Strategy

Bigger Banks Do Better - Swiss Banking Institute Survey

The Swiss Banking Institute, a department of the University of

Zurich has published its biennial Private Banking Survey. The

report, co-authored by Dr Teodoro Cocca and Dr Hans Geiger, is

based on analysis of 253 institutions focusing on private banking

from 11 countries and looks at data from 1990 to 2006. 2,176

in-house funds were also analysed. On the whole the news is

pretty up-beat. When compared to 2004, cost/income ratios are

down across the board and return on equity is up in every country

surveyed, continuing the trend seen since 2002. The larger

players have increased their share of the market based on assets

under management. The top 20 private banks now hold 16 per cent

of the market up from 15.4 per cent in 2005. According to the

survey, the biggest single player is UBS Global Wealth Management

which has 4.3 per cent of the market – hardly a dominant

position. Switzerland maintains an edge as the leading country

for private banking with the highest adjusted return on equity

and a fairly tight control on personnel costs which were

surpassed by costs in the US for the first time in 2006. Revenue

per employee grew for the fourth year in a row as it did in

nearly every country, reflecting the strong market conditions of

the past few years. Overall, Switzerland and Liechtenstein are

tied in first place in the rankings based on financial metrics.

Where the survey presents a rare insight is in its second section

of research. Taking banks’ in-house funds as a proxy for their

investment strategies, the survey attempts to report on the

success of various private banks in managing client money. These

returns are reported in bar charts that show the absolute returns

over all investment fund categories for each bank, grouped by

country. During 2006, no bank achieved a negative stock fund

performance. The averages over all countries show that clients

with stock funds received on average 7.02 per cent higher returns

in comparison to a mixed investment fund portfolio. And last

year, on average, banks outperformed their benchmark (0.65 per

cent) and therefore managed to create sustainable value for their

clients. In terms of investment performance there was no clear

winning country although the Nordic countries put in a general

strong showing. Switzerland was mid-range and the survey thus

suggests that it is individual manager selection that is vital

and the country of operation is probably not so important. The

trend to mergers in the industry will be enhanced by the finding

that size in terms of AuM has a direct correlation to

profitability. In particular the survey reports three facts: •

The relative and absolute performance of investment funds has a

significant positive correlation with the growth of AuM. • Large

banks appear to have better risk-adjusted returns over a long

period. • A uniform picture of the relations between

profitability, efficiency and performance can be discerned. So

bigger banks with more expertise do better than the boutiques.

Unless, of course, you are talking about THE boutique! No

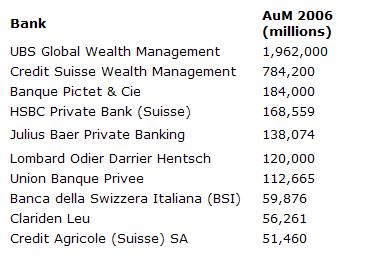

generalism is true, after all. And then towards the back of the

report is a real nugget. The section “Focus Switzerland” provides

a plethora of data on the Swiss market, including the AuM figures

for banks that I have never known publish such figures before.

The list of the top ten banks by AuM are shown below.  .

.