Offshore

Cross-Border Wealth Rose Strongly In 2024; Hong Kong, Singapore And Switzerland Dominate – BCG

The "big three" international booking centres of Singapore, Hong Kong and Switzerland clocked up strong cross-border inflows last year, showing that they remain as relevant as ever. The Boston Consulting Group study also warned that organic growth in firms has been tough, and that universal banks are more likely to win client business.

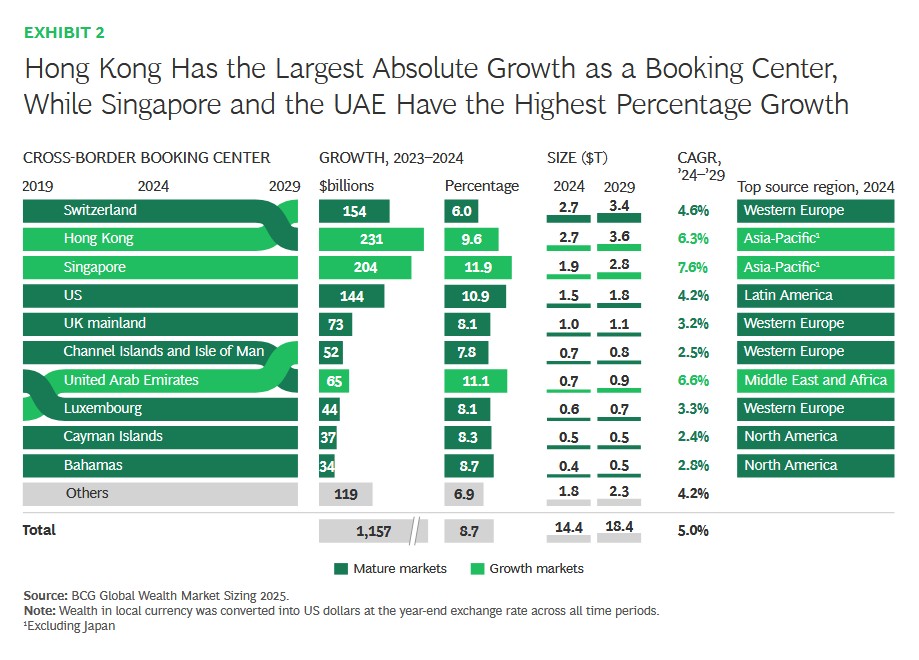

Cross-border wealth sitting in international financial centres –

sometimes dubbed “offshore” – rose by 8.7 per cent in 2024 from a

year earlier, accelerating from the prior four-year average pace

of 6.3 per cent, according to Boston

Consulting Group.

The three largest booking centres – Switzerland, Singapore and

Hong Kong – grabbed more than half of all new cross-border

wealth. Several mid-sized hubs such as the UAE showed strong

momentum. In the UK, however, growth was slower.

(Editor’s note: The impact of tax hikes in the UK and the end of

the resident non-domicile system may also affect future

figures.)

Singapore led all centres with 11.9 per cent growth, driven by

strong net inflows from China, India, and across Southeast Asian

markets. The United Arab Emirates, the US, and Hong Kong also

featured strongly. The data appeared in BCG's Global Wealth

Report 2025: Rethinking The Rules For Growth.

Switzerland posted moderate 6.0 per cent growth, caused primarily

by market performance rather than net inflows.

Source: Boston Consulting Group

The data underpins why such centres continue to attract an influx

of wealth managers, private banks, fiduciary services firms,

accountants, lawyers and tax advisors. Singapore and Hong Kong,

for example, have been busy building structures to attract family

offices, while Switzerland’s political neutrality and political

stability remains a draw.

The future

Looking ahead, BCG said that it expects Switzerland, Hong Kong,

and Singapore to capture nearly two-thirds of all new

cross-border wealth through 2029. Switzerland will remain a top

destination for clients from Western Europe and the Middle East,

while Latin American investors will continue to channel most of

their cross-border wealth into the US. In Asia-Pacific, Singapore

and Hong Kong will lead inflows. The UAE is poised to maintain

strong growth, the report said.

Totals

Global net wealth reached $512 trillion in 2024, growing by just

4.4 per cent – below the 5.3 per cent average growth

recorded in the prior four years. This muted topline result masks

sharper contrasts underneath. Financial wealth rose by 8.1 per

cent, buoyed by momentum in global equities, while real assets

fell by 0.4 per cent and liabilities grew by just 0.2 per cent,

dragging down overall net wealth growth.

Wealth managers grew their AuM by 13.0 per cent, outpacing growth

in overall financial wealth. They benefitted from strong exposure

to high-yielding asset classes and higher growth in the high net

worth segments relative to mass and affluent investors.

However, wealth managers’ revenue didn’t keep pace, rising by 7.1

per cent. As a result, revenue per AuM slipped slightly. Even so,

many firms reduced costs in parallel, helping to maintain a

steady cost-to-income ratio of 75 per cent.

North America was the strongest engine of financial wealth

creation in 2024, expanding by 14.9 per cent – propelled by

a 23 per cent rise in the S&P 500. Asia-Pacific followed with

7.3 per cent growth, supported by robust performance in China,

India, and ASEAN economies. In contrast, Western Europe lagged,

posting just 0.8 per cent growth, partly caused by the fall of

major currencies against the dollar.

Looking ahead, Asia-Pacific is forecast to lead global financial

wealth expansion, with projected growth of about 9 per cent

annually through 2029 – ahead of North America (4 per cent)

and Western Europe (5 per cent).

Organic challenge, and universal bank

advantage

The BCG report identified a “critical weakness” – slow organic

growth in AuM. It also found that universal banks perform more

strongly than “pure-play” firms in generating organic growth.

“The forces that powered asset growth over the past decade are

shifting. Bull markets have softened. M&A integrations remain

complex and costly. And firms that once expanded by hiring

seasoned advisors and absorbing their books are now confronting

diminishing returns: experienced advisors are in short supply,

and nearly half of new hires fail to deliver their

initially-agreed business case. As a result, organic growth

matters more than ever.

“Yet many wealth managers are struggling to raise it. As one

senior executive told BCG, "More than 80 per cent of our net new

assets over the last five years came from newly-hired advisors –

not from the teams already in place.’

“Organic growth accounted for only a small share of total asset

growth over the past decade. Yes, wealth managers have made

progress on efficiency. Global cost-to-income ratios fell from 78

per cent to 75 per cent on average – driven largely by the

top quartile, where the average dropped from 69 per cent to 64

per cent.”

The report’s findings have implications for business models, for

example universal banks covering a range of functions, versus

more “pure-play” firms concentrating entirely on private banking

or wealth.

“On the surface [of BCG’s findings], pure plays appear to

outperform, with AuM growing at close to 8 per cent annually over

the last decade, slightly ahead of the 7 per cent seen at

universal banks. But that topline figure hides a deeper issue.

Only 15 per cent of pure-plays’ growth came from net new assets

generated by existing advisors – compared with 32 per cent for

universal banks."

BCG said universal banks have "built-in" advantages to help

organic growth, such as internal referrals; retail banking

channels; capital strength, and recognisable brands.