Real Estate

Dubai D33: Agenda Of Growth – Market Overview, Long-Term Outlook

Property prices have surged in Dubai, fuelled by intense demand for a variety of reasons. The author of this article examines the state of the market, and what the future holds.

The following article about the Dubai real estate market

comes from Christian Atzert. Atzert has been engaged in the

Dubai property market since 2005 as an independent consultant,

advising institutional and private clients on asset acquisitions,

legal structuring as well as property management matters. He

heads Dubai-based PPP Advisors.

The editors of this news service are pleased to share these

comments; the usual disclaimers apply about views of outside

contributors. To jump into the debate, email tom.burroughes@wealthbriefing.com

Property prices in the Dubai market have increased substantially

over the last three years, prompting some commentators to

frivolously announce the onset of a new bubble.

However, a spectacular GDP growth of 7.6 per cent in 2022 paired

with continued significant inflows of people and investment

capital may lead to other conclusions.

This article therefore aims to put the current market metrics

into a broader perspective and present an outlook on the

long-term developments, specifically in light of Dubai`s goals

announced under the D33 development strategy.

Relief rally followed sell-off

Firstly, it is noteworthy that the present property cycle has

started out from an extremely low baseline, following six years

of gradually receding valuations, further exacerbated by a panic

sell-off at the onset of Covid-19.

Intense demand for prime property has pushed prices in the luxury

segment upward by 112 per cent since January 2020. While this may

seem alarming at first glance, Dubai`s prime residential property

is far from expensive compared with its peers.

According to Knight Frank et al, Dubai is the 16th most

affordable luxury market in the world at present. Dubai prime

residential properties cost an average of $9.470 per square

metre, only around a third of the prices demanded in London, New

York or Singapore.

Plan D33 – Dubai`s quest to rise to the

top

Plan D33, a Dubai government roadmap and economic plan recently

unveiled is geared at – inter alia – establishing Dubai

within the top four of the world`s leading financial hubs

(presently number 22) alongside London, New York and Singapore by

the year 2033.

Besides aiming to become a top dog in financial centres, Plan D33

entails further targets with respect to Dubai`s economic

performance:

- increase foreign direct investment (FDI) to $16.3 billion

per annum (+87 per cent);

- increase its foreign trade to $7 trillion (+80 per cent,

decade on decade); and

- increase gross domestic product (GDP) by 36 per cent

decade on decade.

While this undertaking may seem ambitious at first, Dubai has an

impressive track record of achieving similar feats.

Top-tier banks, family offices, hedge funds and other big players

within the financial realm are already setting up shop in Dubai,

the continuation of which will inevitably further nourish the

immigration of high-profile employees, entrepreneurs and

investors catering to and feeding off the financial

ecosystem.

PPP Advisors strongly believe that (luxury) property

valuations in Dubai will – during the course of this process –

further converge with those seen in other leading financial

hubs.

Relative value compared with peer cities

Meanwhile, luxury property in Dubai is presently valued at 33 per

cent less compared with such assets in Berlin, Germany`s capital

which is already placed in the lower third of the ranking for the

world`s most expensive cities.

Considering a shortage of prime residential property under

construction in Dubai and a continued strong demand, the firm

expects the upward trajectory to remain intact for the

foreseeable future, albeit at a slower pace.

With prime waterfront properties such as Palm Jumeirah and

Jumeirah Bay being limited, we see a trickling down/diversion of

prime property demand into inland high-end communities such as

Jumeirah Islands, Jumeirah Golf Estates, Tilal al Ghaf and Al

Barari.

Common denominators amongst the former are modern, high-quality

apartments and villas with ample living spaces, top-notch

community services and infrastructure complemented by excellent

connectivity.

Off plan vs secondary market – no signs

of overheating

We have stated previously and the presently available transaction

data proves that Dubai`s third market cycle is characterised by a

dominance in real demand of end users and second-home

buyers.

This was profoundly different in 2009, on the eve of the

global financial crisis and preceding the stark correction in

Dubai`s property market. At that time, the off-plan segment was

dominating secondary market transactions, representing 61 per

cent of all property sales. Whereas development activity has

indeed picked up in the recent years on the back of returning

demand and the influx of expats, 2022 saw a proportion of

only 44 per cent of off-plan sales against 54 per cent in

secondary market transactions, a figure in line with the 10-year

average.

Stability as a new paradigm

Without a doubt, however, the dominance of real property demand

and its stability is a rather new phenomenon in Dubai`s

marketplace.

