Offshore

The Golden Visa Markplace: A Critique

Questions by policymakers about such visa programmes and last year's sudden suspension by the UK of its investor regime have created fresh questions about this market.

The market for what are called “golden visas” – citizenship/residency-by-investment programmes – is now a global one. It remains a highly controversial one, as recent stories from the UK, for example, demonstrate. High net worth and ultra-HNW individuals from Asia, the Middle East, Africa, Latin America, Europe and North America have sought out these programmes. Defenders of these visas argue that they fit with a globalised world of free movement of people and capital. Critics say they facilitate movement of dirty money. Debate is sure to continue.

Robert Lyddon, who is the director of Lyddon Consulting, his eponymous firm, and former general secretary of international banking alliance, IBOS, takes a look at the market. He is unafraid to be critical of the market, and the editors here are pleased to share his views. Needless to say, the editors do not necessarily agree with all such opinions and invite readers to respond. Email tom.burroughes@wealthbriefing.com

Governments such as the UK have come under renewed pressure to limit or suspend visa systems which offer residency or passports for money. Allied to this, there have been revelations of the interconnection of this with the offshore banking and finance business, tax evasion, and laundering of the proceeds of crime. Time for action, one would think, but in certain countries words speak much louder.

The concept of golden visas originated in efforts to attract the rich and famous with an offer of citizenship or residency in a low-tax country whereby they could legally reduce their tax bills.

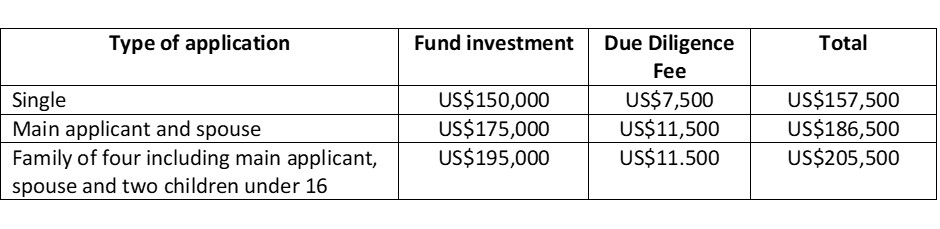

Recent editions of the British Airways High Life magazine have included an insert from St Kitts and Nevis for “the oldest and most trusted citizenship by investment programmes in the world”, which fits into this category. The insert is positioned initially like an offer of a warm winter break – “The Perfect Winter Destination” – and its proposition for citizenship is dressed up as an ecology ploy: a contribution to the “Sustainable Growth Fund” is presented as “a faster, less complicated route to receiving citizenship”. It is cheap as well:

Additional dependents other than a spouse cost $10,000 each, and there is no due diligence on dependents.

The Paradise Papers and the Panama Papers, by shining a light on two similar, traditional low-tax jurisdictions (Bermuda and Panama), have revealed how multiple jurisdictions can be used in concert within one scheme, and how access to their facilities is not limited to those who have obtained their wealth through overtly legal means and who wish to shield it from taxation.

The revelations have included a smattering of cases of corrupt governmental kleptocrats and of “businessmen” whose wealth has been derived from criminal, or at least highly suspicious, activities.

They have also demonstrated the widespread usage of companies and trusts domiciled in such jurisdictions in the context of multi-country schemes, to exploit both the low taxation in the jurisdiction and the Double Taxation Treaties (DTTs) that the jurisdictions have signed with one another and with third countries. So-called “treaty shopping” is rife: routing transactions through a country for no other reason than to make use of its favourable DTT with a third country.

Companies that are established in a country without having any substance or indeed business in it are known as “shell companies”, and their frequency in multi-jurisdiction tax avoidance schemes – combined with the suspicions that monies being transferred through them have been earned illegally - has led to their being brought within the scope of legislation to combat money laundering and the financing of terrorism.

At a European level, the European Council in its meeting on 14 May adopted the 5th EU Anti-Money Laundering Directive. The new elements compared with the 4th Directive include greater transparency of the beneficial ownership of companies and trusts.

Countries like St Kitts and Nevis may be fine for a winter break, but not all of the rich and famous want to live there. They prefer the EU. Numerous EU countries have their own golden visa scheme, but the same concerns that have led to a crackdown on shell companies and bogus trusts are now casting a shadow over such schemes.

Last December, the UK decided to suspend its Tier 1 Investor visas, as part of a drive to crack down on organised crime and money laundering.

These visas allow non-European Union residents over three years entry in return for £2 million ($2.6million) in investment in UK bonds, share capital or loan capital in UK companies. The visas have brought in billions of pounds of investment into high-end property, soccer clubs, and UK businesses, but the provenance of the individuals – and of their wealth – has been an issue of increasing concern.

Bulgaria

EUobserver recently reported on the case of Bulgaria,

where naturalisation certificates are available for foreigners,

both those with a legitimate claim to one and those that do not.

