Market Research

UK Investment Landscape: Mostly In Charts

A five-minute read and useful charts showing what the UK's IA sector survey revealed for 2018.

Second only to the US as an investment centre, managing 37 per cent of total assets, and attracting the most international client base, the UK has maintained its market share in spite of the drag of Brexit, more market volatility and rising geopolitical tensions. These are some of the reassuring findings from the annual Investment Association's 2018/19 survey of the sector released this week.

Total assets managed in the UK by association members ended unchanged for the year at £7.7 trillion ($9.62 trillion). The wider industry, including hedge funds, private equity, commercial property and discretionary wealth managers, which accounts for around £9.1 trillion in assets, was also unchanged from 2017, the report said.

.png)

In a global markets context, the US leads with £26.1 trillion under management; Europe combined is second with £21.6 trillion; and Japan third with £4.1 trillion. Finland appeared at the European top table for the first time taking 1 per cent of AuM for the region.

The takeaways….

-- Across the £7.7 trillion managed by the UK, three quarters (74 per cent) of assets are actively managed, down from 84 per cent a decade ago; and

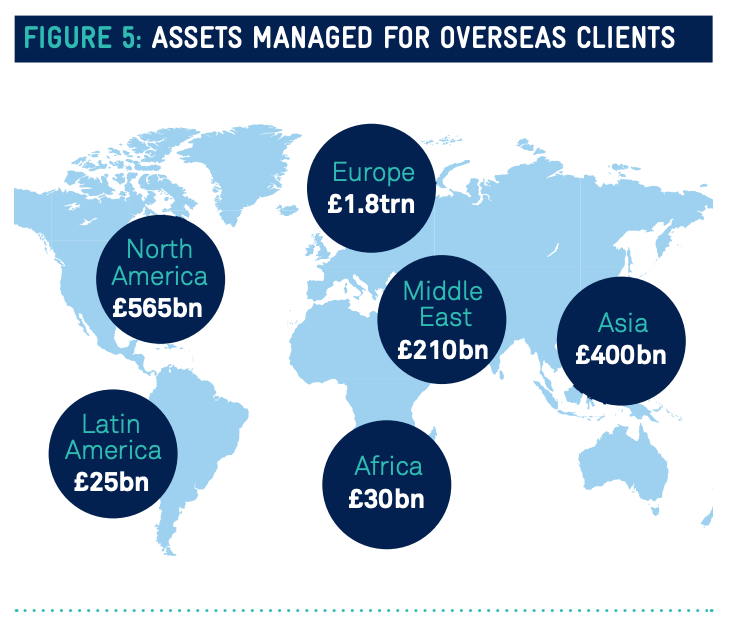

-- Overseas clients account for 40 per cent of total UK managed assets, making up the largest client base with £3.1 trillion managed. See the chart below for how international clients divide by region.

-- Outside a Brexit settlement, chief concerns lay in retaining access to international talent and access to overseas markets as protectionism and diverging regulations take hold; and

-- A “significant new dimension" to UK financial services has been investment managers and fintechs co-locating around city hubs, notably in London and Edinburgh, which asset managers say is vital to talent access. The UK is unlike any other leading investment hub for its tight clustering of services.

The rise of responsible investing

This is becoming the widely accepted norm. Among the total assets

managed by IA members, a quarter are subject to a responsible

investment approach, but how to explain the different approaches

to customers in a clear and consistent manner remains testing.

Client assets and allocation

-- Institutional clients remain the largest investor group

holding 80 per cent of AuM. Pension schemes within that hold 45

per cent of total assets;

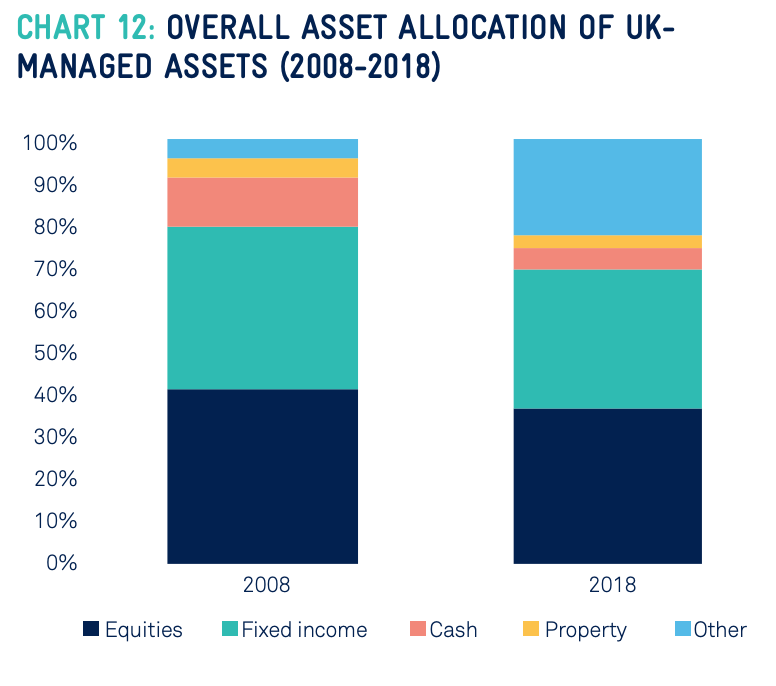

-- Equities’ proportion of total assets fell from 40 per cent to 36 per cent, with global market turmoil in late 2018 partially to blame. Within equities, the UK allocation stayed at 30 per cent (down from 46 per cent 10 years ago); and

-- Despite Brexit’s fatiguing ambiguity and allocation in UK assets dropping off, IA members maintained a healthy £1.6 trillion in UK equities, corporate bonds, and commercial property. The survey saw a notable increase in infrastructure and direct lending.

Average revenues for the industry after commission stood at £21 billion in 2018, with profits at 29 per cent, down marginally (by 1 per cent) from 2017.

A view from a wealth manager

“Whether you’re a multi-asset fund manager or a discretionary

wealth manager such as ourselves, you have the option of choosing

between active and passive investments. The key is to prove value

and to be able to demonstrate value to end consumers. We do use

active funds but we use them selectively where we think we can

actually demonstrate some alpha over and above a passive

solution. The thing we find is our differentiator is the

investment of time and money into our asset allocation process.

Roughly 80 per cent of the contribution to outperformance of the

benchmark comes from the asset allocation rather than from asset

selection.”

Private market potential

Persistent low interest rates have boosted private markets and

demand for alternatives assets among institutional investors,

while the proportion of listed companies has declined.

A view from an asset manager

"In our view, the area that is most interesting for investors

going forward is the private market. The UK economy is not the

2,500 listed companies, the UK economy is the 4 million

companies. They are really interesting businesses and someone’s

got to work out a way of gaining access to the returns in the

wider economy rather than just the quoted economy. First, it’s a

much bigger pool. Second, regulation and political pressure is

going to lead to a reduction in the number of quoted companies.”