Asset Management

Europe's Big CLO Growth Promise, Investment Potential – PGIM

We talk to PGIM, the US-headquartered investment firm, about what it says is the rapid expected growth of collateralised loan obligations. These are securities that are backed by a pool of loans.

This summer, PGIM, part

of US-headquartered Prudential Financial, launched a

collateralised loan obligation (CLO) fund inside a European UCITS

structure. PGIM said the demand for these products is hotting up,

for example among wealth managers.

The full name of the fund is called UCITS PGIM Global AAA

CLO Fund.

European CLO issuance is expected, it says, to double to €75

billion ($86.4 billion) annually by 2030. CLOs are, according to

one internet definition, a "form of securitisation where

payments from multiple middle sized and large business loans are

pooled together.” Such investments offer an opportunity for

investors to gain exposure to higher-than-average returns by

assuming default risk. Each tranche within a CLO has distinct

risk-reward characteristics, with equity tranches offering higher

potential returns at higher risk levels. We have carried

commentaries about the CLO sector before.

At a time when interest rates have fallen and there is a focus on

sources of yield – of a risk-controlled nature – firms such as

PGIM are saying that the asset class deserves attention.

WealthBriefing recently spoke to Edwin Wilches, co-head

of securitised products at PGIM’s fixed income business, about

the sector.

WB: Why in your view are European investors keen

on CLOs and what is driving this?

Wilches: The bond bull market that began in late

2022 is continuing, driven by an environment of elevated yields

and ample carry opportunities. Securitised products, particularly

senior CLO tranches, stand out in today’s fixed income landscape

for their strong relative value and attractive risk-adjusted

returns. With credit spreads for most high-quality fixed income

assets tighter than historical averages, CLO senior tranches

offer compelling opportunities, especially at the top of the

capital structure. Indeed, AAA CLOs continue to offer some of the

widest spreads among investment-grade assets, with far less

duration risk.

WB: I understand that CLO issuance is expected

to double to €75 billion annually by 2030? Who is making this

prediction?

Wilches: Most market watchers agree that CLOs

will continue to serve as a key source of funding for corporate

debt issuance in both the US and European markets, while also

offering an attractive value proposition for debt investors. The

issuance projections vary depending on the source, but €75

billion in euro CLO issuance is definitely within the realm of

possibility by 2030.

WB: In your view, why has this market

boomed in the US in recent years? What sort of investors are keen

on it?

Wilches: In the years following the global

financial crisis, a common misconception among investors was

confusing CLOs with CDOs [collateralised debt obligations), the

highly complex instruments made infamous during the 2008 global

financial crisis. As time has passed and CLOs have demonstrated

their resilience across multiple market cycles, a growing number

of investors have given the asset class a closer look. More

recently, this greater receptivity has coincided with a period of

tightening credit spreads in more traditional investment grade

assets, as well as the rise in rates that served as a return

headwind for fixed rate bonds in 2022.

While investors such as pension funds, insurance companies, and

family offices have historically been active investors in CLOs,

these market developments have led to greater uptake among

investors in the wealth and private banking space.

WB: In terms that a lay investor can understand,

how do CLOs work?

Wilches: Put simply, CLOs are fixed income

securities consisting of aggregated corporate loans. Each CLO

diversifies across 150 to 250 senior secured loans from corporate

borrowers, which are segmented into ‘tranches’ based on

subordination and income priority. Catering to a range of

investor appetites, AAA tranches sit at the top of the capital

structure and are considered the most risk-remote, while

lower-rated tranches offer higher yields but carry greater

risk.

WB: CLOs today are backed by broadly syndicated,

more transparent, senior secured corporate loans. What else can

be said to reassure people who think that complex packages of

loans or bonds make them queasy?

Wilches: A key factor differentiating CLOs from

the pre-GFC CDOs is collateral. CLOs are backed by diversified,

transparent corporate credit, from large, often well-known

companies. This robust collateral base offers greater protection

and comfort versus legacy securitisations such as subprime

mortgages.

WB: Can you give examples of how they are less

correlated to other markets? What sort of data is there on

this?

