Strategy

The Great Wealth Transfer: Three Trends Reshaping Wealth Management

The author of this article argues that the "Great Wealth Transfer" is not just a movement of assets from one generation to the next; it is a transformation of how these assets are managed and grown.

The following article is from Ken Gamskjaer, who is CEO and

co-founder at Aleta, a

“next-generation wealth platform” for family offices, wealth

managers, and advisors. He is based in Copenhagen,

Denmark.

The editors of this news service are pleased to share these

views; the usual editorial disclaimers apply. Jump into the

conversation! Email tom.burroughes@wealthbriefing.com

As the largest wealth transfer in history unfolds, with 30 per

cent (!) of global wealth poised to change hands in the coming

decade, the stakes for wealth managers, family offices, and

advisors have never been higher.

This transfer is reshaping the landscape of wealth management,

driven by the distinctive priorities and expectations of the next

generation of inheritors. In this article, I explore three

critical trends linked to this shift: digitalisation,

sustainability, and the evolving role of trusted advisors.

A digital ultimatum for modern wealth

management

The impending wealth transfer traces its roots back to the

post-World War II era, a time of immense growth and wealth

creation. As this wealth is due to shift to the next generation,

wealth managers find themselves at a critical juncture.

Some 90 per cent of heirs switch wealth managers after

inheriting. There are many reasons, but a significant cause is

dissatisfaction with digital maturity.

The incoming generation isn't just passively using technology;

they’re fully integrated with digital platforms that offer

personalised, immediate, and seamless experiences.

They don’t just want online portfolio access; they want the

wealth management equivalent of a Spotify playlist: personalised,

accessible anytime, anywhere and, dare I say, capable of

predicting their next favourite investment trend.

But there’s a digital divide between wealth managers and the next

generation of wealth clients, and it’s not just a gap; it's a

chasm. And for the traditional wealth manager, average age 57, it

can feel wider than the Grand Canyon.

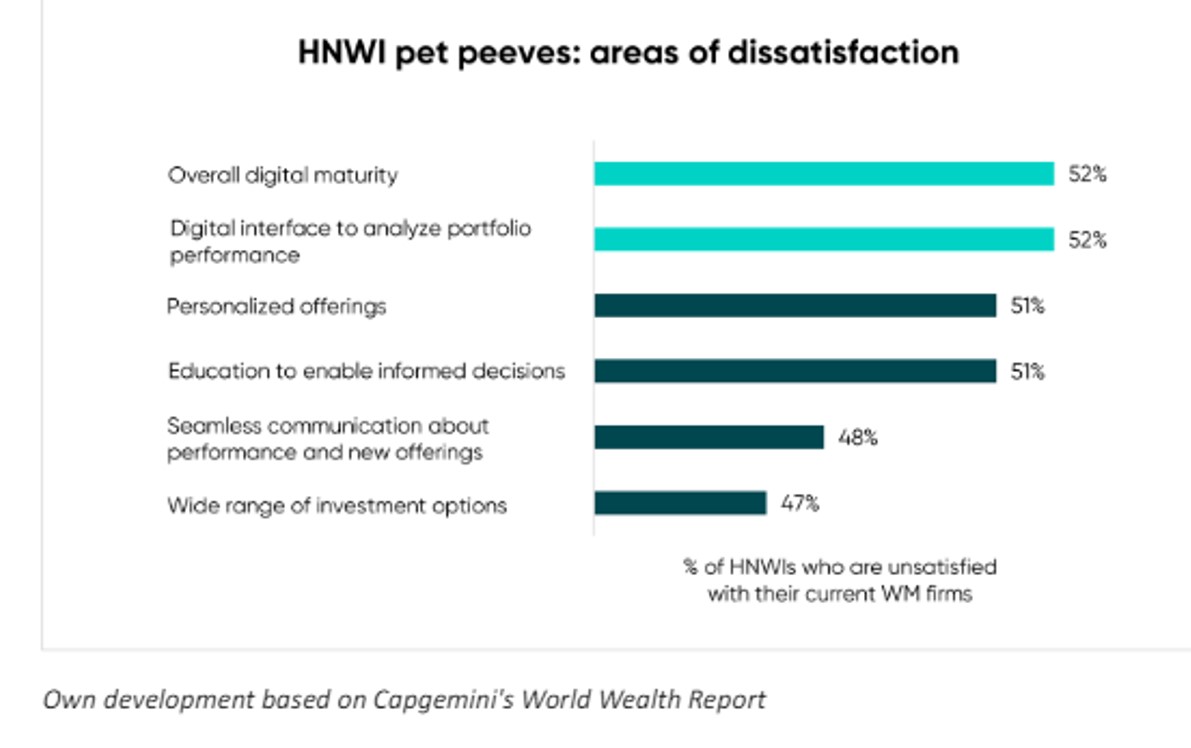

Own development based on Capgemini's World Wealth Report

The overall digital maturity of their wealth manager is number one pet peeve among current HNW individuals along with the wealth manager’s digital interface for analysing portfolio performance.

