Compliance

EXPERT GUEST OPINION: Common Reporting Standard - A Trigger For Voluntary Disclosure?

This article examines the likely reaction to the arrival of what is called the Common Reporting Standard, seen in some ways as akin to a "global FATCA".

Could regulations that have much in common with the

controversial US FATCA rules, known as the Common Reporting

Standard, trigger voluntary disclosures? This is a question posed

by Andrew Knight, partner with Maitland, the global

advisory, fund administration and fiduciary services firm. Knight

is based in Luxembourg. This publication is grateful for

these comments but the editors stress that they don’t necessarily

endorse all the views expressed, and invite readers to

respond.

In recent years there has been a series of attacks on perceived

tax evasion by way of a concerted drive for greater tax

transparency between countries. The US Foreign Account Tax

Compliance Act (US FATCA) and the so-called UK FATCA will soon be

followed by a set of global FATCA-like regulations drawn up by

the OECD, known as the Common Reporting Standard.

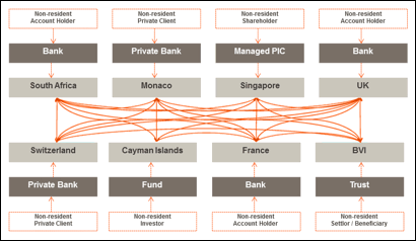

The CRS is a “universal code” of reporting aimed at incorporating

as many jurisdictions as possible on a global reciprocal basis of

“you show me yours and I will show you mine.” For example, once

Switzerland, Monaco, South Africa, France and the UK are all

implementing CRS, each of them will be reporting to each of the

others on any accounts maintained by its local financial

institutions for any of the others’ tax residents.

The diagram illustrates the impact.

The CRS has already been adopted in principle by over 100

jurisdictions. Well over 50, known as the “early adopters”, have

committed to implement CRS as from 1 January 2016, with the

others a year later. The result is that all the traditional

secret banking centres (including Luxembourg, Switzerland, Monaco

and Liechtenstein) and all the traditional offshore jurisdictions

(including the BVI and the Cayman Islands) have committed to

applying automatic exchange of information.

The early adopters group will have filed their first reports with

their CRS partner countries by the end of September 2017. This

group includes most of Western Europe (including Luxembourg and

Liechtenstein), Mauritius, the UK’s Crown Dependencies (Isle of

Man, Guernsey and Jersey), and the UK Overseas Territories

(including the BVI and the Cayman Islands). The rest of the

signatory states will start reporting in 2018. This second-phase

group includes Monaco, Switzerland, Brazil, Hong Kong, Singapore,

Macao, Antigua and Barbuda, the Bahamas, as well as Australia,

New Zealand and Canada.

The first date of relevance for the early adopters group is 31

December 2015 and for the other signatories, 31 December 2016.

Any accounts in existence on such dates will be subject to due

diligence and reporting by the financial institutions maintaining

those accounts.

What will be reported?

Reportable information includes the personal details of the

account holder, the year-end account balance and, in due course,

the interest, dividends and other income or proceeds from sales

credited to the account.

The scope of “reportable accounts” extends beyond typical

offshore bank or investment fund accounts and includes

information relating to beneficiaries, settlors and, in some

cases, protectors of trusts. This is because the CRS extends the

scope of a financial institution to include trusts whose trustees

are professional corporate trustees or whose assets are managed

by professional investment managers. The fact that a large number

of states have committed to the CRS will make it very difficult

for individuals connected to trusts to avoid

disclosure.

Even those trusts that avoid falling within the definition of

financial institution (for example by having only

non-professional trustees) will not escape the CRS, since any

bank situated in a CRS signatory state that maintains an account

for a trust (wherever situated) is likely to require the trustees

to disclose the identity of the trust’s beneficiaries, settlors

and protectors who are resident in a CRS signatory state, which

in turn will disclose the information to its local tax

authority.

The way the CRS applies to trusts is such that awards made in the

course of 2015 to discretionary trust beneficiaries under trusts

that are resident in early adopter countries are already at risk

of reporting in 2017. Settlors and mandatory beneficiaries will

find themselves subject to similar reporting. Thus, the clock is

already ticking in relation to early adopter countries. In

respect of trusts in other countries, reporting will start in

2018.

Time for voluntary disclosure?

The CRS will have two major implications for residents of CRS

signatory states. Firstly, their local tax authority is likely to

acquire information regarding undeclared funds and income, which

may well result in a tax audit followed by criminal

prosecution and significant penalties. A number of countries

currently have voluntary disclosure programmes (whether formal or

informal) in place including South Africa, Brazil, the US, and a

number of European countries (for example, France, Germany,

Italy, Netherlands, Portugal, Spain and the UK). Indications are

that the EU Commission will encourage all EU member states to

introduce regularisation programmes before implementation of the

CRS.

Ideally, in order for a regularisation programme to be

successful, it should have the following attributes:

• It should be managed by a separate unit of

the tax authority and disclosures should not give rise to a

general tax audit;

• The information provided should be used for

purposes of the programme only and not be shared with other

regulators;

• Advisors offering taxpayers assistance should

be able to offer them legal privilege, something that generally

only lawyers can offer; and

• Penalties should be commensurate with the

nature of the historical non-disclosure.

While some taxpayers will wish to consider the alternatives to

regularising their affairs, the scope for alternative course of

action is limited. Furthermore, indications are that, where

regularisation programmes exist, financial institutions will be

insisting that clients take advantage of them.