (with a calculated mean average of £233,000), setting the stage for millions of pounds to be gifted to charity over the next 30 years.

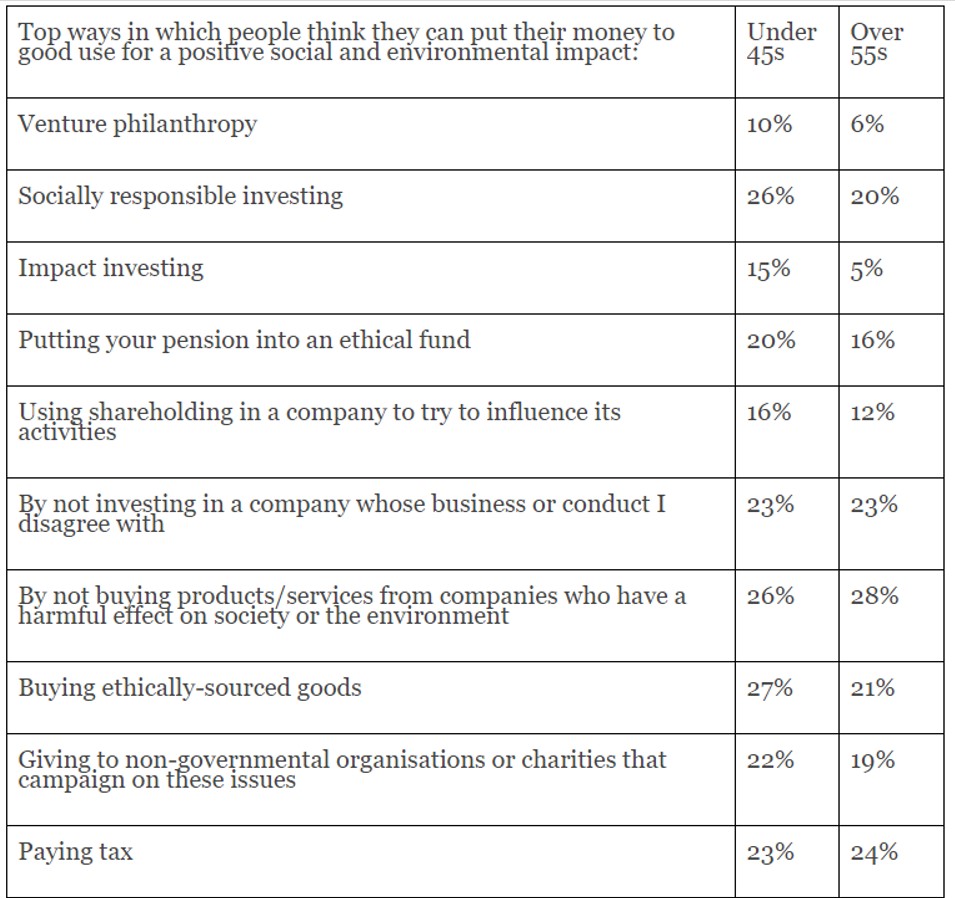

Not surprisingly, Millennials, seen as the key architects, scored high across a number of values-based investment choices, embracing options such as socially responsible investing (26 per cent), impact investing (15 per cent) and venture philanthropy (10 per cent).

While much is made of the social savviness of the under 45s, their views on responsible giving are not much different from the views of the over-55s.

Only on impact investing did the 55+ group score markedly lower than their younger counterparts, with just 5 per cent considering this an option. It could be argued that the low uptake is partly down to awareness and what the relatively new idea of “impact investing” means to the older cohort.

Both sets of demographics – 80 per cent of over-55s, and 88 per cent of under-45s -- believe it is important that they don't invest in something that contravenes their beliefs.

The survey highlights a trend that has been copiously discussed but far from fully addressed by wealth advisors, “the fact that younger generations increasingly want to use their wealth for good,” said Carl Drummond, senior wealth planner at Sanlam UK, which has around £12 billion of assets under management.

Drummond acknowledges that those over-55 share a strong awareness of how their money should be ethically invested but “defining what is and what isn’t ethical” is the challenge for the industry, he added.

“As people of all ages become more connected with their money and have greater visibility around how it is invested, those advising them will need to balance how to meet their desired financial returns with their moral ideals.”

“It is a minefield but as our report shows, appetite for these types of products and services is not going to go away.”

Figures for the survey are taken from three sets of research commissioned by Sanlam UK in April 2018. They include an online survey by Atomik research of 1,000 people aged between 25 and 45, who are expecting to receive an inheritance of at least £50,000 (in fixed assets or money) from their parents and/or grandparents; an online survey by Atomik research of 500 over-55s, with investable assets of £100k+, who are leaving an inheritance to their children or grandchildren; and an online survey of 200 IFAs carried out by Opinium. Sanlam said it also conducted more than 100 face-to-face interviews with intermediaries, lawyers, accountants and family offices.