Wealth Strategies

Enjoy A Vaccine-Inspired Boost Before "Japanification" Comes Back

A Swiss private bank says that certain long-term trends of lower growth and interest rates - sometimes likened to Japan's experience of recent decades - will persist in much of the world. However, the surge in growth and confidence stemming from vaccines for the virus may give investors a chance to enjoy some reflationary moves.

As thoughts turn to what markets may hold in 2021, we are

starting to compile a range of views and reflections from various

private banking houses. Here are thoughts from the team at

Geneva-based SYZ Private

Banking.

Adrien Pichoud, chief economist, and Fabrice Gorin, senior

portfolio manager at SYZ Private Banking, set out their

thoughts. As always, the usual editorial disclaimers apply.

To join the debate, email tom.burroughes@wealthbriefging.com

and jackie.bennion@clearviewpublishing.com

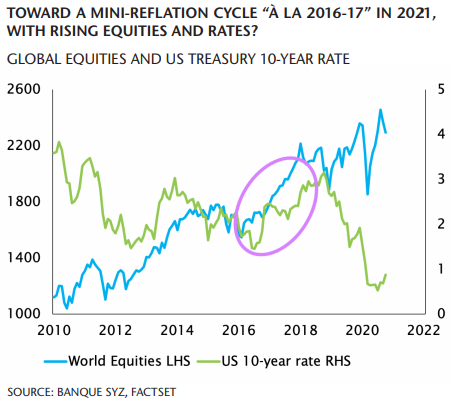

Although the global economy remains mired in a “Japanification”

scenario – the prevailing state of lower rates and slower growth

– positive news of a COVID-19 vaccine was a boost for risk

assets. In the short-term, this could trigger an acceleration in

both growth and inflation – a reflation. If this materialises,

investors should capitalise on the temporary shift, before we

return to the deeper, more profound deflationary cycle.

Within the Japan-style scenario, market cycles still occur, but

the episodes are typically milder and shorter. For example, risk

assets rose off the back of very accommodative central banks and

synchronised global growth in 2017, before being dragged back

down by the Federal Reserve reversal on monetary policy.

Similarly, we believe that the global economy will experience a

positive mini-reflationary cycle in the coming months – and

investors need a tactical response to capitalise on it before it

fades away.

Reflation requires coordinated global growth and a supportive

policy environment. As optimism over a post-COVID-19 return to

normal sweeps through markets and economic data adjusts

accordingly, we expect these conditions to transpire over the

next six months. However, evaluating the impact of the second

wave of COVID-19 will be crucial before we can be sure of a

reflation.

Flexible in fixed income

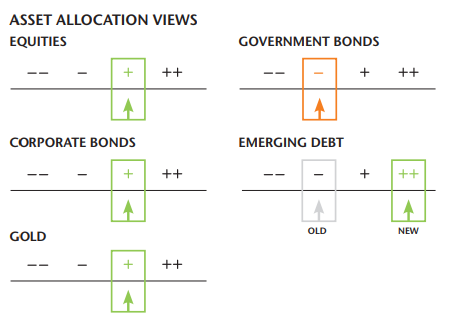

Acknowledging the rising possibility of a reflation, we have

tactically increased risk exposure through our fixed income

allocation. We have reinforced our bias to hard currency emerging

market debt, which has lagged the credit recovery so far. Spreads

are attractive compared to the broader market and emerging market

assets should benefit from a reflation scenario. A combination of

global growth, higher risk appetite and a softer dollar is the

sweet spot for emerging market debt.

In addition, to counter the rising probability of interest rate

increases and steepening yield curves in a global growth

environment, we have further reduced duration in the portfolios.

We did this by selling long-dated positions, notably US

treasuries, as the US curve appears most prone to a bear

steepening. We also took some profits on long-dated corporate

bonds, as valuations become less appealing.

However, credit remains attractive compared with cash and

government bonds in the risk-on environment, and we have

implemented hedges that allow us to maintain some exposure to

credit spreads while containing the impact of a potential rise in

rates. We still have a mild preference for high yield, with

attractive valuations, but the deterioration in credit

fundamentals warrants remaining selective.

By reacting to shifts in economic dynamics through tactical moves

like these – taking advantage of expected mini-cycles in asset

prices – we are able to generate positive performance in spite of

the low rate environment – even on negative yielding assets.

Dynamic asset allocation and tactical positioning are key for

navigating the current environment of very low interest rates, as

this allows us to capitalise on even the shortest and mildest of

reflationary cycles.

Dynamic approach to equities

On the equities side, we are also preparing to make strategic

adjustments. Given our conviction that we will ultimately return

to a Japan-like scenario, we do not believe value can sustainably

outperform growth.

However, if the impact of the second wave of COVID-19 is

relatively mild and coordinated global growth is reignited, there

will be an opportunity to tactically increase our cyclical

exposure in the short term to drive alpha within the

portfolios.

While our portfolios have a growth bias, we also have some

cyclicality in the equity allocation – so we will not be

wrong-footed if a rotation materialises early. Our overweight to

quality companies includes some industrial names and other more

cyclical stocks. If we see confirmation of positive global

growth, we will consider increasing cyclicality in the portfolios

in the short term. Core eurozone equity markets, such as France

and Germany, are particularly attractive given the super-low rate

context in Europe.

Meanwhile, structurally, we are increasing our exposure to

emerging markets – specifically China, as we see long-term

potential for the country catching up with developed market

peers. Chinese equities, which have lagged for the last five

years, are currently benefiting from the low-rate environment and

global growth pickup, in addition to the authoritarian

government’s handling of the COVID-19 pandemic.

The country has not witnessed a second wave of infections, and

liquidity injections and fiscal support have boosted domestic

credit growth. We are playing this through a combination of ETFs,

to provide us with exposure to Hong Kong listed giants, such as

Alibaba and JD.com, as well as domestic A-shares, which are less

dependent on the foreign environment.

Within the Japanification framework, reflationary episodes will

occur. While these events will create short-term volatility, they

will also provide valuable windows for multi-asset portfolio

managers to dynamically deliver additional alpha. At SYZ, we

embrace these opportunities to demonstrate the value of active

management.