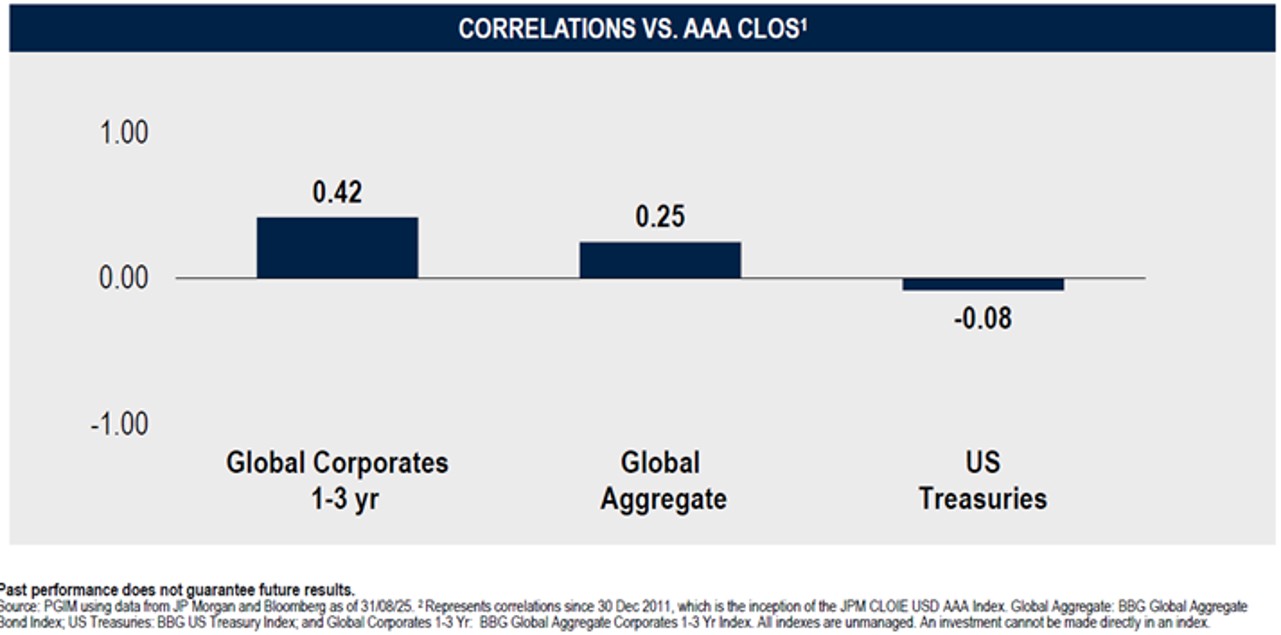

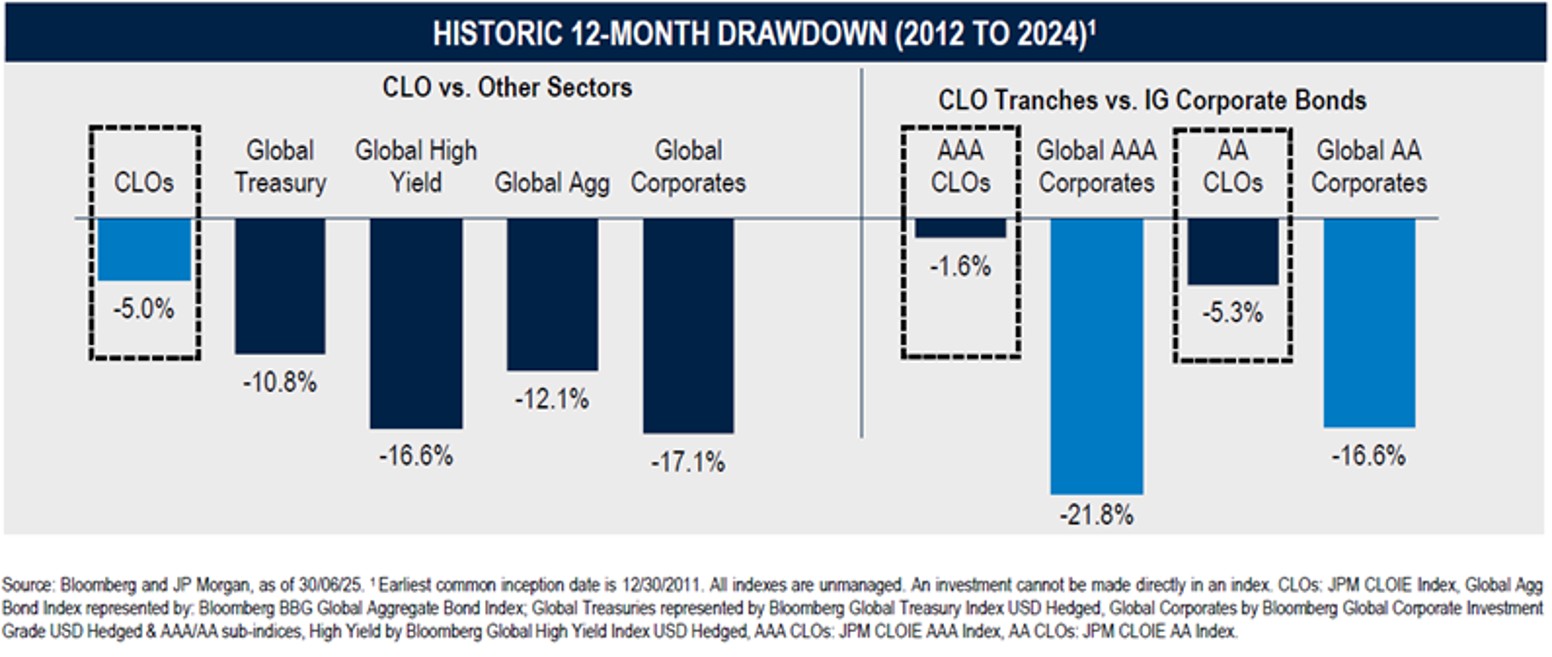

Wilches: Given their underlying corporate

exposure, CLO tranches tend to be positively correlated with

floating rate or shorter duration corporate of similar quality.

Given the broad, liquid nature of the CLO market, there is ample

data to demonstrate this (see below chart, “Correlations vs AAA

CLOs”). While the correlation between CLO tranches and corporate

debt is positive, it’s not one-to-one – and during certain

periods, such as the UK gilt crisis, CLO tranches have exhibited

lower downside volatility than corporate debt of similar quality

(see “Historic 12-month drawdown” chart below), highlighting the

diversification benefits this asset class can bring.

These benefits are even more pronounced when drawing a comparison

with broader bond indices and developed market government

debt, which have historically demonstrated low or negative

correlation to CLOs.

WB: In holding funds linked to CLOs, what

typically are the fees/expense ratios?

Wilches: Fees and expenses can vary based on a

broad range of factors including CLO tranche focus (e.g. AAA vs

lower rated tranches), flexibility level (e.g. US-only vs full

global approach), distribution channel, vehicle type, etc, so it

really depends.

WB: In terms of time horizons for investors, are

these short/medium/long-term investment

propositions?

Wilches: We see CLOs as offering a compelling

long-term investment proposition. While some investors may take a

more tactical, short-term approach, AAA CLO tranches can serve as

attractive long-term allocations alongside other high quality

fixed income exposures.

WB: Can you give me a general quote on why this

asset class deserves more attention in Europe?

Wilches: The global CLO market is a large,

established segment of the fixed income category. With momentum

building since the late 1990s, these instruments are becoming a

core component of broader fixed-income strategies. New structures

are now democratising access for retail investors following

decades in which CLOs comprised an exclusively institutional

asset class. The US remains the largest market, but Europe is

expanding rapidly.

For investors seeking to enhance yield with minimal credit risk,

AAA CLOs offer a compelling alternative to traditional holdings

such as government bonds and corporate debt. However, rather

than simply replacing core bond allocations, AAA CLOs are gaining

appeal as a complementary holding to improve a portfolio’s

overall efficiency and diversification. For example, allocating

10 to 30 per cent of a traditional bond portfolio to AAA CLOs has

historically improved risk-adjusted returns, especially during

periods of market stress or rate uncertainty.