Investment Strategies

US Elections Aftermath: The View From BNY Mellon Wealth Management

More commentary from the industry about the Georgia Senate run-off results and the approach of a Joe Biden Presidency. These views come from BNY Mellon Wealth Management.

The following comment comes from BNY Mellon Wealth Management and is republished here with permission.

The results of the 2020 election were made final on Wednesday,

two months after Election Day. It all came down to the pair of

runoff races in Georgia, where Democrats won control of the

Senate. With former Vice President Joe Biden winning the White

House, a 50-50 split in the Senate allows Vice President Kamala

Harris the deciding vote in a tie, handing Democrats the majority

in both chambers of Congress. The House and Senate also

convened on Wednesday in a joint session to count electoral

votes. We were saddened by the violent events at the

US Capitol in what is a normally symbolic affair affirming

the president-elect's victory.

Let’s take a look at what happened in Georgia, its impact on the

new administration’s policy priorities and what it may mean for

the markets and your portfolio.

What happened in Georgia

In two very competitive races, Georgia voters determined which

party controls the Senate. In one contest, Democratic candidate

Rev. Raphael Warnock defeated incumbent Republican Senator Kelly

Loeffler. In the other, Democrat Jon Ossoff defeated incumbent

Republican Senator David Perdue. This gives Democrats control of

both chambers of Congress.

The runoff elections were a result of Georgia’s election in

November, in which none of the Senate candidates received a

majority of the vote. Under Georgia law, if no Senate candidate

gets more than 50 per cent of the vote, the two candidates who

receive the most votes, regardless of party, compete in a runoff

election. Georgia had two separate Senate races this year, thanks

to a special election to replace the retired Senator Johnny

Isakson.

Expected policy focus for the Biden

administration

A slight majority in the Senate gives Biden more room to pursue

his agenda of fiscal relief, infrastructure, green energy and

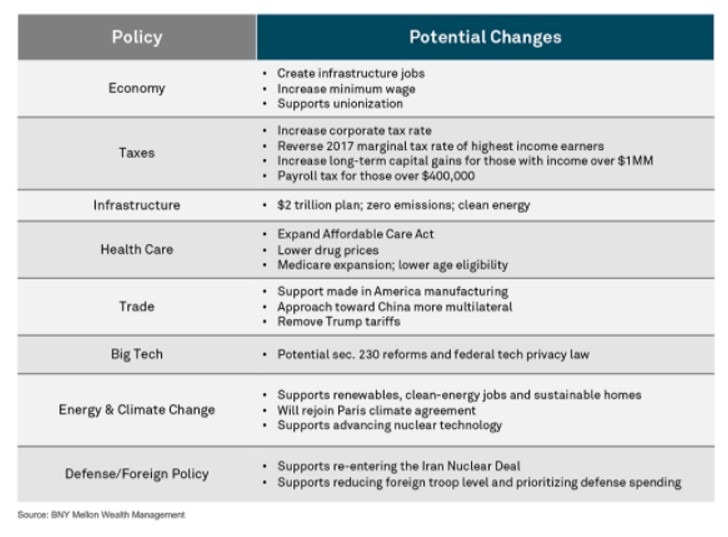

higher taxes (as highlighted in Exhibit 1). Having said that, the

political divide is very thin both in the Senate and the House of

Representatives. Nevertheless, the George W. Bush and Obama

administrations were able to pass major legislation with less

than 60 votes in the Senate, including the Bush tax cuts, which

were passed with a 50-50 Senate.

Exhibit 1: Biden's Policy Platform

In the early days of Biden’s administration, the focus will most

likely be on addressing the pandemic and ensuring the US economy

can continue to recover despite showing some recent signs of

moderation. We expect that the emergency coronavirus relief

package passed in December will be followed by more stimulus as

early as February, with higher direct payments to individuals

likely.

