New Products

Currency Firm Teams Up With Auction House To Smooth Away Forex Pain

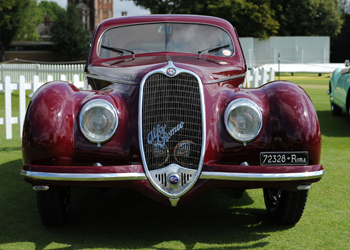

Buyers and sellers of classic cars have enough detail to concern them without having to deal with forex market gyrations. An auction house and currency firm have teamed up to deal with that issue.

UK-based collectors’ car and motorbike auction

house H&H

Classics aims to make it easier for buyers to steer

around twists and turns of the sometimes volatile forex

market through a partnership with Currency

Solutions.

Under the partnership, Currency Solutions enables those buying

or selling a car or other vehicle at auction to have a fixed

exchange rate in place “on the hammer” at the H&H sale the

person is attending, removing risks of forex losses in the

aftermath of the deal.

Currency Solutions says it is typically able to beat banks’ forex

rates by up to 5 per cent, which can translate into significant

sums in the case of the large prices fetched these days by

marques such as Ferrari, Aston Martin, Jaguar, Porsche, and

others.

With collectibles such as classic cars, fine wines, watches and

fine art seen as ways for high net worth individuals to diversify

wealth and have some fun at the same time, the idea of helping

soothe potential forex pains drew Currency Solutions to the

field, said Steve Geoghegan, senior broker at the firm.

“We’ll be attending the auctions as currency brokers to speak to

people, help them, and let them get on with the market,” he said.

“We know they [H&H] have a very cosmopolitan clientele.”

Currency Solutions will adopt a “consultative approach” in

working with clients, he added.

Currency Solutions was formed 14 years ago, while H&H

was founded in 1993 by Simon Hope, devoted entirely to

collectors’ cars and motorcycles. It has handled machines ranging

from pre-20th century cars to Formula 1 motor racing machines. It

is headquartered in Cheshire.

Recent data in the UK show a slight fall so far this year for

major classic marques. According to Historic Automobile Group, or

HAGI, its HAGI Top 50 benchmark fell by 0.32 per cent in

February. Various sector indices, such as those tracking

Ferraris, also fell.

Taylor Wessing, the law firm, last year issued a guide on

collectibles and “trophy assets” – see here for one of its

articles

on cars.