Tax

Who Are The UK's 1 Per Cent?

New data this week from the Institute For Fiscal Studies shines a light on income distribution in the UK and where disparities may fan the flames on an Autumn budget.

Much of the public conversation about economic inequality is focused on the top 1 per cent, "how different they are from the rest, how they got to where they are, and what – if anything – policy should do about it,” The Institute For Fiscal Studies said in new research out this week about the UK’s highest-earners.

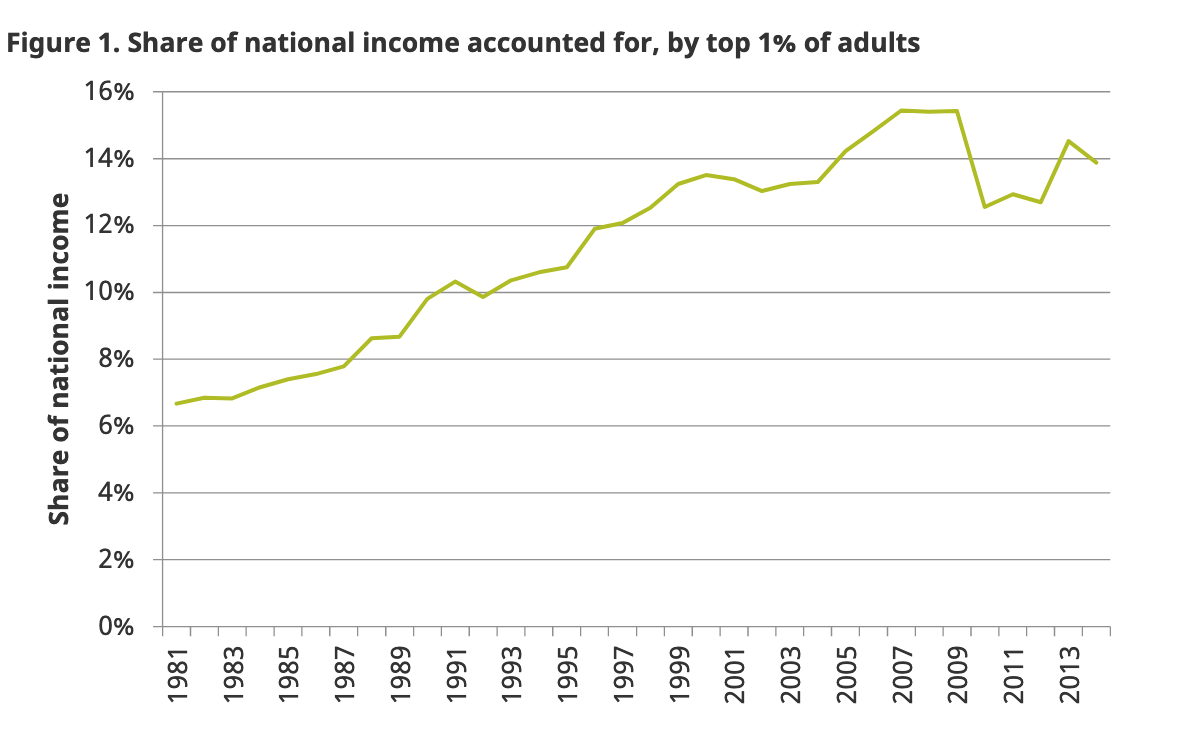

The latest analysis from the IFS shows that the top 1 per cent are increasingly likely to be 45-55, male and concentrated in the southeast. Men make up 83 per cent of the top 1 per cent of taxpayers and the group currently receives around 14 per cent of national income. This proportion has more than doubled since the 1980s as “overall inequality has increased,” the IFS said. Equally, the 1 per cent pay roughly a third of the nation’s tax bill and are “extremely important” for funding the welfare system and public services, the tax policy specialist noted.

The characteristics of the 1 per cent are worth highlighting for wealth managers to understand how they divide by gender, region, and age, and where certain characteristics are being concentrated. Also how fair the current tax system is judged to be when analysis shows the scale of geographic and gender inequalities.