Other areas of spending, including infrastructure, heathcare and

clean energy, can be enacted through the budget reconciliation

tool. This process allows the Senate to pass legislation with

just 51 votes and for funding to be paid for over 10 years. To

pay for these initiatives, we will likely see some form of higher

taxes, with a corporate tax increase having the most support; an

increase in personal taxes may possibly be off the table until

the recovery is under solid footing. Also, since trade policy is

controlled by the executive branch, Biden's support of free trade

should help allay fears of more protectionist policies, helping

to support global growth.

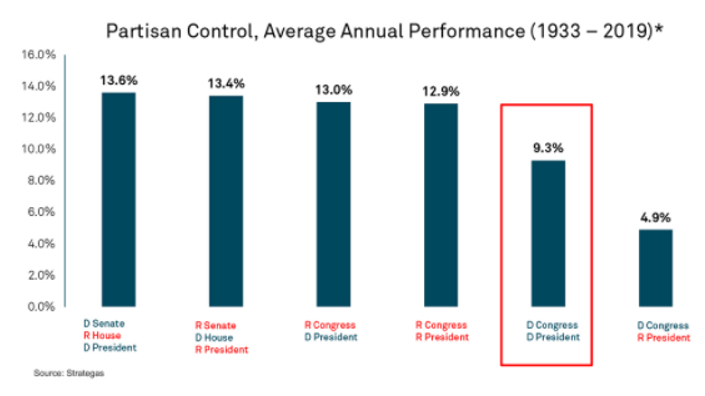

Although equity markets tend to like divided governments, as

illustrated in Exhibit 2, a single party can still be positive

for stocks. As history reminds us, a single party controlling the

White House and Congress is often short-lived. Presidents Bill

Clinton, George W. Bush and Barack Obama saw their parties

control both houses of Congress when they were first elected and

each lost that majority in the first mid-term election.

Exhibit 2: What History Tells Us

The impact on markets and portfolios

Equity markets and interest rates moved higher on Wednesday

following the Georgia Senate outcome given the increased clarity

on the makeup of Congress and growing expectations for more

fiscal stimulus. The S&P 500 and Dow Jones Industrial Average

were up 0.6 per cent and 1.4 per cent, respectively. Meanwhile,

the Nasdaq Composite declined 0.6 per cent, as technology names

lagged. Smaller capitalization stocks, as measured by the Russell

2000 index, jumped 4 per cent. The US Treasury yield curve also

steepened, with the 10-year Treasury note yield above 1 per cent

for the first time since last March.

Although at the time of the November election many market

participants believed a so-called “blue wave,” where Biden won

and Democrats took control of both chambers of Congress, would

lead to an equity market selloff, at present investors are

focusing on the near-term benefits of more fiscal stimulus and

less on potential tax changes down the road. The markets are

discounting brighter days ahead as vaccinations get rolled out,

monetary and fiscal policy remains supportive and the path of the

recovery gains momentum.

We have positioned portfolios for a more cyclical, global

recovery (Exhibit 3). We expect stronger growth to be reflected

in higher yields, a steeper yield curve, a rebound in earnings

and a weaker dollar. As such, we continue to favor equities over

bonds and look to further take advantage of the rotation from

growth to cyclical stocks – a trend we’ve been acting on since

last summer. At this week’s meeting of our Investment Strategy

Committee, we continued to recommend taking profits from US large

cap stocks and move to those asset classes which are tied more to

the cyclical, global recovery, such as US small cap stocks and

emerging market equity. With expectations for more fiscal

stimulus and the potential for higher taxes down the road,

municipal bonds should also provide attractive yields for

tax-sensitive investors within a diversified fixed income

portfolio.

Exhibit 3: Asset Class Positioning: Investment Strategy Committee

Recommendations

It has certainly been a unique election cycle but it is important

not to put too much weight on political outcomes and instead stay

focused on your long-term wealth objectives. We believe our

clients are well-positioned for this political and economic

landscape and we will continually evaluate policy impacts on

business, economic and capital market cycles.