WM Market Reports

Wealth Platforms Must Improve Digital Experience For Clients - Refinitiv

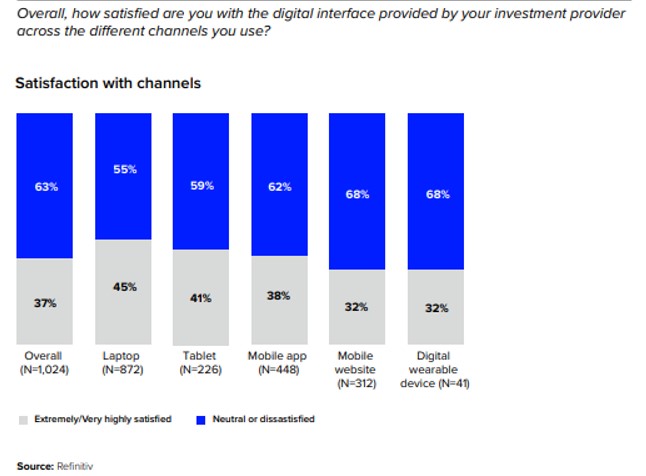

The study of 1,300 investors found that only 37 per cent of them globally give their platforms top scores for the digital experience.

Generally, advisory and self-directed clients are not happy with

the digital experience they receive on platforms, and the vast

majority say they would be able to analyze investments better

with real-time data, according to a new study from Refinitiv.

The market data and information provider polled 1,300

self-directed and advised mass affluent investors in Australia,

Canada, China, Hong Kong, Japan, Singapore, Switzerland, the UK

and the US. The findings come from a study called The Gold

Standard: The Race for Digital Differentiation. The report

is the second in a two-part series examining how investors’

trading activities, data needs and digital expectations have

changed and continue to evolve.

Only 37 per cent of investors globally give their platforms top

scores for the digital experience; some 20 per cent of advisory

clients will consider switching providers compared with 11 per

cent of self-directed investors; some 43 per cent of investors

use mobile applications to access their investments and 72 per

cent of investors say better integration of news updates is a key

area for improvement by platforms.

The study also found that 80 per cent of investors say real-time

data would enhance their analysis and 20 per cent of investors

are not receiving alerts that they would find helpful.

This kind of research is an example of how big technology firms

argue that the industry must continue to raise its game for

mass-affluent, high net worth and ultra-HNW clients, particularly

as conventional business models are being challenged by fintechs.

At the same time, the global pandemic has forced firms to deliver

higher-value digital content, such as two-way video and

interactive data sharing.

“The consequences of COVID-19 have emphasized just how vital it

is to have a robust, customer-centric digital experience enriched

with deep insights and analytics. Rather than settling for

digital transformation progress in 2020, platforms need to set

their sights higher and deliver a digital experience that meets

and exceeds expectations,” Charles Smith, head of digital

solutions, wealth, at Refinitiv, said.

Ashley Longabaugh, senior analyst, wealth management practice at

Celent, said: “The wealth management industry is at an inflection

point between serving NextGen clients and creating innovative

platforms for a NextGen workforce - all against the backdrop of

an accelerated transition to remote and digital service

models.”

April Rudin, CEO and founder at The Rudin Group (also a member of

this publication’s editorial

board), said: “The era of hyper-personalization in wealth

management is here to stay, and in the minds of investors,

financial advisors are only as good as their last client

experience. Refinitiv's latest report shows that only 37 per cent

of investors give their digital experience top marks. This means

that there is significant room for improvement.”

The

first of the Refinitiv reports - Redefining Investor Data

Needs - examined the investor’s need for new data sources to

take advantage of promising investment opportunities and avoid

potential risks.