The publication quoted a former director of citizenship at

Bulgaria's Ministry of Justice, who said that an informal charge

of between €500 ($575.6) up to €7,000 was levied, depending on

the wealth of the individual, both on those with a legitimate

claim to a certificate and those without one.

The official claimed that the address of an electricity pylon in a Bulgarian village had been used by its local mayor as the address to which a large number of Macedonians had become registered as part of the fraudulent issuance of certificates, and that at least 5,000 people every year with no Bulgarian roots managed to wrongly obtain a certificate.

In the face of these strong headwinds Cyprus, however, continues its operations unabashed. Ever since its accession to the EU it has had its “Cyprus business model”, whereby “introducers” based in Cyprus developed contacts with and business propositions for potential customers outside Cyprus, and then established legal entities domiciled in Cyprus and banking facilities with indigenous banks.

Close connections have been shown to exist between these introducers – in the form of law offices, accountants and company formation agents - and senior politicians and bankers. Indeed, the president’s own law firm is a prominent introducer.

Cyprus has featured in the Panama Papers, the Paradise Papers, the Paul Manafort affair and Hermitage/Magnitsky where Bank of Cyprus was heavily involved, Liberty Reserve where Hellenic Bank was prominent and many more, as a nexus for the running of shell companies and the transfer of funds to realise these multi-jurisdiction schemes.

Then came its financial bailout in 2012/13 by the European authorities and the IMF, extended against a promise to clean up its act regarding the Cyprus business model and all matters to do with money laundering.

However, this promise was a dead letter in that the deposits of Russian persons, in particular in the largest Cyprus banks, resulted under the terms of the bailout, with these deposits being converted into shares. Russians became major shareholders in Cyprus’ biggest bank - Bank of Cyprus – which was the result of a merger with Popular Bank.

Indeed the largest single shareholder in Bank of Cyprus - Viktor Vekselberg - is a Russian who is now subject to formal US sanctions.

Hellenic Bank – now increased in size by the accretion of Cooperative Bank of Cyprus in a deal in which the Cyprus taxpayer was loaded up with Cooperative’s bad loans – counts as its main shareholders:

-- For 26.2 per cent - Third Point Hellenic Recovery Fund LP, a Cayman Islands limited partnership that is an offshoot of the Third Point hedge fund, run out of New York by Daniel Loeb;

-- For 24.9 per cent - Wargaming Group Ltd, a Belarusian-Cypriot video game company based in Nicosia, founded in 1998 by Victor Kislyi in Minsk, where the Cypriot company now has its main office, and a company that has come under the microscope of the US FinCen; and

-- For 10.1 per cent - Demetra Investment Public Ltd, a domestic Cyprus investment company whose largest shareholder, with 29.62 per cent, is Logicom, a Cyprus IT company.

These are unprestigious names to have as major shareholders in the country’s two largest banks.

Not content with continuing with its “Cyprus business model” when it had agreed to stop it as a quid pro quo for the bailout, Cyprus then put in place its golden visa scheme in 2013. The scheme has so far attracted over 3,000 users, and brought in fees of €4.8 billion.

The scheme has acted as an adjunct to Cyprus’ pre-existing facilities for foreign investors. The foreign party must purchase property with a value in excess of €500,000, and invest at least €2 million in a national development fund, Cyprus businesses or Cypriot government bonds. This buys a Cypriot passport and unfettered access to the EU.

Cyprus was recently quoted in Transparency International’s report European Getaway as being amongst the top four earners from these schemes in the EU – with Spain, Portugal and the UK – and was said to take little interest in the “source of funds” of the investor.

The scheme has come under the scrutiny of EU and US regulators as it has emerged that both Cyprus regulators and local banks were turning a blind eye to the bone fides of funds coming into the country for the purchase of luxury residential properties in order to utilise the scheme. When the EU and US again asked difficult questions, the Cypriot authorities pledged to improve their AML/CTF efforts.

Words are cheap, though, and actions costly, and Cyprus’ past performance has been to fail to back up its words with watertight implementation actions. On paper Cyprus has some of the strongest legislation to combat money laundering, and yet the train keeps rolling: it’s all part of the “Cyprus business model”.

References:

https://issuu.com/transparencyinternational/docs/european_getaway_-_golden_visas?e=2496456/65719517

https://uk.reuters.com/article/uk-britain-immigration-visas/britain-suspends-2-million-golden-visas-to-tackle-money-laundering-idUKKBN1O50Z1

https://euobserver.com/justice/143706

https://www.hellenicbank.com/portalserver/hb-en-portal/en/about-us/investor-relations/show-me/stock-information

https://www.thirdpoint.com/

https://en.wikipedia.org/wiki/Wargaming_(company)

http://www.demetra.com.cy/EN/AboutUs/Pages/Shareholding.aspx

https://www.stockwatch.com.cy/el/article/trapezes/askiseis-kefalaion-stin-elliniki-kai-sto-vathos-wargaming