M and A

Wealth Advisors’ M&A Trend – What’s Driving The Market

A number of forces are driving M&A deals in the US registered investment advisor space and a study examines how certain types of business are gaining an edge.

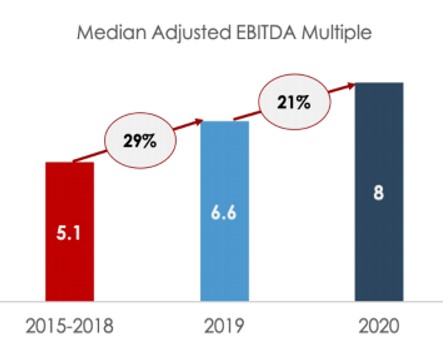

The median valuation for registered investment advisor M&A

transactions rose by 21 per cent in 2020 from a year before as

deals increased, figures show, with larger acquirers benefiting

from scale and track record. It is unclear, however, if multiples

paid for transactions will continue rising at the same pace as

over the past five years.

Data from organizations such as ECHELON Partners

and DeVoe show a red-hot

market for wealth management deals in the RIA space (although so

far there have been relatively few among firms - such as

multi-family offices - serving ultra-high net worth

clients).

While it is much harder to enter the market as a buyer, 65 per

cent of potential sellers prefer a local or regional partner. The

spoils will go to acquirers with a well-defined approach to

inorganic growth or a platform that enhances front, middle, and

back-office capabilities, argues Advisor

Growth Strategies, a group that has polled industry figures

from December 2020 to March this year about the market. It

tracked 33 transactions last year, comprising a total of more

than $60 billion in assets under management. Deal volume rose 4

per cent in 2020, the report’s survey participants said. A total

of 130 RIA deals took place last year.

The multiple paid in deals is based on earnings before interest,

taxation, depreciation and amortization. The report’s authors

said that since it first studied such deals in 2019 (based on

deals completed between 2015 and 2019), the median adjusted

EBITDA multiple rose almost 60 per cent. The report said that it

doesn’t expect multiples to keep rising at the same pace,

however.

Source: Global Strategies Group, 2021 RIA Deal Room

Report.

The RIA is becoming more concentrated, with the largest players

holding a larger share of AuM, it said.

“2020 was a pivotal year for the RIA industry. RIA M&A

started the year at a record pace, and all signs pointed to

continued success. At the end of 2019, the total number of RIAs

increased slightly, and the RIA channel also became more

concentrated as 67.2 per cent of AuM was controlled by 6.4 per

cent of RIAs. Overall, the industry was more successful, and 2020

shaped up to be another busy year for RIAs for familiar reasons,”

the group’s report, sponsored by BlackRock, said.

All participants covered in the survey said that they intend to

do more deals this year than in 2020. And, ironically, they said

working-from-home arrangements meant fewer distractions, actually

helping more deals take place.

Battle lines have been drawn between integrators growing a

single, dominant brand, and investors who offer more autonomy and

flexibility, the report said. The average 2020 transaction showed

an increase in cash. Sellers took less contingent risk and

instead gained substantial upside opportunities. Initial

valuations tended to improve by 20 per cent or more through

“earn-more” provisions, it said.

“It’s clear 2020 was a breakthrough for RIA M&A valuations,

diversity in structure, and new market entrants. As we look ahead

to 2021 and beyond, we can expect the robustness of the market to

continue, John Furey, managing partner at Advisor Growth

Strategies, said. “Firm owners should take the time to understand

the market opportunities as the industry has transformed itself

over the last few years.”

Pandemic gyrations

As already reported, last year’s onset of the COVID-19 pandemic

squashed deals initially, bringing them to a halt in the second

quarter of 2020 before the market resumed. The report noted that

outside institutional capital continued to pour into the RIA

space.

Clients of Advisor Group Strategies said it is hard to find new

contributors and 25 per cent of survey respondents in the report

said finding new talent is a top priority this year.

The vast bulk of RIA deals tend to be among firms serving

mass-affluent/HNW clients, and haven’t yet greatly affected those

serving clients further up the wealth spectrum. In a forthcoming

interview with wealth management industry consultant Jamie

McLaughlin in this news service, he notes that there are a few

exceptions to this, such as involving Tiedemann (Presidio,

Threshold); Pathstone (Federal Street, Convergent, Cornerstone),

and Fiduciary Trust International (Athena Capital Advisors).

McLaughlin argues there are several barriers to M&A in the

multi-family offices space: As partnerships they have no capital

per se other than their free cash flow. Partners can choose to

compensate themselves or reinvest their annual distributions in

the business; few have achieved “scale” as measured simply by

operating leverage; the aging of key principals and their

clients, who tend to be their contemporaries, implies a further

diminution of firm valuations; due to the idiosyncratic nature of

their clients’ needs, it has proven very hard to replicate work

processes and/or leverage technology; and organic growth has also

proven to be longer-cycle so firms' cost-of-acquisition tends to

be higher. (See the

full interview on May 24.)