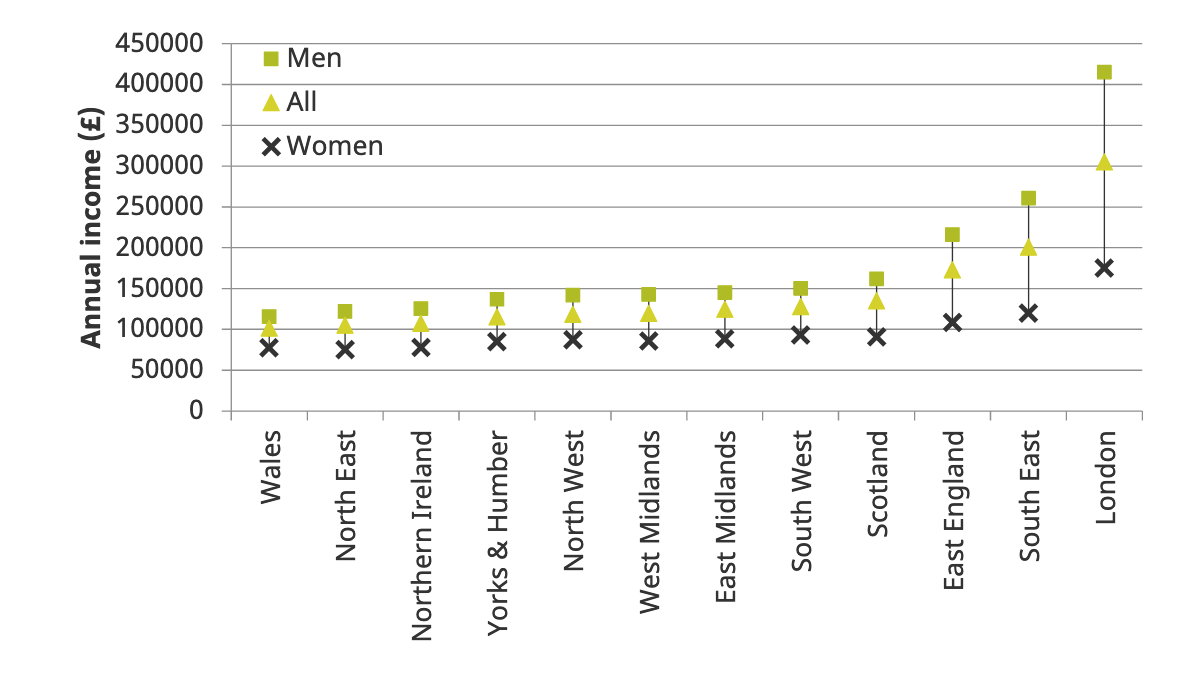

To be in the top 1 per cent of all UK adults, individuals need to earn a pre-tax income of at least £120,000, the policy unit found. For residents in the southeast, the threshold is much higher. A man aged 45–54 living in London needs to earn at least £670,000 to be in the top 1 per cent by age and gender for his region. The dominance of middle-aged London-based males is even more pronounced in the top income bracket. Almost half of the top 0.1 per cent of earners are London based, more than 40 per cent are in the 45-54 peak earnings age group, and only 11 per cent are women.The IFS took data from tax returns submitted between 2000-2001 and 2015-2016 and found that nationally among all UK adults, the 1 per cent amounts to roughly 540,000 people out of 31 million adults who pay tax. Around 43 per cent of adults don't pay any tax, a group that has become considerably larger with raising the personal allowance.

