Compliance

UK Fines Julius Baer ÂŁ18 Million

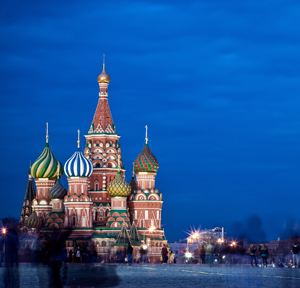

The watchdog also banned three former senior figures who had handled clients from Russia and Eastern Europe. The case hinges around an employee of several Yukos Group companies. The FCA said the firm committed a series of failings. The bank said it accepted the FCA decision and deeply regretted the conduct of its ex-employees.

The UK’s Financial Conduct Authority has fined Julius Baer

International ÂŁ18.022 million ($21.6 million) and banned three

former senior figures who handled Russian and East European

clients, for a string of failings.

The watchdog fined the bank for ”failing to conduct its business

with integrity, failing to take reasonable care to organise and

control its affairs and failing to be open and cooperative with

the FCA,” it said in a statement yesterday.

The FCA banned Gustavo Raitzin, former regional head for Bank

Julius Baer (BJB), Thomas Seiler, former BJB sub-regional

(market) head for Russia and Eastern Europe and JBI non-executive

director, and Louise Whitestone, former relationship manager on

JBI’s Russian and Eastern European desk.

“We deeply regret the serious failings and apologise for the

shortcomings that occurred at JBI between 2009 and 2014. We have

taken full responsibility for these historical failings and

made complete restitution to our client. Since

this wrongdoing took place, we have implemented significant

organisational changes. With a reformed governance

structure, a new management team and a remodelled risk and

compliance function, our clients can trust we will always

safeguard their interests," David Durlacher, CEO of Julius Baer

International, said in a statement.

The regulator said JBI facilitated finder’s arrangements between

BJB and an employee of a number of Yukos Group companies, Dimitri

Merinson. Under these arrangements, BJB paid finder’s fees to

Merinson for introducing Yukos Group companies to Julius Baer.

This was done on the understanding that the Yukos Group companies

would then place large cash sums with Julius Baer from which

Julius Baer could generate significant revenues.

“In particular, uncommercial FX transactions were made in which

the Yukos Group companies were charged far higher than standard

rates, with the profits being shared between Mr Merinson and

Julius Baer. Mr Merinson received commission payments totalling

approximately $3 million as a result of these arrangements,” the

FCA statement said.

These fees were improper and together with the uncommercial FX

transactions showed a lack of integrity in the way in which JBI

was undertaking this business, the FCA continued.

JBI also failed to have adequate policies and procedures in place

to identify and manage the risks arising from the relationships

between JBI and finders (external third parties that introduced

potential clients to Julius Baer in return for commission). This

included having no policies which defined the rules surrounding

the use of finders within JBI until after June 2010. Policies

introduced after that date were inadequate.

Finally, JBI became aware of the nature of these transactions –

including the commission payments to Mr Merinson – in 2012 and

suspected that a potential fraud had been committed. However, it

did not report these matters to the FCA immediately as required

or at all until July 2014, the FCA said.

“There were obvious signs that the relationships here were

corrupt, which senior individuals saw and ignored. These

weaknesses create the circumstances in which financial crime of

the most serious kind can flourish. The FCA’s decisions on the

individuals whom the FCA alleges were involved in these failures

will now be reviewed in the Upper Tribunal,” Mark Steward, FCA

executive director of enforcement and market oversight, said.

Julius Baer International agreed at an early stage to settle all

issues of fact and partially agreed liability (but not penalty)

and therefore qualified for a 15 per cent to 30 per cent discount

under the FCA’s executive settlement procedures. Were it

not for this discount the FCA would have imposed a fine of

ÂŁ24,496,700, the regulator said.

“This was a challenging investigation which required evidence to

be obtained from Switzerland, including interviews. As well,

while the investigation was completed before Covid lockdowns,

publication of the firm’s Final Notice was prevented by an Order

of the Tribunal, which has recently been discharged,” it

said.

Separately, the Upper Tribunal proceedings relating to Thomas

Seiler, Louise Whitestone and Gustavo Raitzin’s Decision Notices

commenced on 28 November 2022.

Whitestone, Seiler and Raitzin have referred their Decision

Notices to the Upper Tribunal where they will each present their

respective cases. The Upper Tribunal will then determine whether

to dismiss the respective references or remit them to the FCA

with a direction to reconsider and reach a decision in accordance

with the findings of the Upper Tribunal. Any findings in the

individuals’ Decision Notices and the descriptions of those

findings in the FCA’s statement yesterday are provisional and

reflect the FCA’s belief as to what occurred and how it considers

their behaviour is to be characterised.

Julius Baer International (JBI) has not referred the FCA’s

decision to the Upper Tribunal.

The bank's statement:

"Julius Baer International (UK) (“JBI”) confirms that it accepts

the decision set out in the Final Notice published today by

the Financial Conduct Authority," it said. "The Final Notice

details serious failings that occurred at JBI between 2009 and

2014 in relation to a finder’s-fee arrangement for one of

its clients. JBI co-operated fully with the FCA in

its investigation, accepted its decision and has paid a fine

in the amount of ÂŁ18.0 million, as previously disclosed in

the 2022 Julius Baer Group Half-Year Report.

"JBI deeply regrets and apologises for the events and

shortcomings that led to today’s Final Notice. As the Notice

sets out, senior management at JBI informed the client in

question and agreement was reached on full

restitution. JBI also established an independent

investigation into the event. This independent

investigation informed the FCA’s findings and has led to

significant changes to the company’s leadership, governance,

systems and processes, including that JBI no longer accepts any

finders’ business. JBI notes that the FCA’s criticism of

individuals was limited to three former employees. In

response to this specific event and as a result of its

continuous review of regulatory requirements and

developments, JBI has introduced additional safeguards to ensure

clients are fully protected. All client relationships are

regularly reviewed and appropriately managed. JBI is satisfied

that it now has effective compliance and risk management

controls, procedures, and policies in place to detect and

prevent any similar conduct," it added.