Legal

Wealth Management In Singapore: Key Updates

The international law firm sets out major developments, and explains continuing cases, that affect the work of private client advisors and wealth managers in Singapore.

The law firm Baker

McKenzie Wong & Leow, member firm of Baker McKenzie in

Singapore, outlines the latest developments important for private

client advisors and wealth managers focused on Singapore. This is

among an occasional series of updates already published by the

international law firm and this news service on developments in

Malaysia.

The individual authors of this article are Dawn Quek,

principal, Enoch Wan, senior associate, and Jaclyn Toh,

associate.

The editors of this news service are pleased to share these

insights. The usual editorial disclaimers apply about

contributions from outside. We invite readers to jump into the

conversation. Email tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

Singapore

Changes to the Global Investor Programme

There have been some updates to the Global Investor Programme

("GIP"), which offers Singapore permanent residency ("PR") status

to individuals planning to invest and relocate to Singapore.

These new updates took effect for new GIP applications made on or

after 1 March 2020.

Updates to qualifying threshold criteria

(a) Established Business Owners. There has been an increase in

the minimum average annual turnover requirement (of the

applicant's existing business) from S$50 million to S$200

million. This criterion is in addition to the existing minimum

shareholding requirements, a proven business and entrepreneurial

track record, and the requirement for the applicant's company to

fall within a list of specified industries.

(b) Next Generation Business Owners. This new criteria requires

(i) the applicant's immediate family to be either the largest

shareholder or hold at least a 30 per cent shareholding in a

company that falls within a list of specified industries; (ii)

such company's minimum average annual turnover should be at least

SG500 million; and (iii) the applicant must be a part of the

management team of such company.

(c) Founders of Fast Growth Companies. This new criterion

requires the applicant to be a founder and one of the largest

individual shareholders of a company that falls within a list of

specified industries and has a valuation of at least S$500

million, and such company must also be invested into by reputable

venture capital/private equity firms.

(d) Family Office Principals. This newly published criteria

requires the applicant to possess some form of entrepreneurial,

investment or management track record, and to have net investable

assets (excluding real estate) of at least S$200 million.

Published investment options

Upon meeting one of the four threshold criteria above, applicants

then have the option of choosing to invest S$2.5 million into one

of three investment options. However, family office principals

may only choose to invest under Option C, which is to invest

S$2.5 million into a new or existing Singapore-based single

family office. If there are intentions to take advantage of

Option C, the applicant should also assess how the GIP

application may be aligned with the applications for tax

incentives (such as the Section 13X or 13R fund incentives).

There has largely been no change to the two previously published

investment options under the previous rules of (a) Option A:

Investing SGD 2.5 million into a new or existing business entity

or (b) Option B: Investing SGD 2.5 million into a GIP-approved

fund.

The third-year milestone requirement of a minimum additional

headcount and local business spending has now been removed.

Renewal criteria for PR status

Upon attaining GIP approval, and having made the requisite

investments within the specified timeframe, applicants and their

dependents will be able to obtain PR status for a period of five

years. Such PR status is subject to renewal criteria that has

recently been amended. Depending on the period of renewal (three

years or five years), the renewal criteria includes additional

headcount, increased local business spending as well as the

applicants or their dependents spending at least half their time

in Singapore.

2, Singapore extends and refines tax incentives for

venture capital funds and venture capital fund management

companies

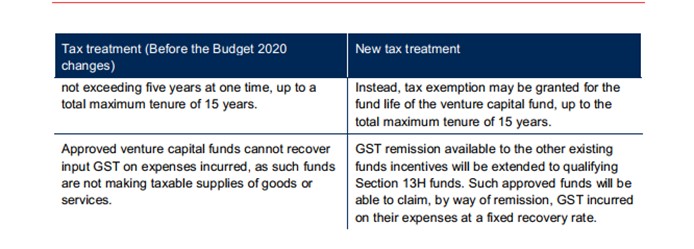

Section 13H Incentive

Introduced in 1993, Section 13H of the Singapore Income Tax Act

(Cap. 134) ("ITA") seeks to encourage investments into

Singapore-based businesses and start-ups by providing a tax

exemption for eligible venture capital funds on qualifying income

streams ("Section 13H Incentive"). Pursuant to Singapore's Budget

2020, this incentive will be extended for another five years

until 31 December, 2025.