Imagine what the numbers would look like if they represented the

next generation.

The message is crystal clear: adapt to the digital expectations

of the next generation or risk being left on "read.”

However, for those willing to embrace change, to

continuously strengthen relationships with next-gen clients, and

to choose the right technological partners, the rewards are

immense.

By teaming up with tech partners that prioritise these next-gen

expectations, wealth managers will be making a strategic move

towards securing a firm position in the future of wealth

management, where digital fluency and innovation are at the

forefront.

A launch pad for sustainable investment

When I meet “next gens,” one of the things they’re most

preoccupied with is identity. Their predecessors largely built

their identity on their business. But the next generation is

inheriting a fortune they didn’t create themselves, and now they

have to figure out what they want to build their own identity

on.

What’s common for many of them is that they want to create a

long-lasting legacy that’s about more than profit.

Because they’re not just inheriting wealth; they're also

inheriting a responsibility towards the planet and are keen to

ensure that their investments reflect their ethical stances. They

are diverting from traditional paths and looking towards

investments that promise not only financial returns but also

contribute positively to environmental and social outcomes.

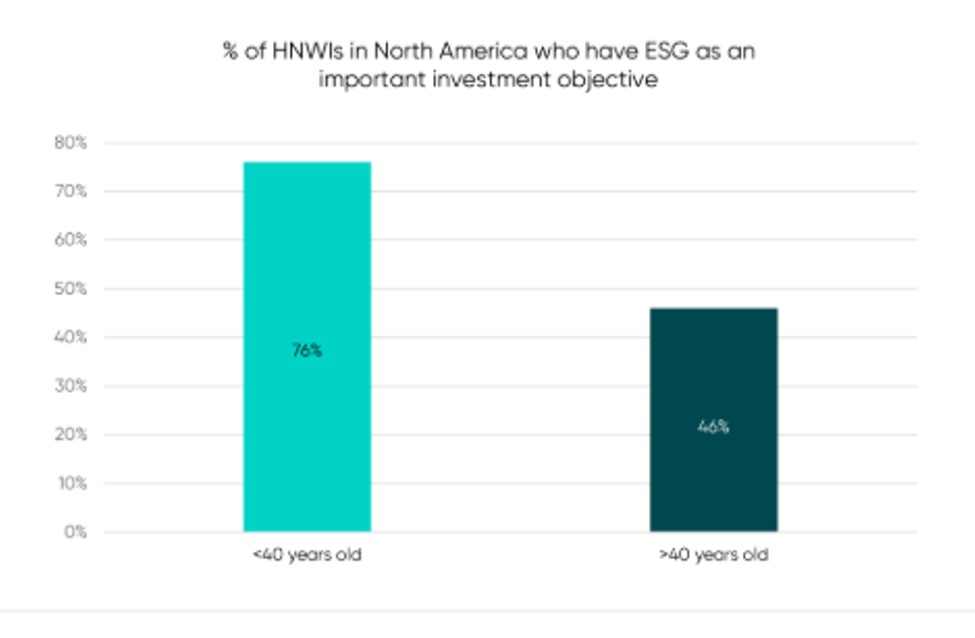

In North America, Millennial HNW individuals show a marked

preference for ESG investing compared with individuals over

40, highlighting a generational shift in investment

paradigms.

Own development based on Capgemini's World Wealth Report

In my opinion, it’s not one or the other. I believe that profit

and purpose will go hand in hand in the future because companies

have to adjust to the reality we live in to thrive in the long

term. In fact, studies indicate that this is already reality in

many cases.

