ESG

The ESG Phenomenon: Moneyfacts, UK Funds Data

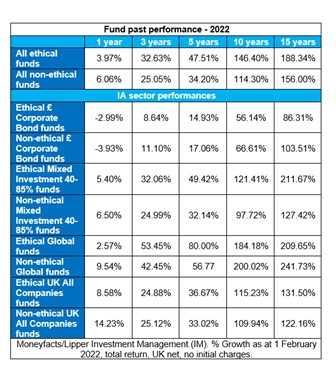

Figures may give pause for thought among those enthusiastically promoting ESG investments, although data from different time periods suggest they can and do match or beat results from more conventional funds.

Ethical funds have failed to outpace supposedly "non-ethical" funds over the 12 months of stock market volatility, a fact that will add to debates about the financial benefits of ESG investing, according to new data from finance website Moneyfacts.co.uk.

It found that ethical funds returned an average 3.97 per cent

over the past year, compared with 6.06 per cent from their

counterparts investing in “sin stocks," raising some

difficult issues for those taking the ESG investment line.

The figures could be just a blip, the finance website said, as

ethical funds have outperformed non-ethical competitors over

every other timescale. Over three-, five-, 10- and 15-year

periods, ethical funds outperformed by a significant margin. This

lends weight to the argument, backed by a number of studies, that

sustainable companies perform better, Moneyfacts said.

Overall, it has found that ethical funds have outperformed

non-ethical over longer investment periods. Out of 26 comparable

sectors, 19 ethical fund sectors produced positive average

growth, compared with 18 sectors for non-ethical funds,

based on past years’ data.

One fund sector, UK All Companies, has seen ethical funds in the

sector returning an average of 8.58 per cent versus 14.23 per

cent for non-ethical funds. The Corporate Bond (£ sterling)

sector saw losses for both ethical and non-ethical funds at -2.99

per cent and -3.93 per cent, respectively.

According to The Investment Association (IMA) inflows to

responsible investment funds totalled a record £16 billion ($21

billion), up £4.3 billion during 2020.

“Consumers may choose on principle to invest in ethical funds, so

it’s good to see an overall positive return over the past year.

However, a return of 3.97 per cent for ethical funds is less than

the non-ethical sector of 6.06 per cent, but it is worth keeping

in mind that ethical funds have outperformed non-ethical funds

overall during previous years,” Rachel Springall, finance expert

at Moneyfacts.co.uk, said.

“This will be positive news for investors who are seeking out

funds meeting Environmental, Social, and Governance (ESG)

criteria, and during 2021 there was continued evidence of demand

for responsible investment funds,” she said.

“The outlook for the stock market is uncertain, so any concerned

investors would be wise to seek advice before switching out of

any fund sector, as a jumpy premature move may result in missing

out on potential recovery. Good advice is essential to any

investor to get some peace of mind, particularly at a time when

the markets are volatile.”

Earlier this month, funds rating firm Morningstar removed more than 1,200 funds with a combined $1.4 trillion in assets from its European sustainable investment list after an “extensive review” of their legal documents, this publication reported.

(The figures drive debate about what is an "ethical" fund, given that some forms of energy, such as nuclear power, are considered off-limits by some investors concerned about the environment, while others might argue this energy source is vital in reducing carbon emissions.)