Key enhancements to the incentive are summarised as

follows.

To be approved under the Section 13H Incentive, the applicant

venture capital fund must fulfil the following conditions:

(a) have a minimum fund size of at least SGD10 million at the

time of application;

(b) attain sufficient localisation by having at least 30 per cent

of its invested capital invested into unlisted Singapore-based

companies by the fifth year of being approved as a Section 13H

fund, or by the end of the incentive period, whichever is

earlier;

(c) incur local business spending ("LBS") of at least SGD100,000

per year, multiplied by the incentive tenure (at the end of each

incentive year, the fund must have incurred cumulative LBS of at

least SGD100,000 multiplied by the number of years of incentive

enjoyed, but the requirement is met if the fund achieves the

total cumulative LBS target at any point during the incentive

tenure);

(d) satisfy any other conditions stipulated in the letter of

award; and

(e) The expansion of the categories of qualifying income

incentivised under the Section 13H Incentive will allow

participants far greater flexibility in structuring their

investments. As it is common for venture capital investments to

be funded by a mixture of debt and equity, the newly-introduced

list of "designated investments" for Section 13H, which includes

Singapore-sourced interest income, amounts to a significant

enhancement of the incentive.

Fund Management Incentive

Introduced in Budget 2015, the FMI offers a concessionary tax

rate of 5% to fund management companies managing Section

13H-approved funds. The concessionary tax rate will apply in

respect

of:

(a) management fees; and

(b) performance bonuses from managing funds approved under

Section 13H.

Like the Section 13H Incentive, the FMI has been extended until

31 December 2025. In addition, under Budget 2020, statutory

limitations on the total incentive tenure will be removed.

Instead, each FMI award will be subject to a maximum tenure of

five years, which may be renewable in tranches of up to five

years, subject to qualifying conditions.

For approvals or renewals under the FMI scheme on or after 1

April 1 2020, the fund manager must fulfil the following

conditions:

· manage at least SGD 40 million of assets under management of

Section 13H funds at the point of application or

renewal;

· hire at least one additional investment professional by the end

of the FMI award. For renewals, an incremental headcount of one

additional investment professional is required by the end of the

renewal tranche. The number of existing investment professionals

at the start of each incentive tranche must be maintained for the

entire award tenure.

There is no LBS requirement for the FMI.

3. COVID-19 administrative guidance on tax residency for

individuals and companies

The COVID-19 pandemic has brought significant disruption to

global cross-border movement. To address uncertainties in tax

positions that may have arisen from border closures and travel

restrictions, the Inland Revenue Authority of Singapore ("IRAS")

published administrative guidance on 6 April 2020 to provide a

clearer picture to both companies and individuals on their tax

position.

Tax residency status for individuals working remotely

from Singapore

(a) Singaporeans or Singapore Permanent Residents exercising

overseas employment and currently working remotely from

Singapore. IRAS is prepared to consider such individuals as not

exercising employment in Singapore for a limited timeframe where

the following conditions are met:

(i) there is no change in the contractual terms governing the

employment overseas before and after the individuals' return to

Singapore; and (ii) this is a temporary work arrangement due to

COVID-19.

Where these conditions are met, the individual will not be

considered as exercising employment in Singapore during the

period starting from the individual's date of return to

Singapore, unyil 30 September 2020. As such, the employment

income earned during that period will not be taxable in

Singapore.

(b) Non-resident foreigners exercising overseas employment who

are on a short-term business assignment in Singapore and are

unable to leave Singapore due to COVID-19. Such individuals may

also be working remotely from Singapore for their overseas

employers during this extended stay in Singapore.

