Philanthropy

Choosing The Right Vehicle For Charitable Giving: Charitable Foundation Vs DAF

The authors of this article examine the differences, advantages and costs of two broadly different structures for philanthropy.

The following article from, Katya Vagner, a partner at law firm Fladgate, looks at how UK-based high net worth individuals choose between charitable foundations and donor-advised funds (DAFs) as part of their broader wealth and legacy planning.

DAFs, which are a large sector in the US (see a recent

article

here), are also developing in the UK. Vagner notes

that giving from DAFs is rising rapidly, driven by demand

for a flexible and simple approach. DAFs are, so their advocates

point out, protective of the donor’s anonymity – an important

feature when privacy is sometimes at risk. There are

practical and regulatory trade-offs between DAFs and foundations,

especially for individuals having to manage succession, estate

planning, or preparing for significant liquidity

events.

The editors of this news service are pleased to share these

ideas; the usual editorial disclaimers apply to views of guest

writers. Email tom.burroughes@wealthbriefing.com

and amanda.cheesley@clearviewpublishing.com

if you wish to comment and suggest ideas.

For individuals and companies wanting to make a lasting impact,

the instinct is often to set up a private charitable foundation.

These structures, typically charitable companies or trusts, are

designed to manage long-term giving. However, donor advised funds

(DAFs) are an increasingly popular alternative as a philanthropic

giving vehicle, with contributions to DAFs in 2023 reaching

£852.6 million and charitable assets under management in UK DAFs

totalling £2.8 billion (1).

A DAF is a dedicated account administered by a third-party

charity that allows donors to make contributions and recommend

grants to selected charitable causes. Donors can contribute a

variety of assets to the DAF, including cash, shares, property

and artwork.

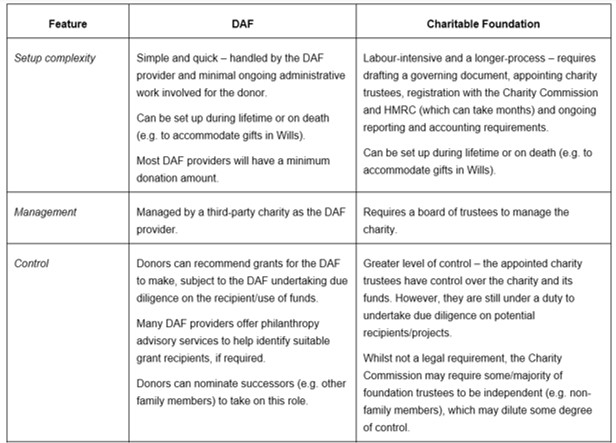

Both options offer ways to support charitable causes and similar

tax benefits, but they differ in structure, administration, and

ongoing responsibilities – a distinction outlined in the table

below.

Key characteristics of DAFs vs Charitable

Foundations

Setup speed and administrative burden

DAFs can typically be established within days and, in urgent

cases, within hours. Conversely, setting up a charitable

foundation generally requires several months, especially if the

Charity Commission raises any queries as it is currently taking a

minimum of two months to respond to applications and

registrations. In many cases. it can take considerably

longer.

Another notable feature of DAFs is their flexibility in estate

planning. Donors can leave a portion of their estate to a DAF in

their will, even if they haven’t opened an account during their

lifetime. While it is possible to instruct executors to set up a

charity after death, this can significantly delay estate

administration.

Historically, setting up a charity was relatively

straightforward, leading to the creation of many charities.

However, many of these charities are now largely dormant, holding

only modest amounts of funds. As of 29 August 2025, there are

170,914 registered charities in the UK with 53,673 of these

charities in receipt of income of <£5,000 (2). Charity

trustees might consider winding up or consolidating these dormant

charities into a DAF, which requires significantly lower

administrative effort.

Control vs compliance

At first glance, charitable foundations appear to offer donors

greater influence over their giving than a DAF. Many assume that

anyone can serve as a charity trustee and that a private charity

staffed entirely by family members is sufficient. In practice,

while this is not a legal requirement, the Charity Commission

often insists on having independent trustees. For corporate

foundations, most trustees cannot be company directors or

employees. Independence and the ability to demonstrate that

trustees act in the charity’s best interests, rather than family

or business interests, is crucial. By contrast, there are no such

restrictions on who can hold a DAF account or give instructions

regarding it.

Private charity trustees may also be willing to take on a higher

degree of risk than DAFs, for instance, making donations

outside the UK. Some DAFs, however, have blanket restrictions on

certain regions. Foundations can offer more flexibility, allowing

trustees to make nuanced decisions based on circumstances and

opportunities, although they must still perform appropriate due

diligence – a key focus area for the Charity Commission.

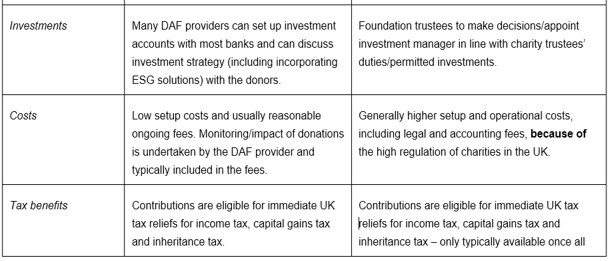

Finally, donors often assume that investment decisions can only

be influenced if they have a private foundation. Many DAFs can

work with a donor’s preferred investment advisors and allow some

input on investment strategy. Account holders often also receive

regular investment statements and other key financial data.

