Surveys

Family Office Sector Wants More Alternative Investment; Infrastructure Big Favourite – Study

There's been a steady drumbeat of talk about how wealth managers, including family offices, are keen to load up on alternative assets, such as private equity. And it turns out that for some, the standout asset of all is infrastructure.

A survey of 200 family office industry figures around the world

collectively overseeing more $68.26 billion in AuM found that

they intend to boost alternative asset class holdings.

Some 46 per cent expect to raise private equity allocations by 10

to 25 per cent in the next two years; 64 per cent expect to raise

infrastructure exposure by 25 per cent to 50 per cent over that

period, a survey from Ocorian, conducted in June from research

firm PureProfile, found. Ocorian provides specialist

services to financial institutions, asset managers, corporates,

and HNW individuals.

Respondents are based in the UK, United Arab Emirates, Singapore,

Switzerland, Hong Kong, South Africa, Saudi Arabia, Mauritius,

Bahrain, Bermuda, Cayman, British Virgin Islands and Jersey.

“We’re seeing a clear acceleration in the shift towards

alternative investments across both mature and emerging family

office markets,” Simona Watkis – head of private client – Cayman,

said.

A shrinkage of listed companies around the world since the 1990s,

and the rise of private equity as an asset class, has driven some

of the shift, along with more than a decade of ultra-low interest

rates after 2008 which crushed yields on listed equities.

Volatility before and after the pandemic has also played a role

in fuelling interest in alternatives. As

explained here in our North American publication, surveys by

both UBS and BNY Wealth found that just over two-thirds of family

offices plan to increase allocation to private equity investments

and funds, while around 30 per cent indicated that they would be

increasing exposure to private debt.

In Asia, to give a specific regional example, more than

three-quarters (77 per cent) of wealth management professionals

in Asia-Pacific saw strong client demand for private market

investment opportunities,

according to a report in 2022 from

WealthBriefingAsia, Hywin Wealth and VP Bank.

Real estate

The Ocorian report said slightly more than a fifth of those

surveyed (22 per cent) plan similar increases in real estate

while a third (32 per cent) expect to boost allocations to

private debt by a similar range. Around 21 per cent expect to do

the same for private equity.

The diversification benefits of alternative assets were

identified as the key reason for increasing allocations ahead of

the increased transparency of the asset class. The ability of

some alternative assets classes, such as infrastructure, to

provide an income was rated as the third most important benefit

of investing in alternatives, the report said.

Recent strong performance was ranked fourth in the attractions of

investing in alternatives for family office fund managers, ahead

of greater choice in the sector which was ranked fifth and the

ability of some alternative asset classes to provide protection

against inflation at sixth.

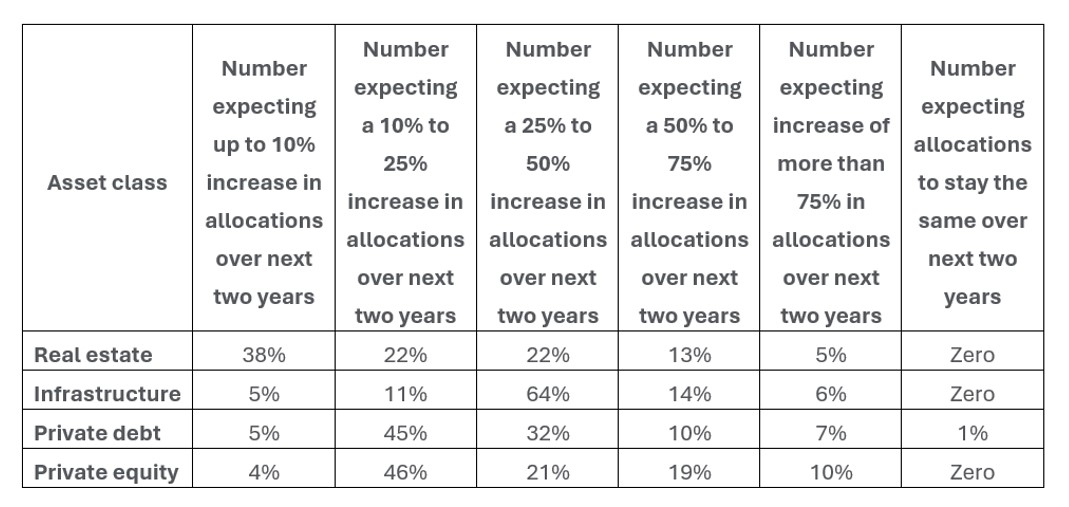

The table below shows planned increases in allocations to

alternative asset classes by family office fund managers

questioned as part of the study in 13 countries or territories

including the UK, UAE, Singapore, Switzerland, Hong Kong, South

Africa, Saudi Arabia, Mauritius and Bahrain.

Source: Ocorian

"Family offices, as they’ve matured over the past two decades,

are behaving more like institutional investors than ever before

– seeking data-driven, operationally-efficient ways to gain

exposure to and track alternatives,” Vince Calcagno, head of US

growth for Ocorian, said. “As the complexity of these investments

increases, so too does the need for sophisticated solutions,

especially outsourced CFO, that can offer the financial clarity

and control families require. Whether it's infrastructure,

private credit, or real estate, the key is supporting families

with the right technology and knowledge to evaluate performance,

manage risk, and plan strategically across generations."