Alt Investments

Classic Cars Didn't Leave Main Equity Markets In Slow Lane In February

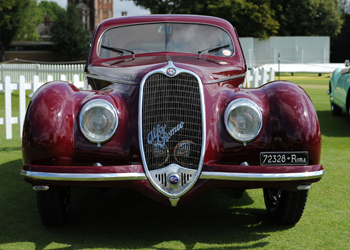

Investors in gleaming Ferraris, Porsches and other classic marques achieved lower returns than the world's main equity markets, according to a benchmark of the sector.

Investors in gleaming Ferraris, Porsches and other classic marques would have made less money in February - on average - by indulging their passions than had they held equities in the world’s main developed markets, new figures show.

Data from UK-based Historic Automobile Group shows that its HAGI Top 50 Index benchmark rose by 3.25 per cent in February from January, slower than total returns of 5.86 per cent for the MSCI World Index of developed countries’ equities. Even so, at an index price of 275.8, the HAGI Top 50 Index has hit a record high, the firm said.

In recent years, the notion of “passion investing” has gained ground, sometimes fuelled by investment returns and the perception that such assets are more “real” or able to give some diversification in uncertain times. There remains debate as to how much negative, or weak, correlation assets such as art, classic cars, jewellery or rare watches actually provide, at least over short periods of time. These assets also tend to be less liquid and require more specific expertise on behalf of the individual investor.

HAG said Ferrari prices helped push the index higher; marques other than Ferrari had a more moderate month. For example, the HAGI MBCI (classic Mercedes-Benz) advanced by 0.24 per cent.

Porsche cars lost ground in February; the HAGI P Index fell 1.09 per cent on the month.