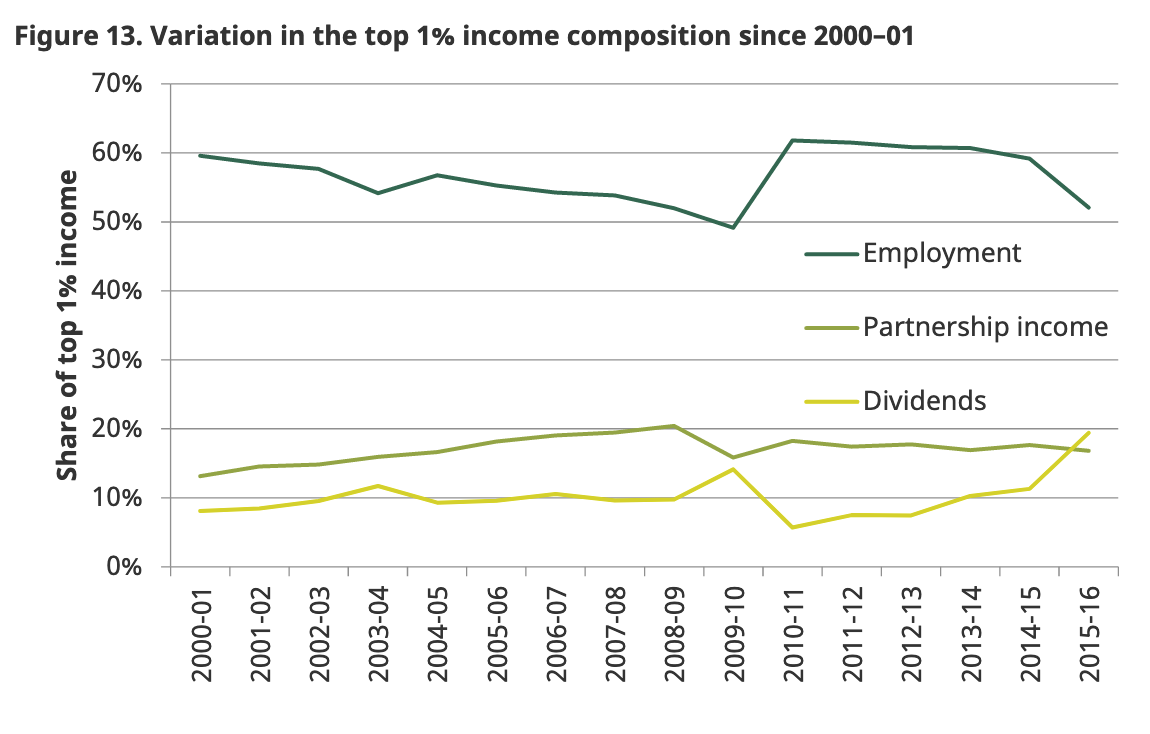

The institute also looked at where income is derived, and found that partnerships, self-employment, and dividends accounted for over a quarter of income for the 1 per cent, and over a third of the income of the highest 0.1 per cent of earners. It found that income through partnerships generally came from a small cluster of sectors, including hedge funds, law firms, consultancies and medical general practitioners, and noted that the policy decision to tax business owners (who make up a third of the group) at lower rates than employees on salaries has significantly benefited the top 1 per cent. The government has already cut tax relief on dividends as a result.

Income disparity between genders is also notable for wealth planners trying to connect with more female savers and an industry that needs to represent women more comprehensively. Current figures show that men need to earn £200,000 to be in the 1 per cent category nationally, while it is half of that for women - at £100,000. But the proportion of women in the 1 per cent is edging up, from 12 per cent at the beginning of the century to 17 per cent today.

The fact that this latest dive into the nation’s tax affairs has confirmed that the top 1 per cent have become even more concentrated in London and the southeast, are generally receiving an increasingly larger slice of the income pie, puts additional focus on how these findings will figure in an emergency budget mooted for October.

Boris Johnson has already committed to raising the highest tax threshold from £50,000 to £80,000, which the IFS has already calculated will cost the governemt £9 billion and give top earners nearly £2,500 extra a year, not a prudent step in its view.

Also on Johnson's agenda is reforming stamp duty, which nets the Treasury around £9 billion annually, and scrapping the tax entirely on homes valued at £500,000 or less to boost a flagging property sector. How the government revisits these and other measures to stimulate growth, with or without a Brexit deal in October, will make for an interesting next few months.