Cost considerations

Setting up a charity used to be relatively inexpensive; however,

it is now rare that creating a private foundation is more

cost-effective than establishing a DAF. Organisations such as

Philanthropy Impact have produced comparisons of costs and

charges across a large range of DAF providers, and it is

relatively easy to access data regarding minimum account balances

and associated fees. Considering all aspects of the charity

creation and registration process, it becomes evident that opting

for a foundation is increasingly less likely to be the cheaper

option.

DAF providers have a range of pricing models and broadly

speaking, the more substantial the donations, the more

competitive the pricing becomes. While the ongoing platform costs

may seem an unnecessary expense, the difference in regulatory

responsibilities between private foundations and DAFs may help to

make those costs more palatable. Private foundations are subject

to rigorous compliance requirements, including annual filings to

the Charity Commission, adherence to specific governance

standards, and detailed reporting obligations. These regulations

can impose considerable administrative burdens on the charity

trustees.

In contrast, DAFs offer a more streamlined approach, with the

sponsoring organisation handling most of the regulatory

compliance and reporting duties. For busy donors, the relief from

administrative responsibilities often outweighs the ongoing fees.

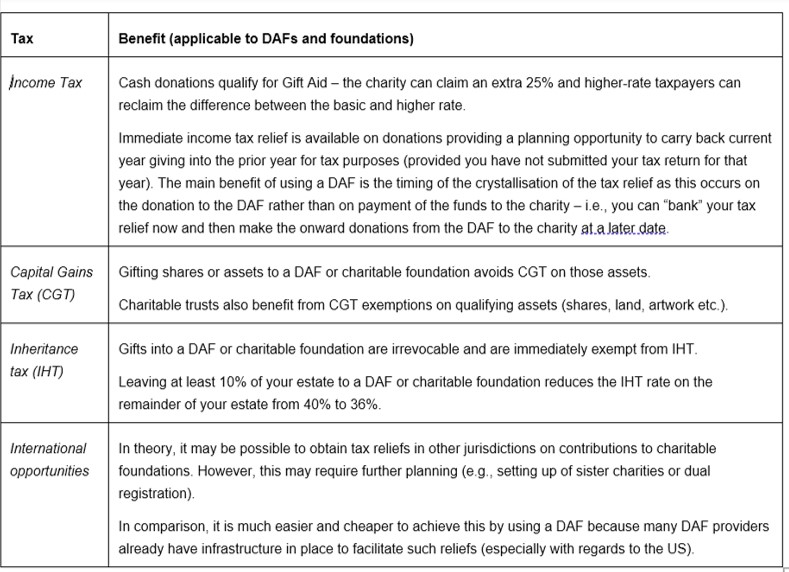

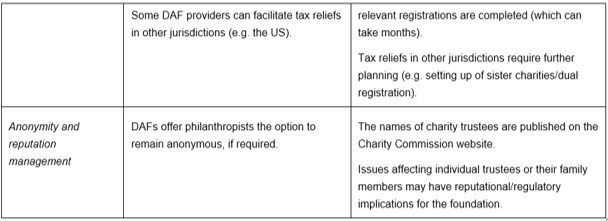

Tax efficiency

Broadly speaking, UK DAFs and UK foundations provide the same tax

benefits to donors.

The key difference lies in the timing for obtaining those

reliefs. DAFs can be established and activated much more quickly

than charitable foundations, which is advantageous if making

donations within a specific tax year is crucial. This accelerated

setup process for DAFs ensures that donors can promptly achieve

their desired tax benefits, unlike the lengthier establishment

process for private foundations, which may delay potential tax

advantages.

Anonymity and reputation

Privacy is often a key concern for donors. DAFs allow

contributors to remain anonymous, keeping personal details and

donation amounts confidential. By contrast, the names of charity

trustees and charity accounts are publicly available on the

Charity Commission website, which might not be desirable for

those seeking privacy.

Reputation is another consideration. Private foundations can be vulnerable to scandals involving trustees, founders, or beneficiaries, potentially harming the foundation’s standing. DAFs, managing many accounts, rarely see a single incident affect the organisation’s overall reputation. Their distributed structure provides greater resilience against isolated issues.

Summary

Both DAFs and charitable foundations have merits, depending on a

donor’s goals and preferred level of involvement. Understanding

the legal, tax, and operational implications is key to choosing.

Footnotes

1, NPT UK ‘UK Donor-Advised Fund Report’, released

2024.

2, Charities by income band

The authors

Katya Vagner

Partner at Fladgate LLP

Katya Vagner is a solicitor and partner at Fladgate LLP. She

specialises in UK and offshore private client and charity legal

and tax matters and advising on complex cross-border issues.

Katya advises clients across the globe on issues such as: estate

and succession planning, setting up and advising on structures,

incapacity planning, administration of trusts and estates,

philanthropic strategies and a range of legal and tax issues. Her

clients include fiduciaries, charities, high net worth

individuals and their family offices. Katya has a particular

passion in helping clients implement philanthropic initiatives,

including advising on the structuring of UK and cross-border

charitable giving and governance matters.

Bethany Brand

Associate at Fladgate LLP

Bethany is an associate in the Private Client and Tax team at Fladgate LLP. She acts for both UK based and international clients, advising high net worth individuals, families and trustees on a broad range of estate planning and taxation matters. Bethany also advises clients on Charity law and philanthropy matters, including assisting charity trustees on constitutional and governance issues.

Zevi Wulwick

Associate at Fladgate LLP

Zevi is an associate in the Private Client and Tax team at Fladgate LLP. He advises HNW and UHNW clients on a range of matters including UK and international tax, succession and estate planning.