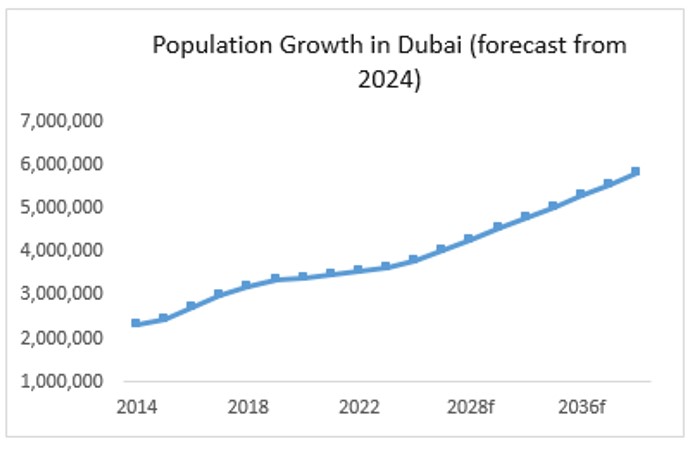

While Dubai had been experiencing a series of economic cycles

characterised by high volatility in population, economic output

and – in turn – property prices, the Emirate`s policies with

respect to visa and company ownership regulations seem to have

fundamentally transformed the demand metrics.

Further supported by a more stable political environment in the

greater MENA region and combined with political and economic

turmoil in European and other First World countries, expats are

more likely to call Dubai their home for much longer than before,

if not until retirement or even beyond.

At the same time, a number of factors such as Dubai`s early

reopening after the pandemic and the UAE`s progressing

integration into the BRICS group of countries is likely to have

attracted a sizeable number of new investors and immigrants from

practically new source markets, namely the US and Canada.

Remarkably, but certainly due to the factors mentioned above,

Dubai has not seen a slowdown in economic activity like the

European and North American economies.

As a result, Dubai`s real estate market is increasingly

exhibiting characteristics of a mature market, showing stability

in demand and supply, leading to a higher resilience against

exogenous shocks (i.e. rising interest rates).

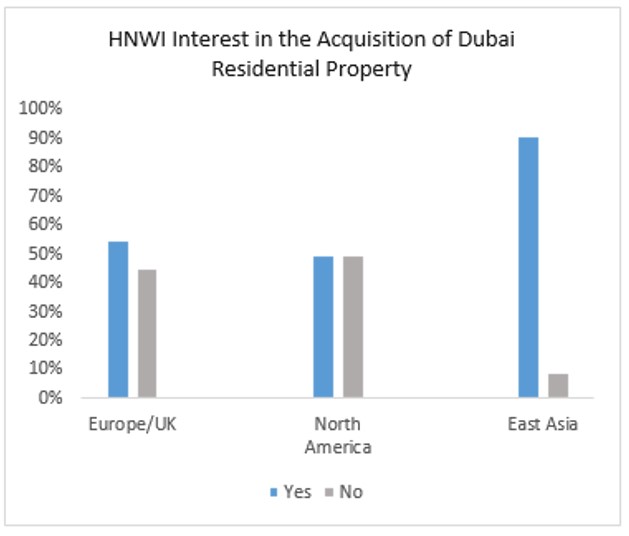

International survey amongst HNW individuals with

remarkable results

A worldwide survey, recently conducted by Knight Frank amongst

high net worth individuals, has prompted some eye-opening

insights into the strong appetite for Dubai properties within

this cash-rich clientele.

Specifically, 90 per cent of the respondents from East Asia have

expressed an interest in investing into residential property in

Dubai while their peers from Europe/the UK (55 per cent) as well

as North America (50 per cent) have also exhibited a strong

appetite for Dubai properties. Some 40 per cent of the HNW

individuals stated that their purchase would be purely for

personal or second-home use while 60 per cent would see their

acquisition as an investment. It is an obvious assumption and

noteworthy therefore that a substantial percentage of properties

purchased by this buyers' group would not be made available in

Dubai`s rental market.

We have reason to believe that the tendency of a weaker US dollar

will increase the budgets (denominated in dollar/Dirham) and

possibly accelerate the decision-making of investors towards

their property acquisition within the Asian and European

jurisdictions, thereby driving more capital into the Dubai

market.

Conclusion

On the back of forward-looking policymaking by the government

combined with favourable geopolitical shifts and notably a weaker

dollar, Dubai`s growth is accelerating, progressing on its path

to evolve into one of the world`s leading business, finance and

tourism hubs.

Despite the recent price hikes, we see substantial further

upwards potential if Dubai`s game plan is to play out over the

course of the coming decade.

Moreover, as properties in tier-2 locations and qualities have

only undergone a fraction of the price appreciation compared with

the high-end segment, we see significant investment opportunities

to be seized by smart investors.

To contact the author, email c.atzert@ppp-advisors.com