Legal

UK-Listed Litigation Firm Burford Revamps C-Suite, Lawsuit Dismissed

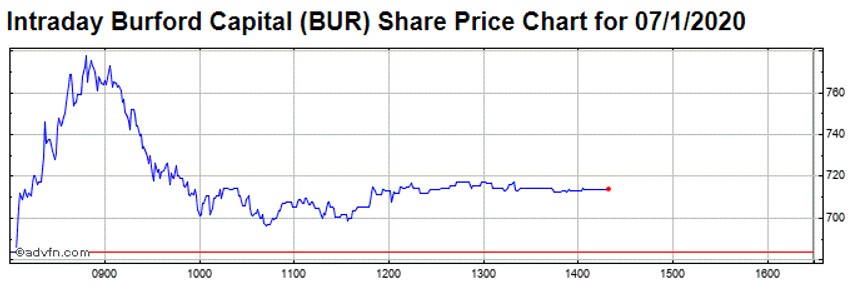

A firm making money out of litigation finance ironically was hit hard last year by claims of poor accountancy practices, triggering a massive fall in its share price. Burford claimed that patterns suggested illegal trading activity in its shares. Prices rose yesterday.

Embattled litigation finance firm Burford Capital

yesterday announced sweeping changes to its C-suite line-up and

said that a US class-action lawsuit against it had been

withdrawn. The firm’s shares were crushed last year by activist

hedge fund Muddy Waters, with the latter organisation accusing

Burford of questionable accounting

practices.

The firm said that Aviva Will and David Perla will become

co-chief operating officers. Craig Arnott will become Burford’s

Deputy Chief Investment Officer, working with CIO Jonathan Molot

across its entire investment portfolio, and he will also retain

responsibility for growing and developing the Australian market.

Mark Klein, Burford’s general counsel, will become of chief

administrative officer.

Burford will still be managed by its management committee,

composed of Christopher Bogart (chief executive), Jonathan Molot

(chief investment officer), Jim Kilman (chief financial officer),

Elizabeth O’Connell (chief strategy officer) and the four

executives previously named.

The firm is one of a crop of specialists which make money by

investing in litigation cases, a sector that arguably falls into

the category of alternative investments. Last year, hedge fund

firm Muddy Waters criticised Burford's accounting methods of

valuing its litigation cases, saying it is “aggressively

marking”. It claimed that Burford is “actively misleading

investors” with some of the metrics that it reports. Burford

denied the claims. Additionally, it said that a devastating

“short-attack” on its shares in August was consistent with

illegal activity. Shares in the firm slumped, although they

spiked yesterday when the announcement was filed to the London

Stock Exchange.

Source: ADVFN

Separately, Burford said the class action suit filed against it

in August last year had been withdrawn by the plaintiffs and

“dismissed in its entirety”.

“There is no litigation pending against Burford at present other

than ordinary course skirmishing within a small number of ongoing

funded investment matters,” the firm said.

As previously announced, director David Lowe will leave the board

at the May 2020 annual meeting and Sir Peter Middleton will leave

the board at the same date. The company has engaged Korn Ferry to

lead a search for two new independent board directors.

“That search has been proceeding well and the interview process

around new directors is ongoing. We expect to be in a position to

nominate two new directors (at least one of whom will be

qualified for audit committee membership) for shareholder

consideration as part of the board elections to be held at the

May 2020 AGM,” it said.

Burford said it plans to either add a US listing on the New York

Stock Exchange or NASDAQ for trading in its ordinary shares or to

migrate to the London Stock Exchange Main Market.

Following preparatory work, Burford is ready to formally seek a

US listing, it said, adding that it intends to purchase - as soon

as practicable - up to 410,000 of its ordinary shares for a total

value not to exceed £4 million ($5.25 million).