IRAS is prepared to consider such individuals as not exercising

employment in Singapore during this period of extended stay,

where the following conditions are met:

(i) the period of the extended stay is not more than 60 days;

and

(ii) the work done during the extended stay is not connected to

the initial business assignment leading to the travel to

Singapore and would have been performed overseas but for

COVID-19.

Where these conditions are met, the employment income for this

period of extended stay will not be taxable.

Tax residency status for companies

Under the ITA, for a company to be resident in Singapore, the

control and management of its business has to be exercised in

Singapore. Thus, the location of the physical board meetings of a

company's directors is generally a key consideration in the

determination of tax residency.

Cognisant of the potential impact that COVID-19 travel

restrictions will have on board meetings, IRAS is prepared to

consider the company as a Singapore tax resident for Year of

Assessment ("YA") 2021, notwithstanding the fact that board

meetings are not held in Singapore due to the travel

restrictions, provided that all of thefollowing conditions

are met:

(i) the company is a Singapore tax resident for YA 2020;

(ii) there are no other changes to the economic circumstances

(e.g., principal activities, nature of business operations, usual

locations in which the company operates) of the company;

and

(iii) the directors are obliged to attend board meeting(s) held

outside Singapore or participate electronically (via video

conference) due to their movement being restricted by COVID-19

related travel restrictions.

Conversely, where a company is not a Singapore tax resident for

YA 2020, IRAS will continue to consider the company as a

non-resident for YA 2021, provided that (i) the company is

obliged to hold its board meeting(s) in Singapore due to the

travel restrictions in place; and (ii) there are no other changes

to the economic circumstances of the company.

Whether a company claims to be a Singapore tax resident or

otherwise, IRAS expects the company to maintain relevant records

and to provide the same to IRAS when requested.

4. Ernest Ferdinand Perez De La Sala v Compañía De

Navegación Palomar, SA and others [2020] SGCA 24

One of the largest trust law cases heard in Singapore, this case

concerns an underlying suit brought against Ernest Ferdinand

Perez De La Sala ("Ernest") by several related family companies

("the Companies") on grounds that Ernest had wrongfully, and in

breach of his fiduciary duties, transferred $600 million from the

Companies to his personal account.

Pursuant to the underlying suit, the Court of Appeal had earlier

granted (i) a worldwide Mareva injunction over assets in Ernest's

name, and (ii) a proprietary injunction compelling him to procure

the transfer of USD250 million to the Companies.

The present case concerned Ernest's application to vary the

proprietary injunction so that the assets held on trust by the

Companies can be released in the amount of $60,000 per week for

his living expenses and a lump sum of $6 million for legal

expenses. To this end, Ernest relied on Section 56 of the

Singapore Trustees Act (Cap. 337) ("Trustees Act") and/or the

inherent jurisdiction of the court. Section 56(1) of the Trustees

Act allows the court to empower trustees to perform an act,

otherwise unauthorised by the trust instrument, if the act is in

the court's opinion, expedient in the management or

administration of a trust.

The Court of Appeal dismissed Ernest's application. First, it

found that Section 56(3) of the Trustees Act only provides

trustees or beneficiaries of the trust with locus standi to apply

for relief under Section 56. Since Ernest was neither a trustee

nor adjudged a beneficiary of the trust, he had no standing to

apply for relief under Section 56 of the Trustees Act.

Secondly, it also held that its inherent jurisdiction to vary a

trust only fell within narrow and established classes of cases.

Since the facts did not concern such scenarios, the court

declined to exercise its inherent jurisdiction.

In sum, the Court of Appeal judgment helpfully elucidates the

circumstances in which a defendant can rely on the Trustees Act

and the court's inherent jurisdiction to withdraw funds seized

under a proprietary injunction for living, legal and other

expenses. With the court's interpretation of the Section 56(1) of

the Trustees Act and its exegesis of the common law position on

its inherent jurisdiction to vary trusts, it would appear that

that a relief of the type sought by Ernest would have little

prospect of success under these two legal grounds.