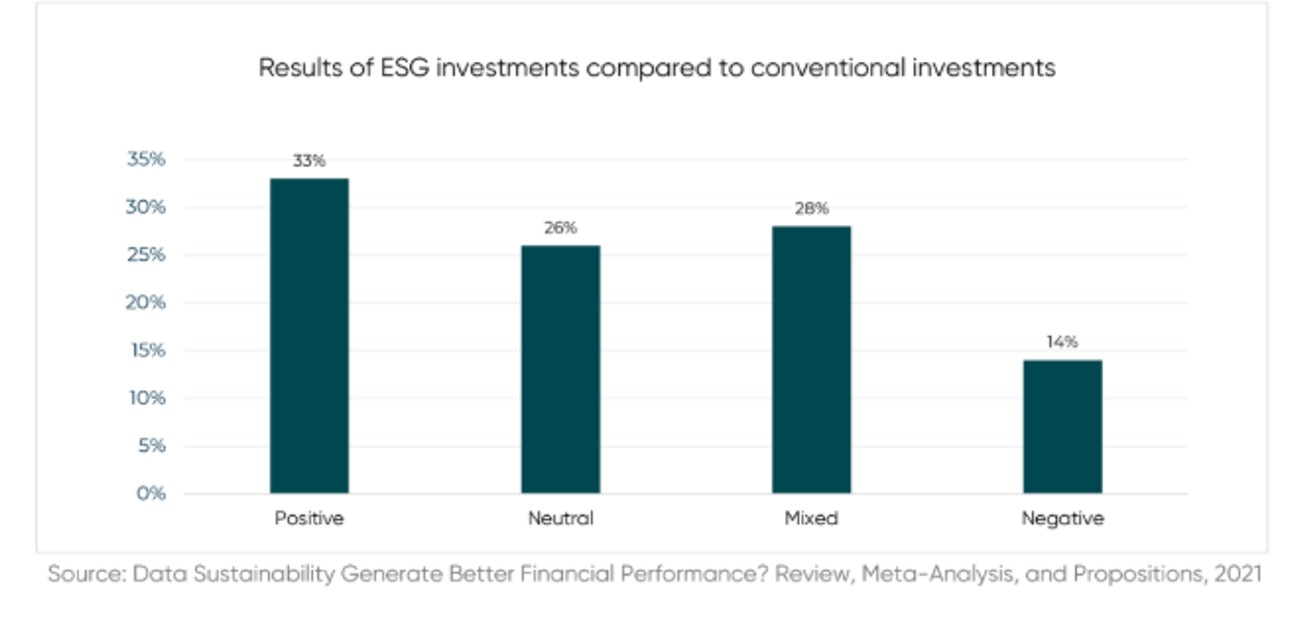

In a meta-study, NYU Stern Center for Sustainable Business and

Rockefeller Asset Management analysed over 1,000 studies. Among

the studies focusing on the relationship between sustainability

and performance, 59 per cent indicate that ESG investments yield

similar or better results than conventional investment

approaches.

Source: Data Sustainability Generate Better Financial

Performance? Review, Meta-Analysis, and Propositions,

2021

However, integrating sustainability into wealth management is not without its challenges. Approximately 40 per cent of wealth managers report that obtaining accurate ESG impact data is a complex task.

Admittedly, it’s not easy to navigate the ESG data jungle, and it

is often grey-on-grey, but that doesn’t mean we shouldn’t take on

the challenge.

But it’s not only about reporting. Wealth managers must deepen

their understanding of sustainable investment opportunities. They

must become as fluent in discussing carbon footprints and social

equity as they are in discussing bonds and equities.

The way I see it, one of the ways to make that happen is to

ensure that sustainability becomes an integral part of financial

education. People in the financial world need to learn from the

very beginning that risk and return are not the only important

parameters to look at.

Rise of the trusted advisor and holistic

advisory

Despite the rise of technology, the importance of the human

element remains paramount.

This becomes clear when looking at the increasing demand for

trusted advisors which is especially driven by increasing levels

of fragmentation and standardisation in the world of wealth

management.

Many HNW individuals experience an increasing degree of

standardisation in private banking. They feel lost in the crowd

of clients, receiving cookie-cutter solutions that fail to

address their unique needs and aspirations.

As a response, they’re moving away from private banking.

At the same time, the wealth universe of HNW individuals today is

becoming more and more fragmented and in more than one sense.

First of all, investments are spread across various asset

classes, both liquid and illiquid, and distributed globally. On

top of that, they’re dispersed between multiple wealth managers,

each specialising in different segments of the financial

market.

It’s becoming more and more difficult and time-consuming for HNW

individuals to stay on top of this fragmented wealth

universe.

As a result of these developments, HNW individuals are looking

for trusted advisors who can act as a single point of entry to

the entire wealth ecosystem and provide them with highly

personalised and holistic wealth management solutions.

And they expect them to look beyond classic asset classes and

assume a broader and more holistic look on wealth – a perspective

they expect to see reflected in their wealth management

platforms. Advisors are becoming partners in building a

legacy that aligns with the personal and social values of their

clients.

Conclusion

The Great Wealth Transfer is not just a movement of assets from

one generation to the next; it is a transformation in how these

assets are managed and grown. For wealth managers, this era

presents an opportunity to redefine their roles and services to

align with a digitally savvy, ethically conscious, and highly

personalised approach to wealth management.

By embracing digital innovation, prioritising sustainability, and

reinforcing the role of trusted advisors, wealth managers can

meet the high expectations of the next generation. Successfully

navigating this transition will require a blend of innovation,

adaptability, and a deep commitment to client relationships. In

doing so, wealth managers can ensure that their services are not

only preserved but are propelled into a future where they are

more relevant and responsive than ever.

Sources

Atz, U. et al. (2022): Does Sustainability Generate Better

Financial Performance? Review, Meta-analysis, and

Propositions.

Campden Wealth: The North America Family Office Report.

Capgemini: World Wealth Report.

Deloitte: 10 Disruptive trends in wealth management.

UBS: Global Family Office Report.

&Simple: Simple Software Technology Review.

&Simple: Simple Looking Forward